(Mike Maharrey, Money Metals News Service) The Consumer Price Index is cooling, but what about inflation?

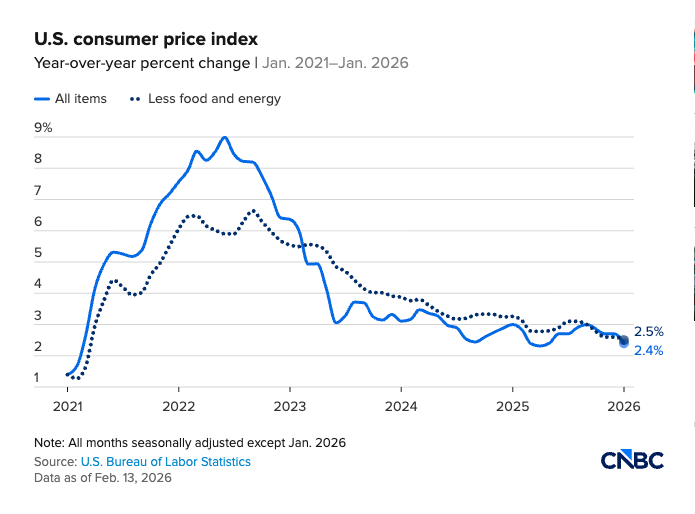

The January CPI data give the impression that the Federal Reserve is finally winning the war against inflation. Not only was the data cooler than expected, but it’s also beginning to edge close to the mystical 2 percent target. CBS News called it “the best inflation news we’ve had in months.”

The January CPI report also boosted hopes that maybe the Fed will cut interest rates more deeply than it’s been signaling. According to CME Group’s Fed Watch tool, traders see an 83 percent chance of a rate cut in June.

