(Jesse Colombo, Money Metals News Service) There’s a frantic global scramble for bullion as major dealers rush to move gold into the U.S. ahead of potential tariffs.

Around a month ago, gold and silver markets were being roiled by the possibility that imported gold and silver could be subject to tariffs announced by the newly elected Trump Administration. This uncertainty prompted banks and hedge funds to scramble to cover short positions.

Since then, ongoing speculation about these potential tariffs has fueled continued volatility in the gold and silver markets, particularly as the January 20th inauguration of President Trump approached.

In addition, a frenzied global rush for gold and silver bullion has unfolded, with major dealers racing to move metal into the U.S. ahead of any potential tariff imposition.

The disruption in the precious metals market has been evident in the behavior of front-month futures contracts for silver (March) and gold (February) compared to their spot prices.

Futures prices have been climbing sharply above spot prices, reflecting the urgency of banks and funds scrambling to mitigate risk by closing out short positions, driving gold and silver prices higher in the process. Typically, front-month futures and spot prices move in close alignment, but in recent weeks, they have frequently diverged in an anomalous manner.

For instance, in the days leading up to the inauguration, the premium for front-month silver futures surged from 56 cents per ounce to $1.12, far above the typical 14-cent range.

On the morning of January 20th, the premium dropped sharply from 88 cents to just 52 cents after the Trump administration released a memo stating that broad tariffs would not be imposed on Day 1 of his presidency. Instead, the administration announced plans to first conduct reviews of trade and currency imbalances.

However, the premium rebounded sharply later that day when President Trump suggested he might impose 25% tariffs on Mexico and Canada starting February 1.

Similar to silver, the premium on front-month gold futures surged from $12 per ounce to $44 per ounce ahead of the inauguration, far surpassing the typical $10 premium.

However, it plummeted to as low as $8 after the Trump administration released the memo announcing that tariffs would not be enacted on Day 1 of the presidency. I anticipate continued volatility in gold and silver futures premiums as the market speculates and reacts to news surrounding potential tariffs that could impact imported gold and silver.

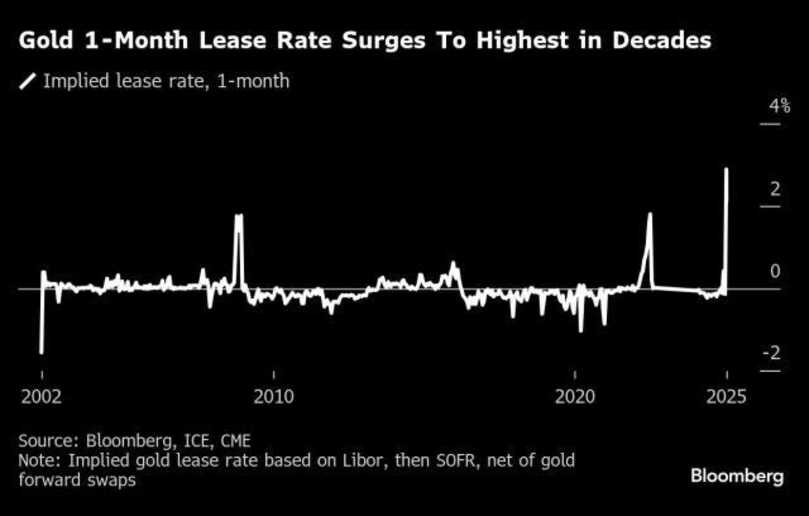

A recent Bloomberg article highlighted that gold lease rates in London have surged to their highest levels in decades amid a frantic global scramble for bullion. Major dealers are rushing to move gold into the U.S. ahead of potential tariffs.

Gold lease rates represent the return demanded by holders of bullion in London’s vaults for lending their gold to other buyers. While these rates typically hover near zero, they have recently spiked to an annualized 3.5%, reflecting the mounting urgency and heightened leasing activity.

Robert Gottlieb, a former precious metals trader and managing director at JPMorgan Chase & Co. explained in the Bloomberg article that “The markets are in total dislocation” and that “There seems to be a scarcity of available stocks in both gold and silver.”

In a LinkedIn post, Gottlieb noted that since November 7, 7.4 million ounces of gold have been delivered to CME Group warehouses in the United States.

The rush for physical gold and silver has the potential to escalate into a squeeze scenario, driving both metals significantly higher. This scramble already seems to be contributing to gold’s nascent breakout:

Silver also appears poised for a bullish move, and I believe it will see a significant surge once it breaks out of its recent consolidation pattern, much like gold’s recent breakout from its triangle pattern:

The start of Trump’s presidency has ushered in significant uncertainty and volatility, but so far, it has proven favorable for gold and silver by sparking a scramble for physical bullion.

Now that both the election and inauguration are behind us, I believe gold and silver are well-positioned to resume their bull markets, which were abruptly disrupted by the November 5th election, causing a sharp but short-lived pullback.

As I’ve maintained all along, this pullback was a temporary buying opportunity for stackers to accumulate at lower prices—a prediction that has proven accurate and will likely continue to hold true as 2025 shapes up to be another strong year for gold and silver.

Jesse Colombo is a financial analyst and investor writing on macro-economics and precious metals markets. Recognized by The Times of London, he has built a reputation for warning about economic bubbles and future financial crises. An advocate for free markets and sound money, Colombo was also named one of LinkedIn’s Top Voices in Economy & Finance. His Substack can be accessed here.