(Jesse Colombo, Money Metals News Service) The stars are aligning for copper, which has surged 25% after breaking out of its triangle pattern and now sits just below the key $5–$5.20 resistance zone.

For months, I’ve been bullish on copper. I predicted copper would rebound and enter a long-term bull market, pulling silver higher due to their strong correlation and the influence of arbitrage algorithms reinforcing that price relationship.

When I first shared my bullish outlook, copper was struggling at $4 per pound. Since then, it has surged to $5—a substantial 25% increase in just a few months. And based on current trends, copper’s bull market may just be getting started, as I’ll explain in this update.

Copper has been surging since the start of the year for several key reasons, including the pullback in the U.S. dollar (as I’ll show shortly), expectations of tariffs on U.S. copper imports, China’s special action plan to boost spending by increasing incomes, and strong demand across multiple sectors, particularly the electrical grid, electric vehicles (EVs), and renewable energy technologies.

Let’s dive into copper’s technicals, starting with the daily chart. In late 2024, copper found strong support at the key $4 per pound level, rebounded, and then broke out of a triangle pattern at the start of February.

That breakout signaled a major surge, and the uptrend remains solid and intact. Given the current momentum, I believe copper still has plenty of fuel left to climb higher.

Copper’s weekly chart reveals a major resistance zone between $5 and $5.20, a level that has held firm for the past three years.

However, if copper manages to close above this range, it will break into blue-sky territory, surging to a new all-time high and fully launching into a powerful bull market.

Stepping back to the monthly chart, a bullish ascending triangle pattern has been forming over the past several years. Once it breaks out, it should trigger a bull run similar to the 2020 rally that preceded it.

Based on the measured move principle in technical analysis, this breakout could drive copper up by $3 per pound, reaching $8—a potential 60% gain from current levels.

Copper’s likely upcoming bull market would align with the outlook of French billionaire and commodities trader Pierre Andurand, who predicted that copper prices could soar to $40,000 per tonne in the coming years—a more than fourfold increase from the current price of $9,853 per tonne.

Explaining his bullish stance, Andurand stated, “We are moving towards a doubling of demand growth for copper due to the electrification of the world, including electric vehicles, solar panels, wind farms, as well as military usage and data centers.”

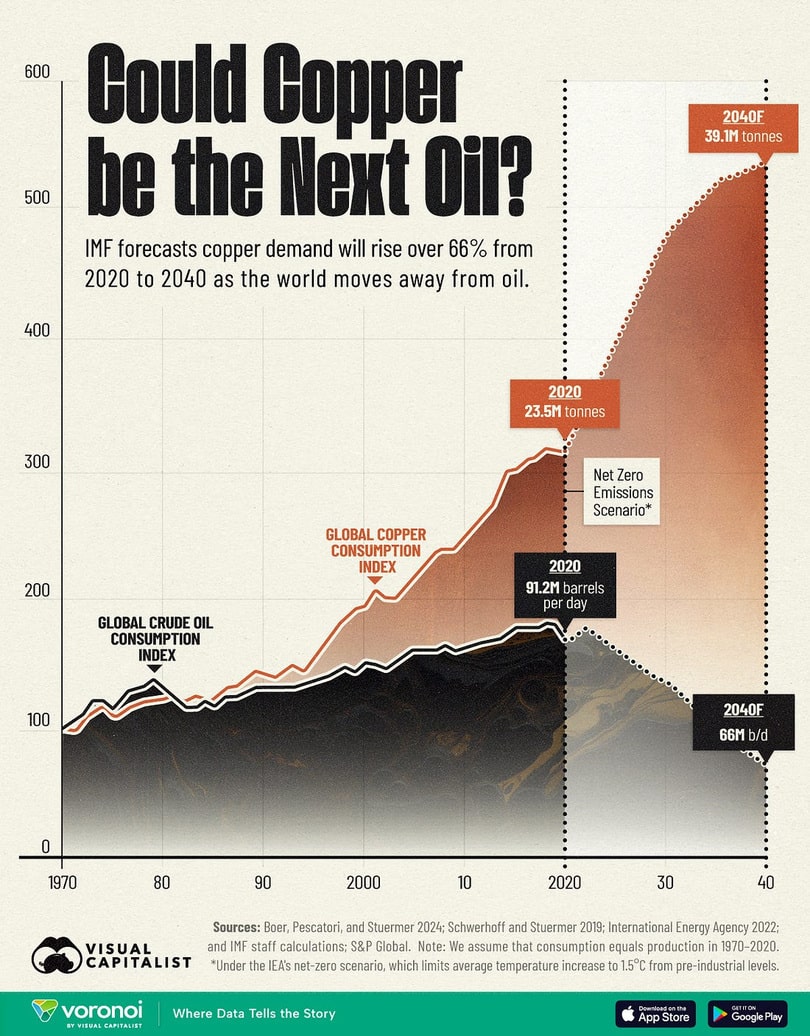

Goldman Sachs has dubbed copper “the new oil” due to its essential role in clean energy technologies, and Visual Capitalist recently published a fascinating infographic on this theme.

Copper earns this title because its demand is expected to surge in the coming decades, while oil consumption is projected to decline as the world transitions away from fossil fuels. Reflecting this shift, the IMF forecasts a 66% increase in copper demand between 2020 and 2040.

