(Money Metals News Service) Significantly higher purchases from the official sector at times provided essential support to gold prices over 2022-23 when aggressive interest rate hikes undermined professional investor interest in gold.

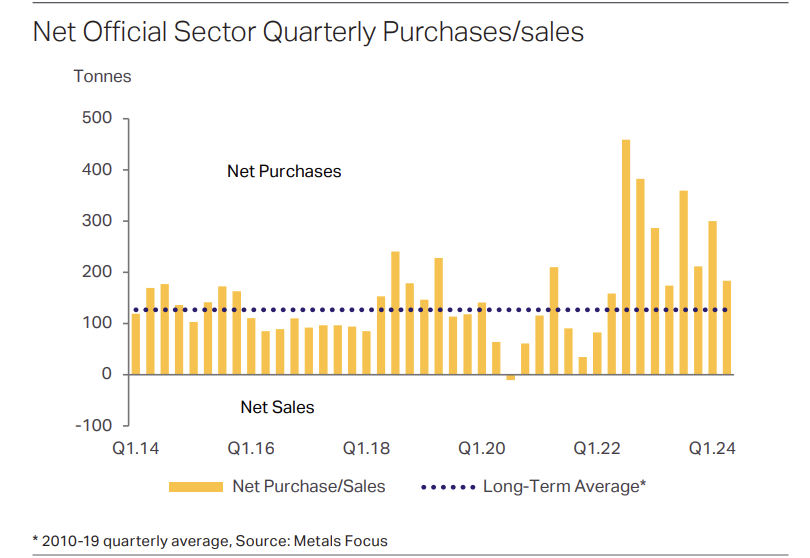

After hitting an all-time high of 1,082t in 2022, net purchases by the official sector remained exceptionally strong in 2023, exceeding 1,000t for the second year in a row. For both years, central banks made up for over 20% of annual gold demand, compared to roughly 10% during the 2010s.

While the official sector has remained a major bullion buyer so far this year, the pace of acquisitions has slowed in recent months. In Q2.24, Metals Focus estimated that net official sector purchases totaled 183t, down by 39% from Q1.24 (300t). Notwithstanding this slowdown, Q2 activity in absolute terms was still elevated by historical standards (44% higher than the quarterly average over 2010-19). Indeed, with significantly higher volumes in Q1, net purchases exceed 480t in H1.24, making it the highest-ever H1 figure and the third-highest half-yearly figure (after H2.22 and H2.23) in our data series starting from 2010.

Looking at countries that have reported purchases from 2024 to date, this was dominated by countries that had been active buyers in previous years. Among these, Turkey (+44t) and India (+38t) were the top bullion buyers in H1.24, the only two countries that had reported significantly higher y/y net increase this year. For the rest of declared activity, such as China (+29t) and Poland (+19t), a slower pace of gold additions was the norm.

To some extent, this slowdown could have been related to gold’s remarkable price gains from March onwards. Even though reserve managers tends to be less affected by gold price fluctuations, record prices and the speed of the rally may have impacted decisions on how much to buy in the short-term. Moreover, even with slower buying (or no changes in gold holdings), rising gold prices still lifted the yellow metal’s share of international reserves for most countries in H1.24. This also helps explain why official sector activity has slowed in recent months.

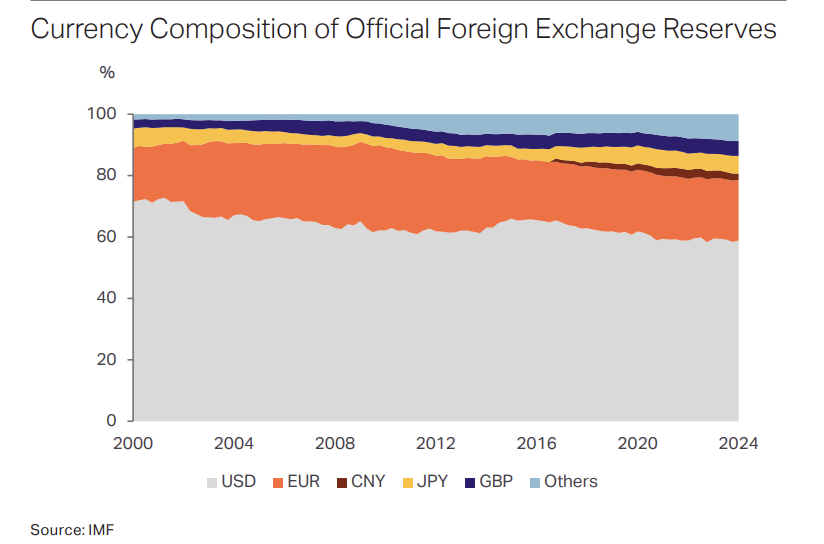

As was the case in 2022-23, de-dollarisation has remained the principal driver behind central banks’ interest in gold so far this year. In large part, this has reflected elevated geopolitical tensions in the last couple of years, particularly after the US arguably decided to ‘weaponise’ the dollar via sanctions against Russia. Despite limited use in transactions, gold is generally viewed as a safe asset which can be stored on home soil and so insulated from sanctions or seizure.

Concerns about the long-term sustainability of US debt have also gained increasing attention this year. Regardless of the results of the upcoming US election, the scope for meaningful cuts in the US budget deficit seems unlikely in the years to come. The scope for a shift to other key currencies, such as the euro and yen, is limited, due to poor economic prospects and worsening sovereign debt issues. Given gold’s remarkable price performance, it is perhaps unsurprising that some central banks decided to lift their exposure to the yellow metal.

On top of healthy purchases, an absence of significant disposals also helps keep net buying from central banks elevated. In fact, gross official sector sales in H1.24 were down by two-thirds y/y, though this

compared with a high base in H1.23 when sales were boosted by a temporary (and extraordinary) injection of gold liquidity by the Turkish central bank into the local market ahead of the presidential election. Almost all official sector disposals during 2024-to-date came from countries that had been major bullion buyers over the last decade or so. Instead of “buy and passively hold,” some countries (such as the Philippines and several countries in the CIS) adopted a more active management strategy, by maintaining gold’s share around a certain target. With a rise in gold prices in recent months, it is perhaps unsurprising that these aforementioned countries cut their gold holdings, albeit by a limited amount.

Going forward, these favorable factors are expected to remain relevant for the foreseeable future, which should continue to justify lifting gold reserves. If anything, the upcoming 2024 US presidential election may result in additional geopolitical instability, particularly if the Republicans win the presidency. Of course, the impact of rising prices cannot be ignored. Metals Focus retains the view that gold will post new all-time highs later this year. This in turn may restrain the scale of official sector purchases, as some reserve managers may view current prices as being too high as an entry point.

On balance, therefore, we expect a slightly slower pace of net purchases in H2.24, with the 2024 total likely to be around 800t on a net basis. Even with a slowdown, the projected 2024 total is some 300t or 57% above the annual average for the 2010s. More importantly, it is worth remembering that the gold market has remained in a structural surplus in recent years. Such buoyant purchases from the official sector have to some degree helped to alleviate the burden on investors who have absorbed excessive supplies in the gold market.