(Mike Maharrey, Money Metals News Service) Have you done your taxes yet? If you’re a procrastinator, like me, probably not. Especially if you owe money.

Well, I’ve got bad news. This is your last weekend to get it done.

The taxman cometh.

Next Tuesday, to be exact.

I’ve been dreading this day for a long time. It means I’m going to have to write a big check, and my bank account balance will be significantly smaller next week than it is right now.

Of course, for a lot of people, tax season is great – or at least they think it is. It means they get a big fat check from the government.

Yay, refund!

In fact, I bet most folks who have refunds coming to them filed a long time ago in anticipation of their little windfall. (Unless, of course, they are hard-core procrastinators – like me.)

Regardless, I’m self-employed. That means I write checks. No refund windfall for me.

On a side note, if you did get a refund, you might consider using it to buy some gold and silver. You definitely don’t want to just stick it in the bank. The way the government is devaluing your money, it won’t take long for that refund to vaporize into the ether.

Anyway, I don’t think anybody is really excited about Tax Day. However, a lot of people don’t mind too much, thanks to the refunds.

The withholding system was a brilliant move by the government. It’s like anesthesia. It deadens the pain of taxation. Most people have no idea how much money the government takes from them. Their employer just siphons it out of their pay and sends it to the IRS. And then they get a refund. I think a lot of people view this as a gift from the government. They certainly don’t feel the pain.

But let me tell you: Writing a check is painful.

For all of you people who got a big refund, I’m going to let you in on a little secret. You’re getting ripped off, too. They just hide it from you.

In fact, they get you with a double whammy.