As a commodities investor, I closely follow copper not only on its own merits but also as a silver investor and analyst, given their strong correlation. The last time I ran the numbers a few months ago, their correlation stood at a solid 0.771 (out of 1).

This relationship exists for several reasons: both are industrial metals, both trade inversely to the U.S. dollar, and trading algorithms further reinforce their price connection. This high correlation makes copper just as important for silver investors to watch as gold.

Once I recognized copper’s significance in understanding silver’s price movements—and how silver behaves as a hybrid of gold and copper—I developed an indicator called the Synthetic Silver Price Index (SSPI) to better validate silver’s price trends.

This index combines the average prices of gold and copper, with copper adjusted by a factor of 540 to prevent gold from disproportionately influencing the calculation.

Despite silver itself not being an input, the SSPI closely tracks silver’s price movements, providing valuable insight into its price action.

For several months, I’ve been closely watching the SSPI as it struggled to break above the critical 2,600 to 2,640 resistance zone, repeatedly emphasizing that a breakout above this level would be a strong bullish confirmation for silver.

Thanks to recent impressive rallies in both copper and gold, that long-anticipated breakout has finally occurred, signaling that a significant move in silver is likely imminent.

One of the key drivers behind the surge in copper, silver, and gold since the start of the year has been the sharp decline in the U.S. Dollar Index.

Since the Dollar Index and precious metals have an inverse relationship, a weakening dollar typically fuels bullish momentum in gold and silver, while a strengthening dollar applies downward pressure.

The dollar’s surge leading up to and following the U.S. presidential election triggered a steep drop in gold and silver, leading many to believe the rally was over—but as I pointed out at the time, that wasn’t the case.

There is a high probability of further significant declines in the U.S. Dollar Index, as it currently sits at one of its most overvalued levels relative to other fiat currencies in over 120 years of data—the last instances being 1933 and 1985, both of which were followed by sharp dollar weakness.

If history repeats, this would be extremely bullish for the entire commodities sector, including copper, gold, silver, and mining stocks, given the strong inverse relationship between the dollar and commodities.

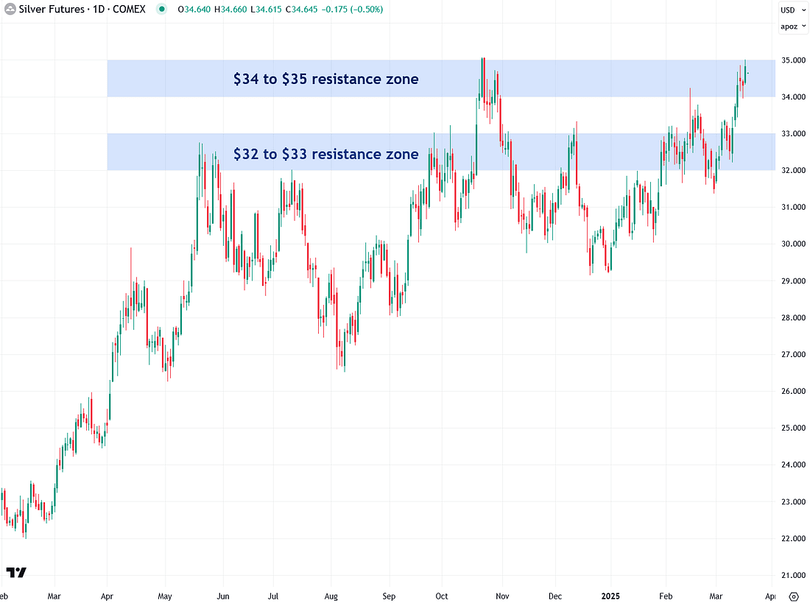

Finally, let’s examine where silver stands after its strong gains since the start of the month. COMEX silver futures have successfully broken above the critical $32–$33 resistance zone, which had acted as a ceiling for much of the past year—a highly bullish development.

The next key hurdle is the $34–$35 resistance zone just overhead. Once silver clears this level, I believe it will enter a powerful bull market, rapidly climbing to $40, $50, $60, and beyond.

While many silver investors are feeling pessimistic after watching gold surge while silver struggled over the past year, I see things differently.

I see a strong parallel between silver’s $32–$33 resistance zone, which has acted as a ceiling for much of the past year, and gold’s $2,000–$2,100 resistance zone, which capped its upside from 2020 until 2024.

Once gold finally broke above that level, it exploded higher—and I believe silver is on the verge of doing the same.

In summary, the stars are aligning for copper, which has surged 25% after breaking out of its triangle pattern and now sits just below the key $5–$5.20 resistance zone—a breakout above should ignite a full-fledged bull market.

This would also be highly bullish for silver, given their strong correlation and the trading algorithms that link their movements.

Additionally, with the overvalued U.S. dollar likely to normalize soon, the entire commodities sector, including copper, silver, gold, and mining stocks, should explode higher. This is an exciting moment for hard asset investors.

Jesse Colombo is a financial analyst and investor writing on macro-economics and precious metals markets. Recognized by The Times of London, he has built a reputation for warning about economic bubbles and future financial crises. An advocate for free markets and sound money, Colombo was also named one of LinkedIn’s Top Voices in Economy & Finance. His Substack can be accessed here.