(Brien Lundin, Money Metals News Service) The world is worried. And typically in such an environment, investors across the globe rush to three safe havens: the U.S. dollar, U.S. Treasuries, and gold.

This time is different — because they’re dumping the greenback and Treasuries… and buying gold hand over fist.

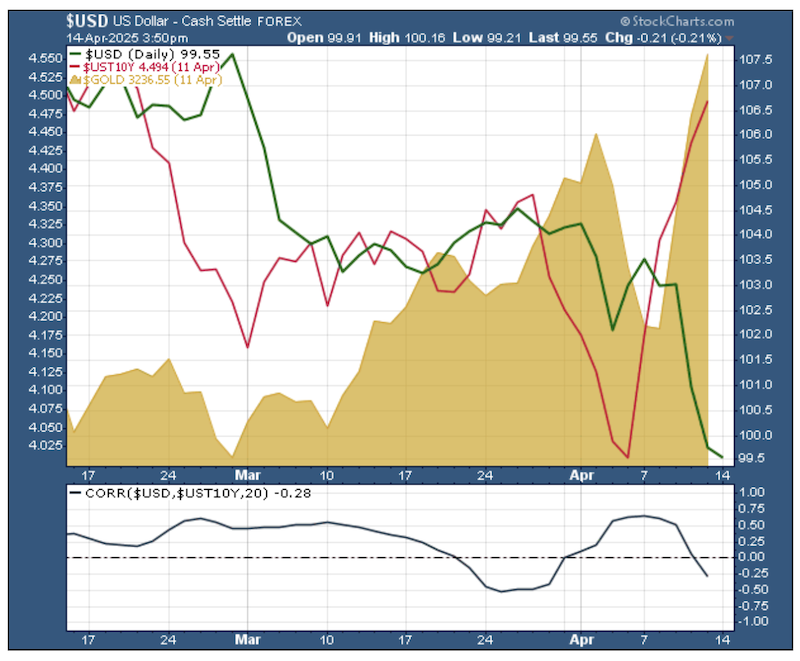

This dynamic isn’t just unusual, it’s unprecedented…and illustrated in the chart below.

In this chart, the Dollar Index is in green, the 10-year Treasury yield is in red, and gold, of course, is the gold area in the background. The bottom panel is the 20-day rolling correlation between the dollar and Treasury yields.

In normal times, the dollar and yields are positively correlated, with the correlation line above zero. That brief dip in the correlation in late March merely reflects some back-and-forth, trendless action earlier in the month.

Now note the sharp divergence over the last week when, counter to the Trump administration’s hopes and plans, their harsh tariff policies sent the world running from the U.S…..and toward the one remaining safe haven of gold.

The dollar sank, Treasury yields jumped and the gold price soared.

Put simply, the rest of the world is selling America.

Importantly, as the chart also shows clearly, that flight from U.S. safe havens into gold ended the metal’s brief correction and sent the price skyward, wiping out much of its overbought status in the process.

On Monday, gold was slammed on the U.S. open, as investors flocked back to U.S. equities because President Trump delayed his reciprocal tariffs and exempted electronics exported from China from his most onerous levies.

The steady-state demand from central banks along with investors and institutions around the world is still in place, though, and sparking a rebound from the early-session price lows.

Mining Stocks Take Off

A soaring gold price is nothing new — we’ve seen this kind of action over and over since February of last year.

What’s different this time is that Western investors are now coming to the party…finding the move in gold far advanced…and deciding to play the trend via gold mining stocks.

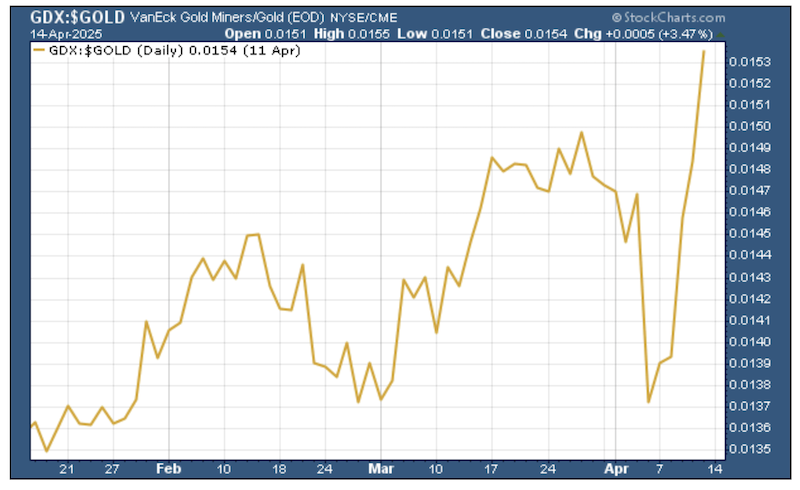

The result is that, even with gold rocketing higher, the gold stocks have been doing even better. This chart of the GDX gold mining index/gold price ratio shows the dramatic outperformance of the miners.

Even more impressive, the gold stock indices are up again, even with gold down about 1%.

It’s an amazing time — fraught with risks and tremendous opportunities.

To get Brien Lundin’s ongoing commentary on the markets at no charge, click here to subscribe to his free Golden Opportunities newsletter.

Brien Lundin is the publisher and editor of Gold Newsletter, the publication that has been the cornerstone of precious metals advisories since 1971. Mr. Lundin covers not only resource stocks but also the entire world of investing. He also hosts the annual New Orleans Investment Conference. To get Brien Lundin’s ongoing commentary on the markets at no charge, click here to subscribe to his free Golden Opportunities newsletter.