(Jesse Colombo, Money Metals News Service) The current gold bull market began in the spring of 2024, fueled in large part by aggressive Chinese futures traders on the Shanghai Futures Exchange (SHFE), while Western investors remained largely on the sidelines.

In just six weeks between March and April, these traders propelled gold prices up by $400, or 23%—an extraordinary surge for the yellow metal. Since then, their activity has quieted, but I’ve anticipated their return, expecting them to push gold to truly staggering levels.

That moment may have arrived. Fresh off the week-long Chinese Lunar New Year holiday, these traders are reentering the market—just as gold was already heating up without them.

The Shanghai Futures Exchange gold futures were the primary vehicle behind the spring 2024 gold frenzy, a surge that subsequently spilled over into international gold prices:

Over the past year, SHFE gold futures have mirrored the international gold price, steadily rising before consolidating in a trading range from late October to January.

But as soon as China’s financial markets reopened this week after the Lunar New Year holiday, SHFE gold futures gapped higher, swiftly catching up to the international rally that unfolded while China was offline.

This breakout signals strong bullish momentum, suggesting even greater gains lie ahead.

The trading range and recent breakout are also evident in the international spot gold price denominated in Chinese yuan, providing further confirmation of the bullish trend:

The spot price of gold in U.S. dollars also recently broke out of a triangle consolidation pattern, confirming the bullish momentum:

I believe all the key ingredients for another China-driven gold mania—similar to last spring—are now in place. It may only be a matter of time.

A key indicator to watch is trading volume in SHFE gold futures. Last spring, a surge in volume accompanied gold’s explosive rally. So far, volume has remained subdued, but it’s likely to increase as the rally gains momentum.

For confirmation, I’m looking for a significant spike in volume to validate this thesis.

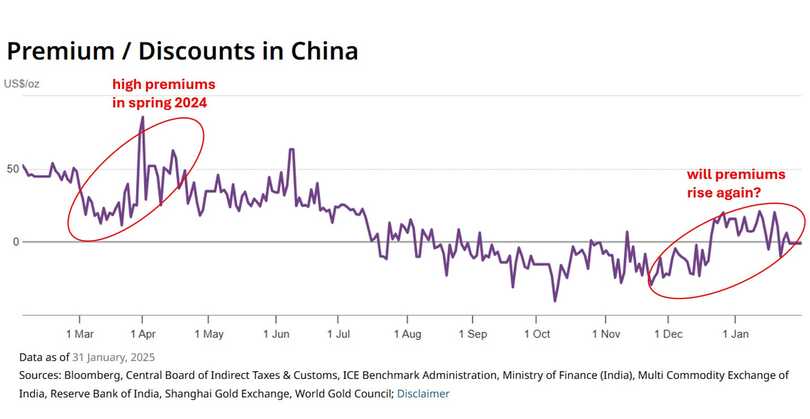

Another key indicator of a potential Chinese gold mania is whether the domestic Chinese gold price trades at a premium to the international price.

During last spring’s explosive rally, the domestic price carried a premium of approximately $50 over the international price. Currently, there is little to no premium or discount, but it’s worth watching closely.

If a significant premium emerges, it would likely signal that Chinese demand is once again driving gold higher.

A major catalyst for a potential Chinese gold mania is the country’s severe economic turmoil. With its real estate and stock markets plunging, an estimated $18 trillion in household wealth has been wiped out—an economic crisis akin to China’s version of the 2008 Great Recession.

Meanwhile, government bond yields have collapsed to record lows, signaling a deepening deflationary spiral. In low-interest-rate environments like China’s, gold— which generates no yield—becomes more attractive as the opportunity cost of holding it diminishes.

Additionally, China is likely to respond with a massive stimulus “bazooka” to combat deflation, which should provide a powerful tailwind for gold, silver, and other commodities.

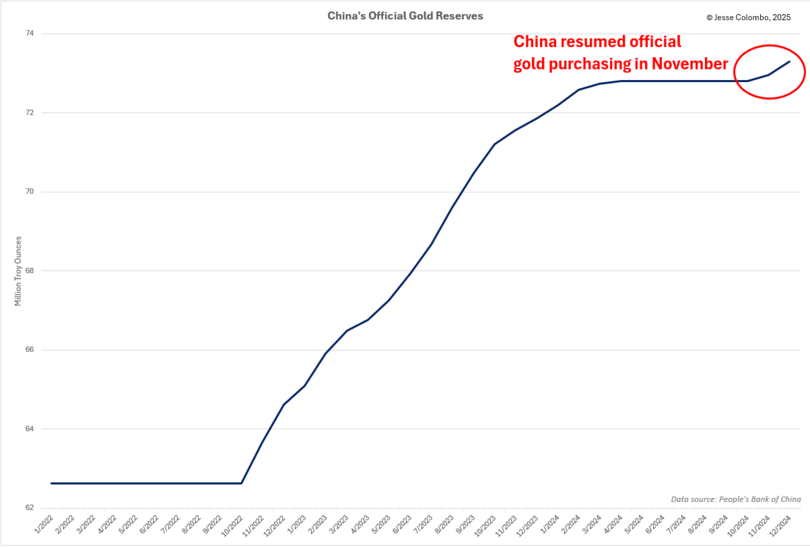

Another potential catalyst for a Chinese gold mania is the People’s Bank of China’s (PBOC) recent resumption of official gold purchases after a six-month pause.

The PBOC was likely accumulating gold all along, but its decision to publicly announce renewed purchases appears to be a strategic move aimed at encouraging domestic gold buying.

This aligns with China’s broader strategy of diversifying away from U.S. dollars and increasing gold holdings across all levels of society.

All signs point to the potential for another explosive gold rally driven by Chinese traders, much like what unfolded last spring.

With SHFE gold futures breaking out, the possibility of rising trading volumes, and the return of a Chinese gold price premium, the conditions for another bullish episode are falling into place.

China’s economic crisis, record-low bond yields, and the looming prospect of massive stimulus only strengthen the case for gold’s continued ascent. Meanwhile, the PBOC’s renewed gold purchases reinforce the broader shift toward gold as a preferred asset.

If these factors align as expected, the next phase of this bull market could be even more dramatic than what we saw in 2024.

Jesse Colombo is a financial analyst and investor writing on macro-economics and precious metals markets. Recognized by The Times of London, he has built a reputation for warning about economic bubbles and future financial crises. An advocate for free markets and sound money, Colombo was also named one of LinkedIn’s Top Voices in Economy & Finance. His Substack can be accessed here.