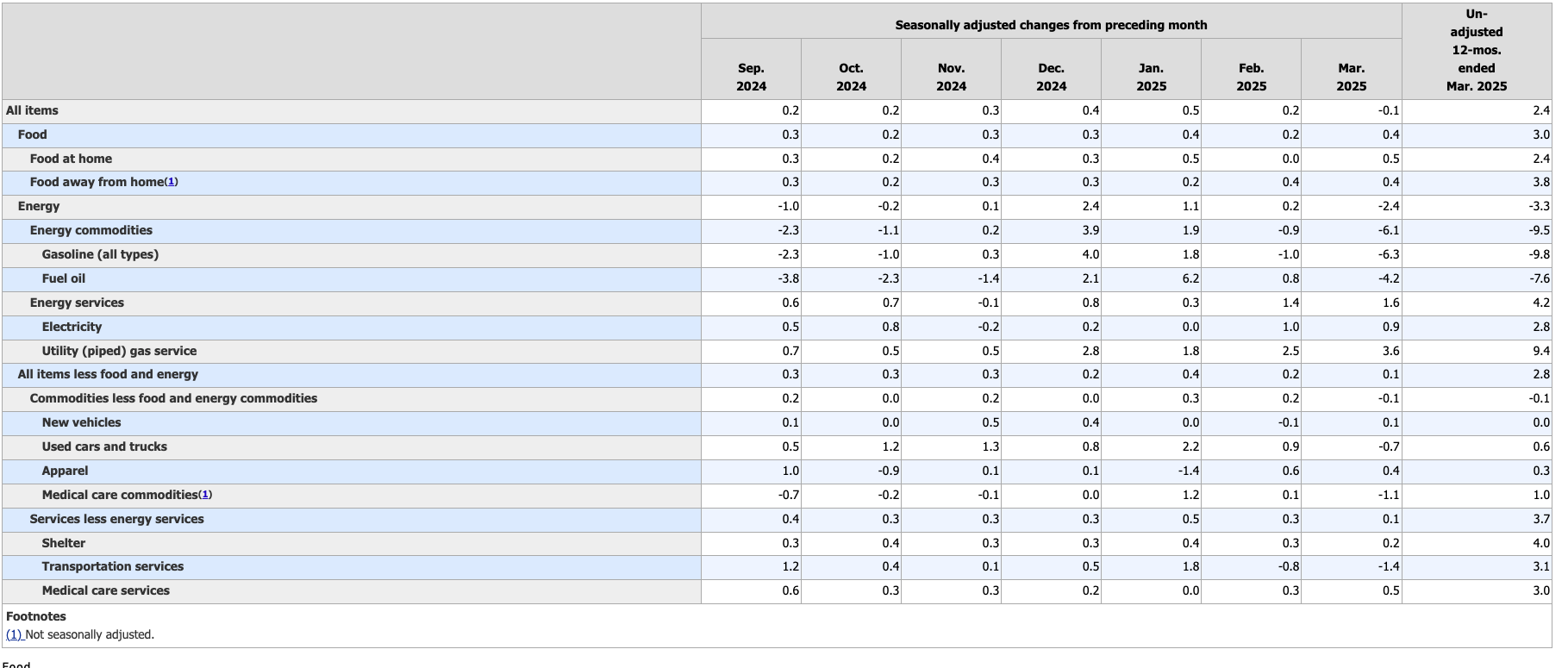

Not only does the IRS suck money out of your paycheck that you never see, but you also pay the inflation tax every time you go to the grocery store or gas station.

That’s right. Inflation is a tax.

You might wonder why they need an additional tax when they suck so much out of your paycheck. Well, the fact of the matter is, that income taxes don’t go as far as you might think. According to the most recent data from the Congressional Budget Office (CBO) and Office of Management and Budget (OMB), individual income taxes only account for approximately 50 to 55 percent of total federal revenue.

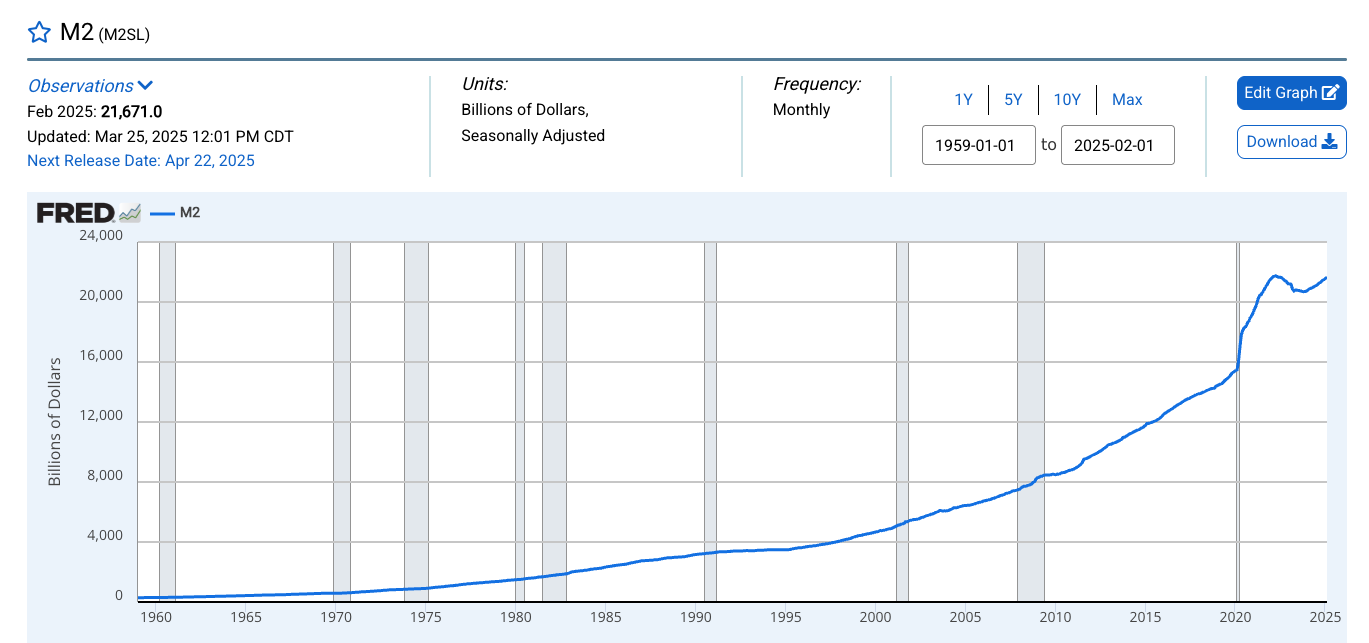

That’s why they have to borrow so much. And borrowing is one of the main reasons the Fed has to inflate so much. Thus, the inflation tax.