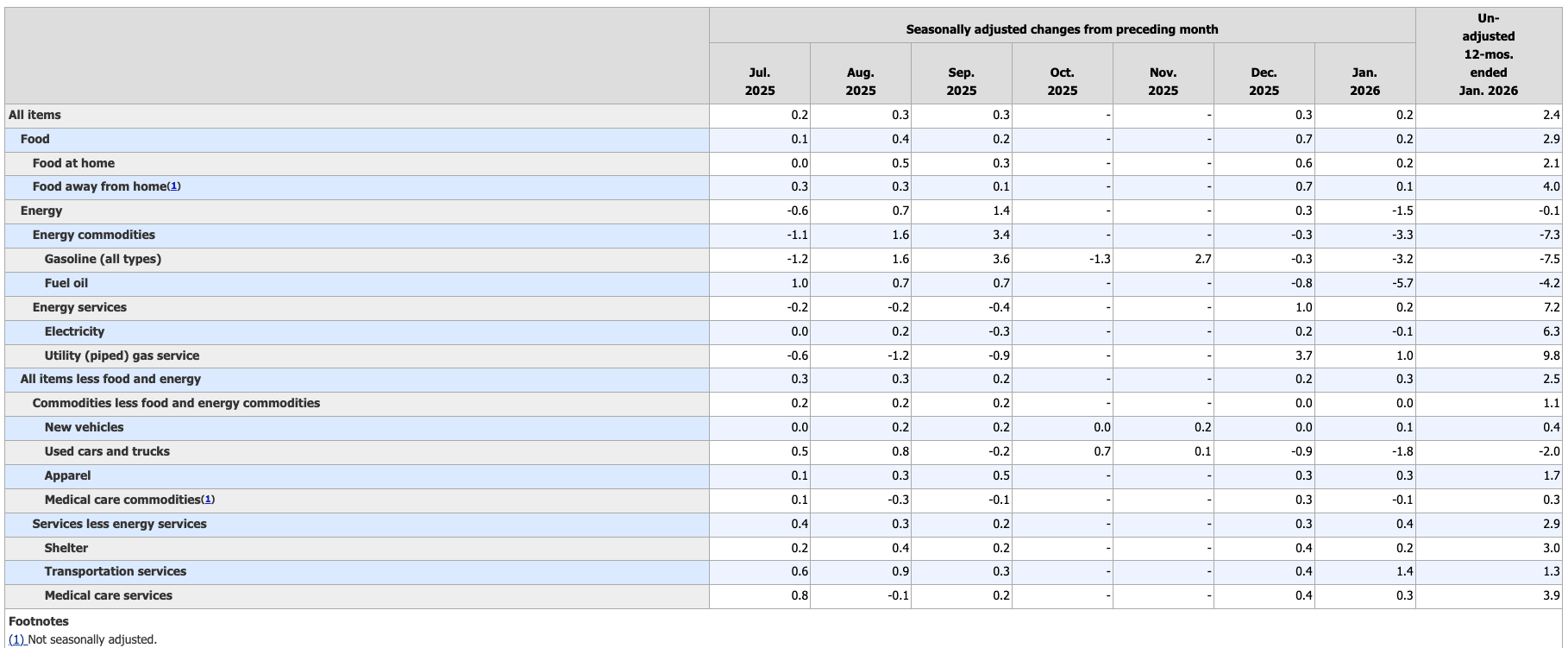

The headline annual CPI rate came in at 2.4 percent, according to the Bureau of Labor Statistics data. That was down from 2.7 percent in December and the same rate the BLS reported in May 2025, the month after President Trump announced his aggressive tariff policy. The forecast was for a 2.5 percent reading.

On a monthly basis, prices rose 0.2 percent, beating the 0.3 percent forecast.

Stripping out more volatile food and energy prices, core CPI prices rose 0.3 percent month on month. The annual core CPI dropped from 2.6 percent in December to 2.5 percent, the lowest reading since April 2021.

However, over the last six readings (with no October data), core CPI has increased by 0.3, 0.3, 0.2, 0.2, 0.2, and 0.3 percent, annualizing to 3 percent. Core CPI has been mired in this range for well over a year.

Digging a little deeper into the numbers, we find shelter prices rose 0.2 percent in January, the smallest gain in months. That dropped the annual shelter cost increase to 3 percent. Shelter makes up more than one-third of the CPI calculation.

After surging by 0.7 percent in December, food prices moderated, gaining just 0.2 percent last month.

Energy prices plunged by -1.5 percent month-on-month, also helping drive the overall CPI lower. Gasoline prices dropped by -3.3 percent.

Service costs heated up slightly, rising by 0.4 percent month-on-month after a 0.3 percent increase in December. Service price inflation is mostly unconnected with tariff pressures.

It’s important to take this (and every) CPI report with a grain of salt. It is still factoring in November data that they basically just made up. And the constant revisions to the labor data should also make you skeptical of government numbers.

You also need to remember that the CPI data understates price inflation by design. The government revised the CPI formula in the 1990s so that it understated the actual rise in prices. Based on the formula used in the 1970s, CPI is closer to double the official numbers. So, if the BLS used the old formula, we’d be looking at CPI closer to 6 percent. And using an honest formula, it would probably be worse than that.

However, this government data drives decision-making, so we need to pay attention to what it tells us.

This CPI data tells us that prices are still rising faster than the stated target; however, the price inflation trend appears to be slowing – at least for the items included in the BLS “basket of goods.”

The mainstream is certainly viewing it as good news. Navy Federal Credit Union chief economist Heather Long told CNBC that the January report was “great news,” noting the slowing price increases for food, gas, and rent will “provide much-needed relief for middle-class and moderate-income families.”

But what did this CPI tell us about inflation?

Not much, when you define inflation properly.

Technically speaking, inflation is an increase in the supply of money and credit. Rising consumer prices (measured by the CPI) are just one symptom of this monetary inflation. In other words, the CPI report is kind of like a thermometer. It can tell you if you have a fever, but it can’t tell you what’s causing it.

