(Luis Cornelio, Headline USA) “Do as I say, not as I do,” seems to be the motto of an infamous Democrat running for the Senate.

Maryland Senatorial Candidate Angela Alsobrooks exploited tax loopholes for which she did not qualify, saving thousands of dollars while viciously advocating for raising taxes on Americans, CNN reported on Sunday.

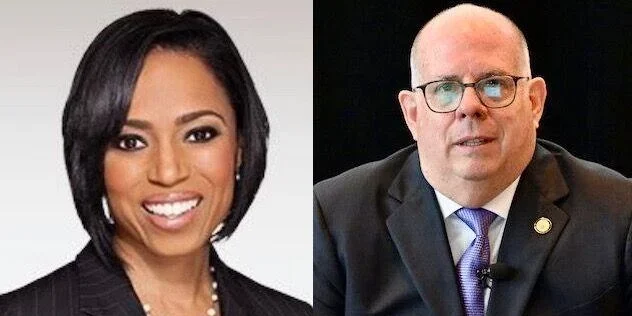

Alsobrooks, a Democrat running against Larry Hogan in 2024, failed to pay the proper taxes on two properties she owned in D.C. and Maryland after applying for a low-income senior citizens’ tax break.

Notably, Alsobrooks is the executive of Prince George’s County, overseeing its finances and tax collection.

According to a CNN investigation, Alsobrooks claimed over a decade of homestead tax exemptions for both of her homes. However, these exemptions are exclusively meant for a taxpayer’s primary residence, not two homes. This tax break allowed her to save at least $2,600.

The 53-year-old Democratic politician also benefited from a senior citizens’ tax break on her Washington home, which cut her tax bill in half.

Alsobrooks was able to save $14,000 using these breaks from 2005 to 2017 despite not residing in the nation’s capital. Even worse is the fact that these breaks are reserved for low-income, senior citizens and D.C. residents only.

Hogan, the former Maryland governor, rebuked the Alsobrooks scandal in remarks to ABC 47, calling out her apparent hypocrisy of backing tax hikes while milking tax breaks.

“I don’t know all the details of it, but it’s concerning obviously,” Hogan said. “I need to look into it. For someone who’s talking about raising taxes on hard-working people at the federal, state, and local level, to have not paid her own taxes is something that she’s going to have to answer for.”

He added, “And, ya know, somebody that’s gaming the system for their own gain while they’re talking about sticking it to everyone else seems to be kind of disingenuous.”

Alsobrooks’ senior adviser, Connor Lounsbury, swiftly engaged in damage control, claiming ignorance of the loopholes she did not qualify for. The adviser affirmed that the Democratic candidate is working with attorneys to amend her tax situation.

Alsobrooks senior adviser Connor Lounsbury swiftly did damage control, claiming ignorance over the loopholes she did not qualify for. The adviser affirmed that the Democrat candidate has retained legal counsel to work on the issues.

“She was unaware of any tax credits attached to that property and has reached out to the District of Columbia to resolve the issue and make any necessary payment,” Lounsbury claimed

In separate statements, Lounsbury claimed that the tax breaks “resulted in no financial gain for” the politician, vaguely affirming that Alsobrooks paid more in taxes.

Angela Alsobrooks responds to claims she saved thousands with improper tax exemptions.

Her senior adviser Connor Lounsbury issued a statement to @7NewsDC pic.twitter.com/ApHpZAXz8o— Scott Taylor : 7 News – WJLA TV (@ScottTaylorTV) September 23, 2024