(Clint Siegner, Money Metals News Service) There aren’t too many upsides to the widespread loss in confidence currently underway. It would be far better if major institutions were trustworthy, competent, and efficiently run. But fixing these institutions first requires recognition of the problems.

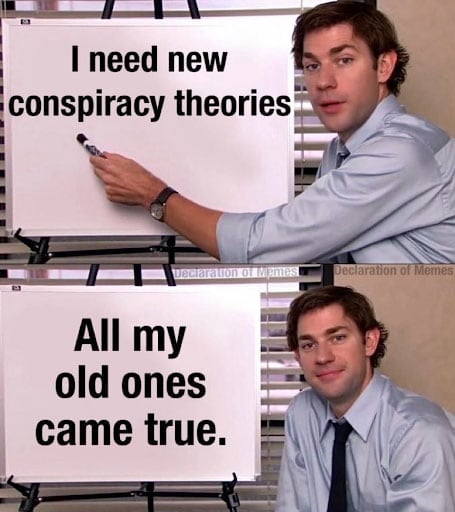

The people who spent all of their time marginalizing gold bugs as nutjobs and conspiracy theorists are starting to find themselves out on the fringe.

It suddenly makes sense to vast swathes of Americans to question whether long-held assumptions are true. It’s the people who implicitly trust what they have been told by bureaucrats and bankers who look a little silly.

The veil is slipping. Gold and silver investors should be ready for some interesting revelations and, perhaps, changes in the metals markets.

They should also beware of “experts” still clinging to conventional wisdom. Now is the time for questions, not blind trust.

The following assumptions are foolish. Those who defend them are naive at best, or they may have some stake in preserving the status quo.

FOOLISH ASSUMPTION #1 – There are no problems with decades-old audits of the U.S. gold reserves, including the bars in Fort Knox, and it’s unreasonable to ask for a new audit that also examines encumbrances.

The best reason to do a comprehensive audit of U.S. gold is that bureaucrats desperately want to avoid it. They resist all efforts for a new inventory and assay of each and every bar.

Jan Nieuwenhuijs makes the case as to why prior accounting relating to U.S. gold is misleading, problematic, and incomplete. Readers who prefer a video can find that here.

There are three possibilities with regards to the U.S. gold reserves. The worst case is that some of the gold is missing.

Another possibility is that the U.S. gold has been leased, or otherwise encumbered and it is no longer 100% available to the U.S. Treasury.

The best case is the gold is all there and it is unencumbered, but much of it is in the form of coin melt (90% pure) bars, which are illiquid (as the bullion markets require much higher purity).

Anyone who still trusts what officials have told them and ridicules the idea of a thorough audit, in this day and age, is a moron. It is high time to go through the gold with a fine-toothed comb. Audits are never “one and done” anyway.

FOOLISH ASSUMPTION #2 – Price manipulation is not a problem in the metals markets.

A number of major bullion banks, including JPMorgan Chase, pleaded guilty to widespread price rigging not long ago. The Department of Justice nailed them, even though the CFTC had not.

There are thousands of documents, chat logs, and voice recordings featuring traders colluding with their peers at other traders at other banks to manipulate prices and stick it to their own clients.

That was the moment it became completely untenable for anyone to assert the gold and silver markets are free and fair. The “conspiracy theory” is now officially a conspiracy fact.

A valid question to examine is whether the manipulation that occurs is merely situational or systemic – and who is involved.

Further, it is more than a little naive to believe compromised federal regulators and DOJ officials were either willing or able to root out this corruption among the most powerful and well-connected banks in the world.

A more informed view is that it can be hard to get a fair shake when playing in the highly leveraged casino that is the futures market.

FOOLISH ASSUMPTION #3 – The Federal Reserve must maintain its independence.

Americans have been told for more than 100 years it is vital for our central bank to operate on its own. We must somehow trust that Fed officials have the best interests of Americans at heart.

This despite clear evidence the Fed’s true mandate is to take care of the Wall Street banks that literally own the Federal Reserve. This includes the massive bank bailouts in 2008, which benefitted executives displaying horrific judgement and in some cases perpetrated fraud.

It’s highly questionable to insist there is wisdom in an “independent” (read unaccountable) Fed. Those claiming the central bank’s token efforts at transparency are adequate either aren’t serious or aren’t honest. They should read “End the Fed” by Ron Paul.

The truth is that the Fed is a black box funneling trillions of dollars around. Who still thinks that is a good idea?

Clint Siegner is a Director at Money Metals Exchange, a precious metals dealer recently named “Best in the USA” by an independent global ratings group. A graduate of Linfield College in Oregon, Siegner puts his experience in business management along with his passion for personal liberty, limited government, and honest money into the development of Money Metals’ brand and reach. This includes writing extensively on the bullion markets and their intersection with policy and world affairs.