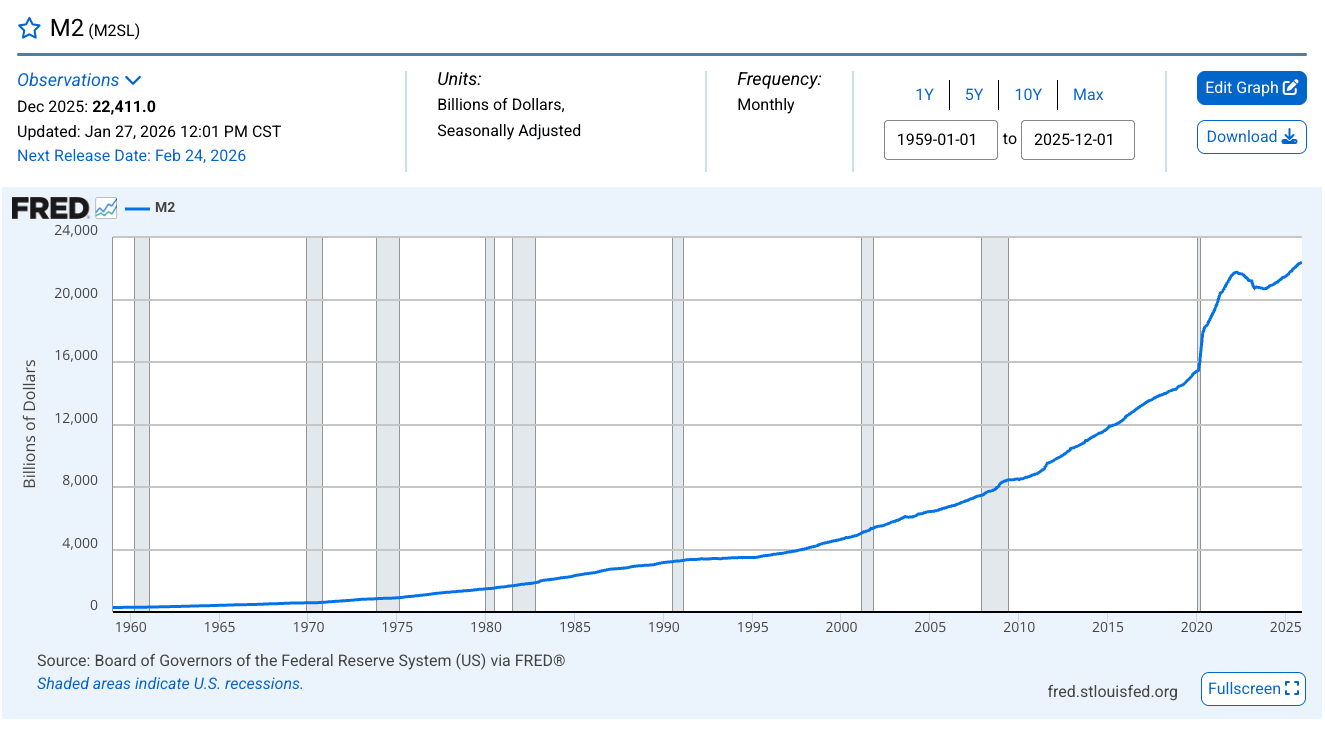

To get the full inflation picture, you need to look at the trajectory of the money supply.

By that metric, we have plenty of inflation, and it is accelerating!

As the Federal Reserve revs up the money-creating machine even higher, the money supply is already growing at the fastest rate since July 2022, in the early stages of the tightening cycle.

After peaking in April 2022, the money supply began to decline as the Fed hiked rates that year. The money supply bottomed in October 2023 and began increasing again. The money supply is now well above the pandemic peak.

And money creation has accelerated over the last several months.

