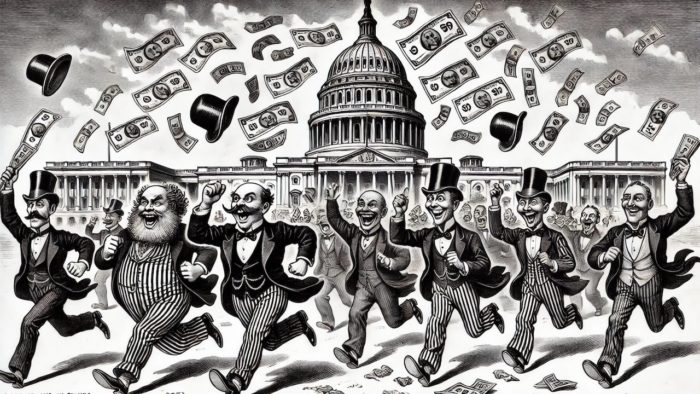

(Mike Maharrey, Money Metals News Service) The federal government “averted disaster” as it continued to hurdle toward the edge of a cliff.

Last week, Congress approved a bill to fund the government through March 14 and avoided a “government shutdown.” However, it did nothing to address the ever-growing national debt, underscoring a systemic problem in Washington, D.C.

In fact, the entire saga hints at the fact that they’ll get the borrowing and spending problem under control until the debt blows up in our faces.

The Budget Deal

The most important thing to understand about the budget deal is that it added more spending to the already bloated federal budget.

The 118-page stop-gap spending bill includes $100 billion for disaster relief and $10 billion in aid to farmers, along with money to fund the reconstruction of the Francis Scott Key Bridge in Baltimore.

On the bright side (for those who care about reducing the size of government and addressing the debt), pressure from President Trump, Elon Musk, and more conservative members of Congress torpedoed the original 1,500-page proposal that was packed full of pork, a pay raise for Congress, and all kinds of unrelated provisions that lawmakers hoped they could slide through the process without debate.

But it’s telling that Congress pushed through additional spending despite the spotlight on cutting government spending in the face of massive monthly deficits and a national debt that recently eclipsed $36 trillion.

And it underscores the harsh reality. The government has a borrowing and spending problem that isn’t going away.

The Biden administration spent a staggering $6.75 trillion in fiscal 2024, a 10 percent increase over 2023 outlays. The federal government is blowing through well over half a trillion dollars every single month.

And as the budget deal underscores, despite some Republicans paying lip service to cutting spending, Congress keeps finding new ways to spend money.

Remember how President Biden promised that the [pretend] spending cuts would save “hundreds of billions” with the debt ceiling deal (aka the [misnamed] Fiscal Responsibility Act)?

That never happened.

And now they’re piling on more spending.

You might think that additional spending for disaster relief is warranted and that helping farmers struggling with declining commodity prices is a good thing. But politicians will always justify their expenditures as “necessary,” “crucial,” or “imperative to our national security.”

There will always be a new crisis, war, or disaster to justify more spending.

Granted, there are a few optimistic signs. The Republicans managed to kill the first budget deal with its barrels of pork. When Republicans control both chambers of Congress and the White House in January, there will be an opportunity to tackle the spending problem, but whether the GOP has the political will to make substantial cuts remains to be seen.

Keep in mind that it’s easier to talk about spending cuts than it is to actually cut spending. Nobody wants “their” program to feel the slice of the scissors. Spending cuts are never as popular in practice as they are in theory.

And even if the Trump administration manages to slash discretionary spending as promised, that only accounts for 27 percent of total spending. The vast majority is for entitlements, and there is little political will on either side of the political aisle to take the scissors to Social Security or Medicare.

The Fake Debt Ceiling Fight

Another bad sign is Trump’s push to raise the debt ceiling and the attempt to ram it through.

Following Trump’s lead, Republicans initially included a provision to suspend the debt ceiling in the budget bill, leading to another (fake) debt ceiling fight.

In practice, the debt ceiling is a legislative limit on the total amount of money the United States government can legally borrow to meet its financial obligations.

In June 2023, Congress suspended the debt ceiling through Jan. 1, 2025. In effect, Congress handed itself a credit card with no limit for two years.

At the time of the debt ceiling suspension, the limit stood at $31.38 trillion. Since then, the federal government has ballooned the debt by $4.79 trillion.

When the suspension ends on Jan. 1, the ceiling will automatically rise to match the current debt level, but the Treasury won’t be able to borrow more without a new debt ceiling or another suspension of the limit.

But even with the federal government up against the debt ceiling, the Treasury Department can execute “extraordinary measures” to keep the government running as normal without issuing more debt. These measures include redeeming existing investments and suspending future investments in the Civil Service Retirement Disability Fund, the Postal Service Retiree Health Benefits Fund, and federal employee retirement system savings plans. These moves would likely push the hard debt ceiling deadline to the summer of 2025.

The debt ceiling game is nothing new.

Congress imposed the first debt ceiling in 1917. The Second Liberty Bond Act capped debt at $11.5 billion. This was supposed to put some kind of restraint on government borrowing.

Of course, it didn’t. Every time the debt approaches the ceiling, Congress simply raises it. Between 1962 and 2011, lawmakers jacked up the debt “limit” 74 times, according to the Congressional Research Service.

In 2013, Congress came up with a new trick. Instead of raising the debt ceiling, it just suspended it. In 2014, Congress set the debt limit with a built-in “auto-adjust.” The auto-adjust ended in March 2015, with the debt ceiling set at $18.1 trillion. After that, Congress suspended the debt ceiling four times, including the latest pause in 2023.

It’s clear the debt ceiling doesn’t do anything to slow down the fast-spending drunken sailors on Capitol Hill. But it does afford a great prop for Republicans and Democrats to put on kabuki theater. And it creates an ideal scenario for political brinksmanship.

So, pop some popcorn and pull up a chair because you’re going to hear a lot about the debt ceiling over the next several months. Politicians will posture, pontificate, and play a dramatic game of chicken. We might even have to endure another government “shutdown.” But at the end of it all, Congress will raise or suspend the debt limit next year, and Trump will sign off on it. Failure to do so would mean default – something nobody is seriously willing to contemplate.

In other words, it’s a fake fight.

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.