(Mike Maharrey, Money Metals News Service) Indians have a strong affinity for gold and silver. This has traditionally been expressed in demand for gold and silver jewelry, along with bars and coins. But over the last year, there has been tremendous growth in gold and silver exchange-traded funds (ETFs).

In simplest terms, an ETF represents a basket of investments that trades on the market as a single entity. For instance, a gold ETF is backed by a trust company that holds metal owned and stored by the trust. In most cases, investing in an ETF does not entitle you to any amount of physical gold or silver. (There are exceptions.) You own a share of the ETF, not the metal itself.

ETFs are a convenient way for investors to play the gold and silver markets, but owning ETF shares is not the same as holding physical gold or silver.

Inflows of gold into ETFs can significantly impact the global gold market by pushing overall demand higher.

2024 Gold and Silver Demand in India

Even with the price of both gold and silver at record levels, Indian demand for both metals has been strong so far in 2024.

The Indian government cut taxes on gold and silver imports by more than half in July, lowering duties from 15 percent to 6 percent. The move initially pushed prices down by about 6 percent and drove record gold imports in August. The price drop boosted demand for both metals.

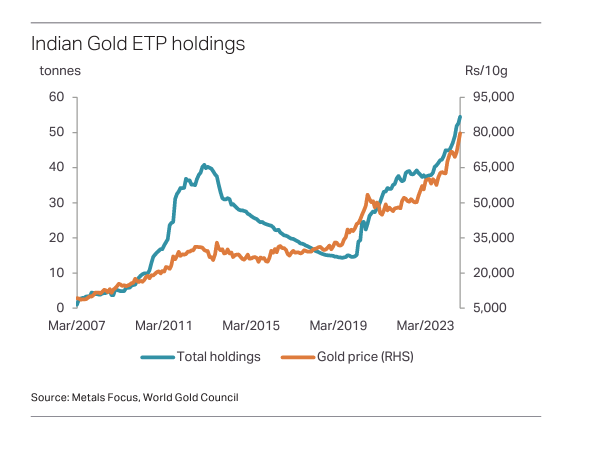

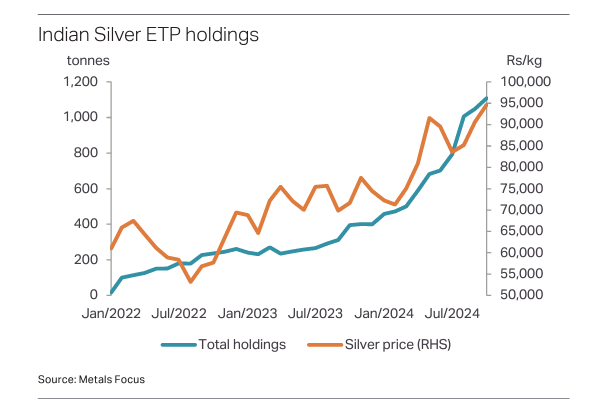

Despite the import duty cut, gold and silver prices have charted strong gains in rupee terms. According to Metals Focus, gold has surged 20 percent this year, touching Rs.80,000/10g in the process. Silver prices have jumped by 17 percent, briefly exceeding the psychologically important Rs.100,000/kg.

Indian buyers tend to be price sensitive, and the higher price has undoubtedly created some headwinds for retail demand, but according to Metals Focus, rising prices have “attracted fresh investment amid expectations of further price increases.”

Demand for gold bars and coins has jumped by an estimated 38 percent year-on-year to 163 tons through the first nine months of 2024. That’s the highest level since 2013.

Meanwhile, silver investment demand is up an estimated 15 percent to 1,766 tons. That’s the second-highest level since 2015.

Indian Gold ETFs Enjoy Resurgence

Gold and silver ETFs are a relatively new phenomenon in India. The first Indian gold ETF was launched in 2007, and the first silver fund was created in January 2022.

Gold ETFs initially failed to attract meaningful flows. According to Metals Focus, this was due to two factors.

- Lack of investor awareness

- A preference for physical metal.

Indian gold ETF holdings initially peaked at 40.8 tons in 2013. As the Great Recession faded into the rearview, tepid interest in ETFs waned even more, with gold-backed fund holdings falling to just 14 tons in 2019.

The introduction of sovereign gold bonds (SGBs) in 2015 put a drag on ETF investment. The government-issued securities are denominated in grams of gold, but they are not backed by physical metal. However, they are guaranteed by the government and offer a 2.5 percent yield. They also have tax advantages.

According to Metals Focus, SGBs attracted gold investment equivalent to 147 tons, with much of the action coming post-pandemic.

“To put this into perspective, up until March 2020, the Reserve Bank of India (RBI) had issued 37 tranches of these bonds, but this attracted just 31 tons of gold. After March 2020, 30 tranches were issued, which brought in 116 tons.”

The government did not issue any SGBs in February 2024, boosting ETF demand.

The positive sentiment toward the yellow metal also boosted gold ETF investment post-COVID. Golding holdings in Indian-based funds rose from 19.4 tons in March 2020 to 54.5 tons as of October 2024. According to Metals Focus, “These inflows, although limited in tonnage terms, were driven by various factors such as a jump in retail trading accounts, the launch of multi-asset funds, and price-driven optimism.”

The pace of gold inflows has accelerated this year. Indian ETF holdings have increased by 12 tons, the highest gain since 2020.

Indian Silver ETFs: A Success Story

India’s love affair with gold is well-known, but Indians also have an affinity for silver. According to Metals Focus, Indian investors have accumulated over 17,000 tons of silver in bar and coin form in the last 10 years.

Indians not only view silver as a store of wealth, but they also see it as a strategic investment option. As Metals Focus put it, the white metal has “tactical appeal, which is driven by its inherent volatility. This has attracted fresh investors in India during the recent bull run they position themselves for potential price gains.”

Silver ETFs based in India have experienced remarkable growth since the first one launched just over 2 years ago. Silver holdings exceeded 1,000 tons in August.

Silver ETFs now equal about 40 percent of annual retail silver investment. This compares to about 5 percent for gold ETFs.

According to Metals Focus, silver’s price performance coupled with a lack of competing products, has driven the growth of silver ETFs.

As Metals Focus noted, silver-backed ETFs also solve a practical problem.

“Given the size of silver bars, this can present a challenge for retail participants to store the metal. This issue was addressed with the launch of ETPs, where investors can hold silver as a security in their trading account.”

Looking Ahead

Metals Focus projects both silver and gold ETFs in India to see inflows of metal.

“This reflects both more investment managers recommending exposure to precious metals and a growing awareness among investors of precious metals ETPs. As a result, we expect to see considerable growth in India’s share of global ETPs, which is currently at 1.6 percent for gold and 4 percent for silver.”

“This reflects both more investment managers recommending exposure to precious metals and a growing awareness among investors of precious metals ETPs. As a result, we expect to see considerable growth in India’s share of global ETPs, which is currently at 1.6 percent for gold and 4 percent for silver.”