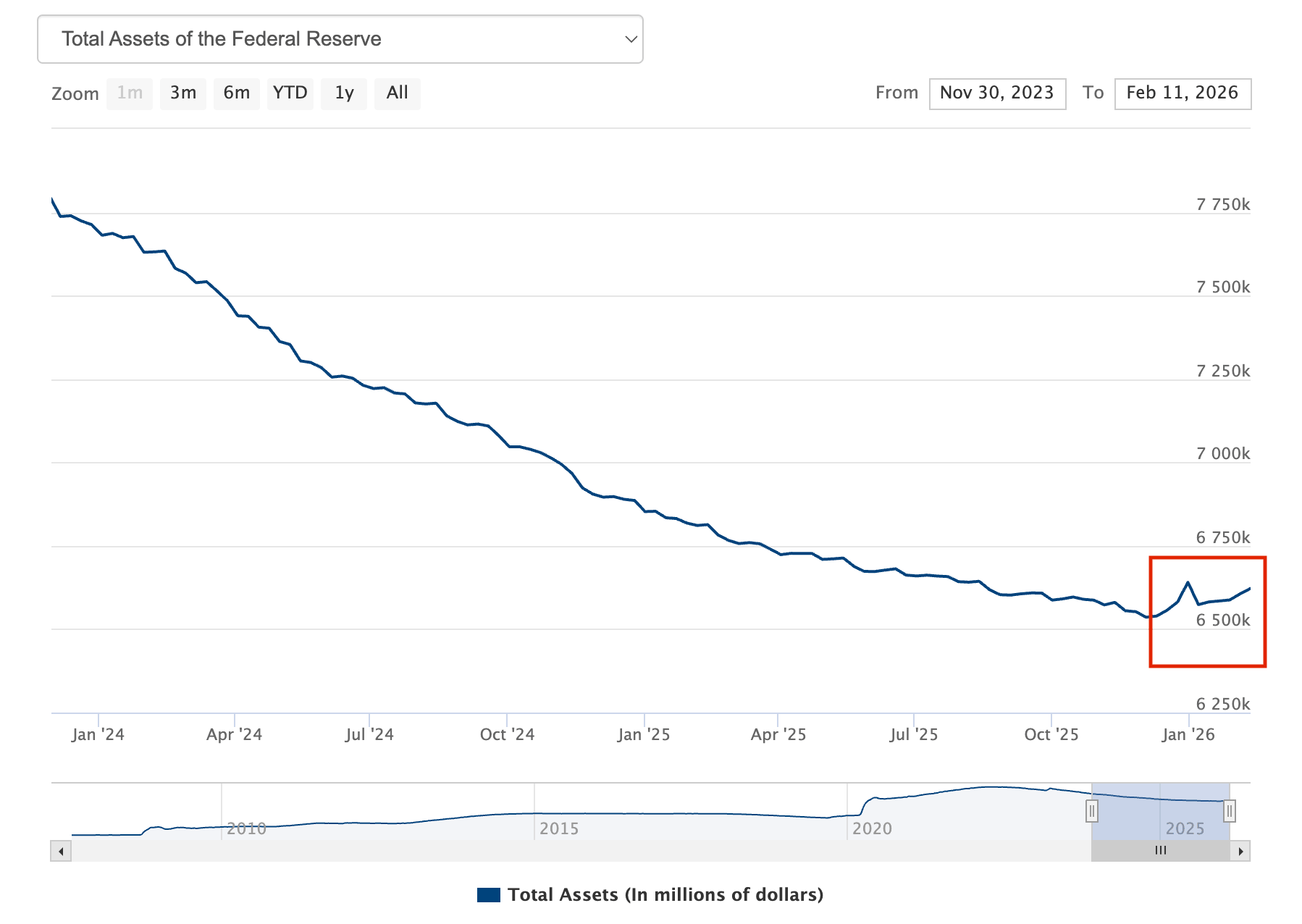

We also know inflationary pressures are increasing because the Federal Reserve is once again expanding its balance sheet.

While you’ll never hear anybody at the Fed utter the term, the central bank relaunched quantitative easing last month. That means they are once again buying U.S. Treasuries using money created out of thin air.

Again – this is by definition inflation.

So, why would the central bank continue to loosen monetary policy even when faced with sticky inflation?

Because, as I have been saying for months, the Fed is in a Catch-22.

The Fed needs to cut interest rates and run quantitative easing to support the debt-riddled bubble economy. But it also needs higher rates to keep price inflation under control.

Obviously, it can’t do both.

Any “cooler than expected” CPI report will throw more fuel on the easing fire and raise the possibility for more this year, despite the central bankers’ efforts to tamp down expectations for further easing.

In other words, you get more inflation — despite what the CPI data might indicate.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.