But hey, we shouldn’t complain, right?

After all, taxes are the price we pay to live in a civilized society.

OK. Hold the phone.

I’m just going to throw this out there – maybe taking people’s money, effectively at gunpoint, isn’t really so “civilized.”

Isn’t that kind of like stealing?

Or maybe extortion is a better word.

Whatever label you want to put on it, I wouldn’t call stealing or extortion civilized. In fact, it’s kind of the opposite of civilized, right?

But I’m supposed to understand that the government is going to take its ill-gotten gains and make the world a better place. That supposedly justifies the extortion and theft. I should feel good about it!

Well, OK. That sounds good in a political speech, or maybe coming from a civics teacher, but it’s propaganda spin.

And by propaganda spin, I mean utter BS.

Think about it: Given the price tag, we should have reached the pinnacle of civilization by this point.

I think we got hosed.

Here’s the truth: Taxation is the price we pay for an overreaching, unconstitutional government that spends way too much money.

In Federalist #45, James Madison explained that the federal government was intended to be rather small. He wrote, “The powers delegated by the proposed Constitution to the federal government are few and defined. Those which are to remain in the State governments are numerous and indefinite.”

We’ve flipped the system on its head. As a result, we hand over a chunk of our income to the IRS, and pay an inflation tax, and the federal government is still running massive deficits month after month.

If the federal government operated the way Madison said it should, we wouldn’t be in this situation.

But here we are.

So, the tax man cometh – over and over and over again.

But some people insist this is a great system. The only problem is that the “rich don’t pay their fair share.”

At the risk of offending some people, that’s also utter BS.

The top 1 percent of earners (people with an adjusted gross income of $682,577 and higher) pay 45.8 percent of all income taxes.

The top 5 percent pay 66.2 percent of the federal taxes.

And the top 10 percent pay a whopping 77.5 percent of all federal income taxes.

This is based on 2021, the latest available data.

So, I don’t exactly know how we define “fair share,” but this has to be close.

Regardless, I don’t think we’re getting our money’s worth out of this scheme.

Every year, as I’m doing my taxes, I listen to a song by Reggae artist Lucky Dube. It sums up the situation perfectly.

I pay my gardener to clean up my garden

I pay my doctor to check out da other ting

I pay my lawyer to fight for my rights

And I pay my bodyguard to guard my body

There’s only one man I pay

But I don’t know what I’m paying for

I’m talking about the taxman

I’m talking about the taxman

I’m talking about the taxman

What have you done for me lately?

Mr. Taxman

What have you done for me lately?

Mr. Taxman

What have you done for me lately?

Mr. Taxman

What have you done for me lately?

Mr. Taxman

You take from the rich, take from the poor

You even take from me, can’t understand it now

I pay for the police to, err…I don’t know why

‘Cause if my dollar was good enough

There wouldn’t be so much crime in the streets

They tell me you’re a fat man

And you always take and never give

What have you done for me lately?

Mr. Taxman

Good question. What have you done for me?

I gotta say – not so much.

I mean, sure, we have roads. But have you driven through Ohio lately? It’s not exactly a ringing endorsement for taxation.

But what about schools?

Yeah. OK. Go chat with some public school students. Also, not a ringing endorsement.

But hey, I’ve sent billions of dollars to Ukraine to help with all of the civilizing going on over there.

You get the picture.

So, whether you’re writing a check or buying some gold with your refund, give Lucky Dube’s song some thought.

I think you’ll come to a similar conclusion – Mr. Taxman ain’t doing much for us.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.