(Mike Maharrey, Money Metals News Service) A colleague recently discovered a website called “WTF Happened in 1971?” The entire main page is filled with charts and graphs. All of them show some kind of significant shift beginning in 1971. There are over 75 of them!

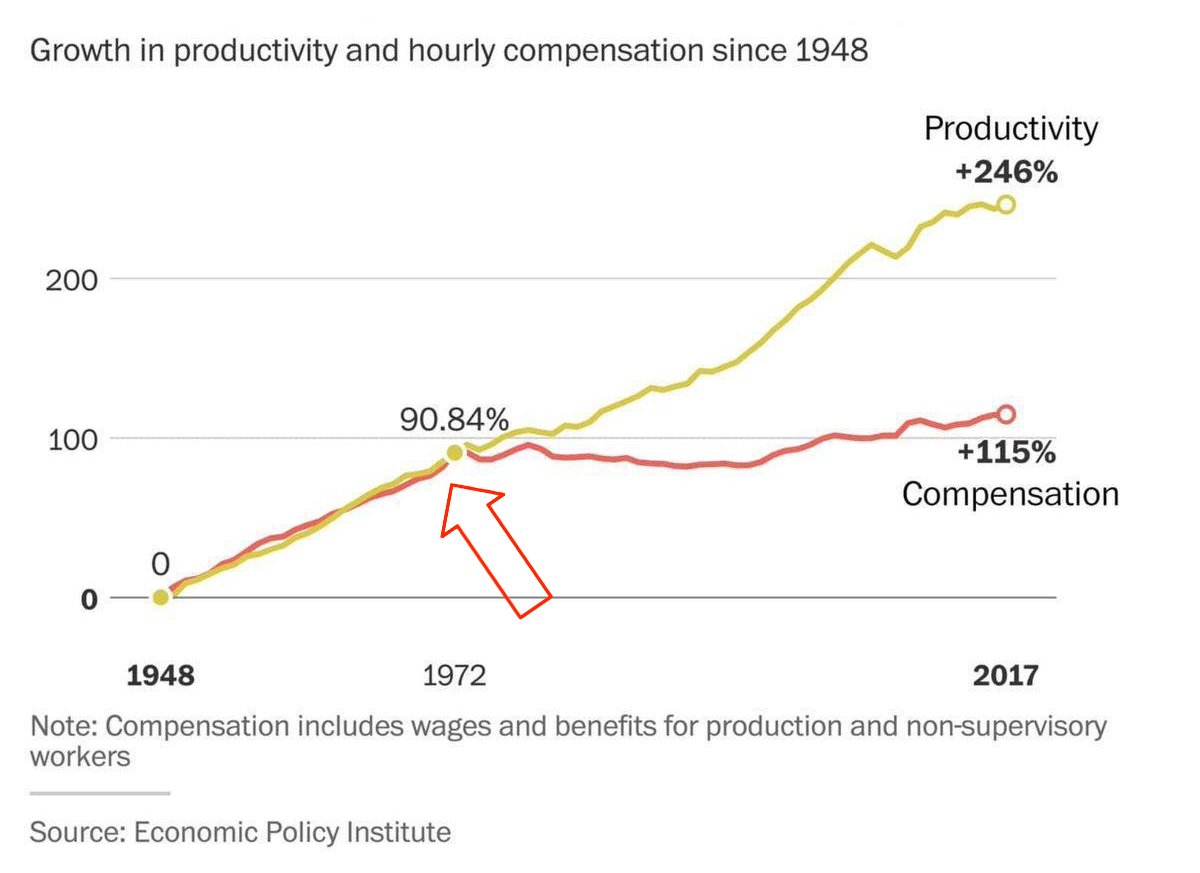

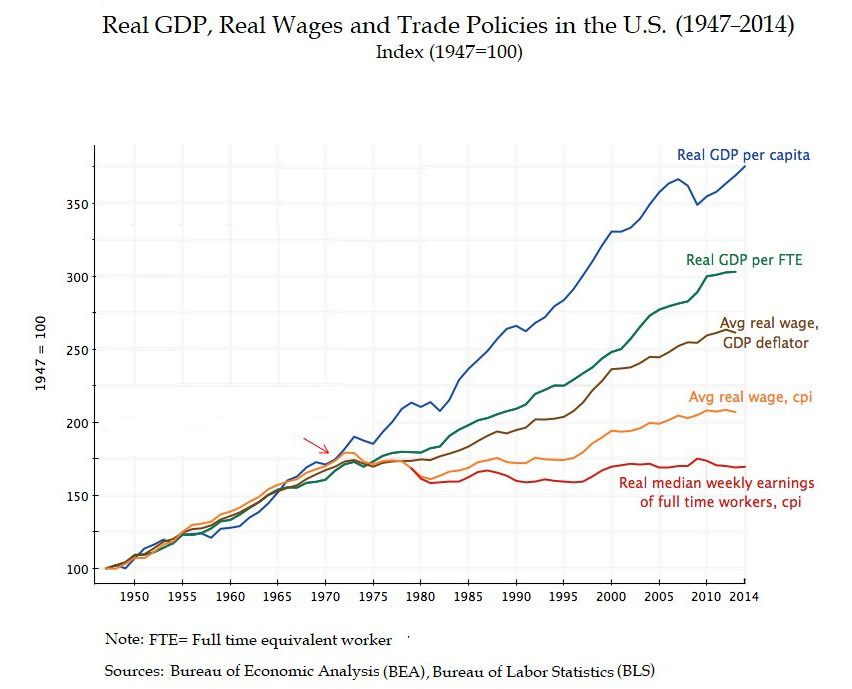

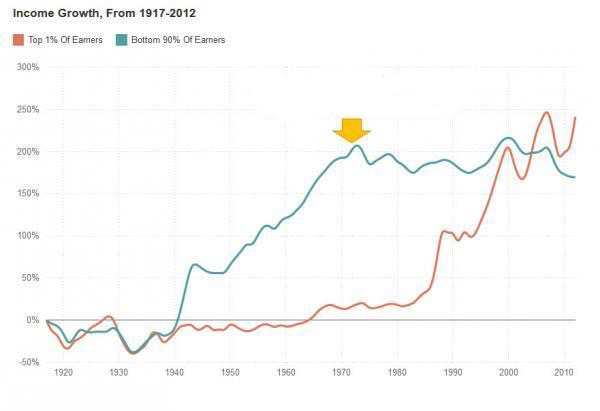

Here are just a few examples:

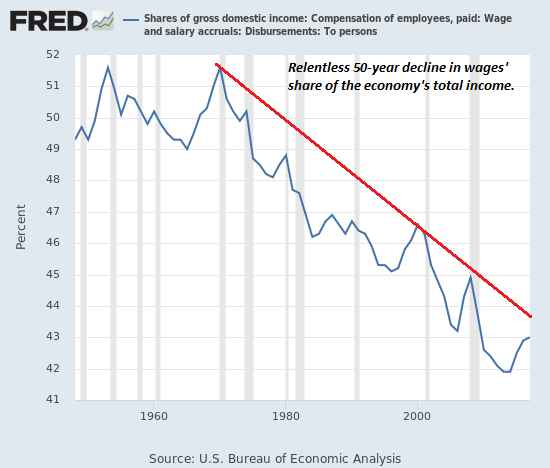

Here is some more data from graphs on the website:

- African-American incomes virtually stopped catching up to white incomes in 1971.

- Median male income has flatlined compared to real GDP per capita since 1971.

- The number of 2-income families has surged since 1971.

- Price inflation has surged since 1971.

- A can of Campbell’s tomato soup has undergone significant shrinkflation since 1971.

- Housing prices have skyrocketed since 1971.

Clearly, something significant happened in 1971 causing a tremendous economic shift.

What was it?

President Richard Nixon severed the dollar’s last connection with the gold standard, making it a purely free-floating fiat currency.

Nixon ordered Treasury Secretary John Connally to uncouple gold from its fixed $35 price and suspended the ability of foreign banks to directly exchange dollars for gold. During a national television address, Nixon promised the action would be temporary to “defend the dollar against the speculators.”

Nixon’s order was the end of a path off the gold standard that started during President Franklin D. Roosevelt’s administration. June 5, 1933, marked the beginning of a slow death of the dollar when Congress enacted a joint resolution erasing the right of private creditors in the United States to demand payment in gold. The move was the culmination of other actions taken by Roosevelt that year, including his infamous “gold confiscation” order.

