(Mike Maharrey, Money Metals News Service) As expected, the Federal Reserve cut interest rates by 25 basis points last week. How will this impact the gold market?

The cut was already priced into the markets. The real question is: what will the central bank do moving forward?

As it turned out, the messaging coming out of the Fed was somewhat more hawkish than markets had hoped.

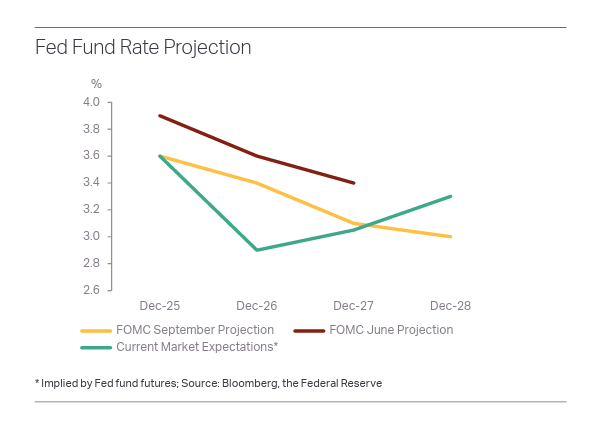

Based on the dot plot projections, the committee forecast two more cuts this year. However, the outlook for 2026 was more conservative, with the committee only anticipating one additional cut.

With the updated dot plot, the median projection is now for the Fed to trim rates to around 3.4 percent by the end of next year. In contrast, implied Fed funds futures point to at least two, if not three, cuts next year, with rates likely to end 2026 closer to 3 percent.

Gold sold off modestly after the rate cut decision and Powell’s post-meeting press conference. Analysts at Metals Focus said the consolidation wasn’t remarkable.

“With the FOMC statement largely aligning with market expectations, some near-term technical profit-taking in gold is unsurprising.”

Beyond the short term, analysts say, “The macroeconomic and geopolitical backdrop remains supportive of gold investment and prices,” and that there will likely be strong buying support with price dips.

“Buying on dips is therefore likely to continue, helping to drive the metal to fresh all-time highs well into 2026.”

Money Metals also expects further rate cuts. While the messaging coming out of the FOMC meeting was somewhat conservative, there will likely be continued pressure from the White House to cut more aggressively. There is also some division among committee members. Trump appointee Stephen Miran advocated for a half-point cut, and Trump will get to appoint a new chair next year.

Further softening of economic data could also speed up the rate of cutting.

Meanwhile, Metals Focus analysts think persistent inflation pressure will support gold.

“There is a risk that inflationary pressures could become more protracted just as nominal interest rates are falling. The resulting larger decline in real rates should provide an additional boost to gold.”

It will be important to pay attention to real rates moving forward.

When interest rates are higher, there is an opportunity cost to holding gold or silver when you could own bonds that generate interest income or stocks that pay dividends. However, when real interest rates fall or turn negative, those income-producing alternatives lose their comparative advantage. In such an environment, the relative cost of holding precious gold and silver diminishes, making the metals more attractive as safe-haven and wealth-preservation assets.

Metals Focus expects equities to continue to push higher in the current market environment, supported by the stimulative effect of looser monetary policy.

“Looking ahead, with rising pressure on the Fed to stimulate growth and reduce financing costs, confidence in US equities is likely to remain intact. Further gains in US equities should encourage portfolio diversification, which also tends to favor gold.”

With or without rate cuts, the geopolitical uncertainty will likely continue, at least in the near to mid-term. Metals Focus notes that geopolitical tensions have “eased somewhat from earlier this year,” but you can’t rule out renewed instability.

“Uncertainty surrounding US economic and foreign policy is also likely to persist. Taken together, these factors will continue to support the case for adding gold to asset allocations among institutional investors with a medium- to long-term outlook.”

One also has to consider the possibility of a recession. While the mainstream has pretty much written off an economic downturn, the reality is that this debt-riddled, bubble economy has not cleansed the malinvestments and misallocations created by the monetary malfeasance in the wake of the Great Recession and during the pandemic. A downturn would undoubtedly provoke the Fed to cut rates more quickly — likely to zero. It would also likely mean a resumption of quantitative easing. This would result in ramping up inflationary pressure even higher than it already is.

All in all, the move toward looser monetary policy is predominantly bullish for gold (and silver).

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.