While American citizens were legally prohibited from redeeming dollars for gold after Roosevelt’s policy changes, foreign governments maintained that privilege. In the 1960s, the Federal Reserve initiated an inflationary monetary policy to help monetize massive government spending for the Vietnam War and Pres. Lyndon Johnson’s “Great Society.” With the dollar losing value due to these inflationary policies, foreign governments began to redeem dollars for gold.

This is exactly how a gold standard is supposed to work. It puts limits on the amount the money supply can grow and constrains the government’s ability to spend. If the government “prints” too much money, other countries will begin to redeem the devaluing currency for gold. This is what was happening in the 1960s. As gold flowed out of the U.S. Treasury, concern grew that the country’s gold holdings could be completely depleted.

Instead of insisting on fiscal and monetary discipline, Nixon simply severed the dollar from its last ties to gold, allowing the central bank to inflate the money supply without restraint.

When he announced the closing of the gold window, Nixon said, “Let me lay to rest the bugaboo of what is called devaluation,” and promised, “Your dollar will be worth just as much as it is today.”

This was clearly a lie. That’s what all the charts on WTF Happened in 1971 reveal.

According to the Consumer Price Index data released by the Bureau Labor of Statistics, the dollar has lost well over 80 percent of its value since Nixon’s fateful decision. Meanwhile, the dollar value of gold has gone from $35 an ounce to about $2,300.

And it decimated the middle class, creating significant socio-economic shifts.

You’ll only find one blurb of text on the WTF Happened in 1971 website. It’s a quote by economist F.A. Hayek.

“I don’t believe we shall ever have a good money again before we take the thing out of the hands of government, that is, we can’t take it violently out of the hands of government, all we can do is by some sly roundabout way introduce something that they can’t stop.”

Check out the work of the Sound Money Defense League to see what’s happening at the state level to do just that.

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.