(Peter Krauth, Money Metals News Service) The Jackson Hole Wyoming pow-wow for central bankers is behind us, and Powell didn’t disappoint markets.

He said the time has come to start lowering rates, citing a softening labor market and inflation. He thinks they can pull off a soft landing. That would be surprising – almost shocking – as it has only happened once, in 1994. All other episodes of inflation have ended after entering a recession and high unemployment.

Good luck Jerome.

Unemployment at 4.3% suggests things should look pretty good. It’s low on a relative basis. But that’s more than 100 basis points above where it bottomed at 3.2% last year.

We’re in a clear uptrend, a shift which tends to happen just as the Fed starts lower rates.

As much as the Fed is supposed to be apolitical, it surely can’t ignore the laws of economics…at least not completely, despite its secret wishes.

The fact is the US is drowning in debt, which is growing at a pace of about $1 trillion every 100 days.

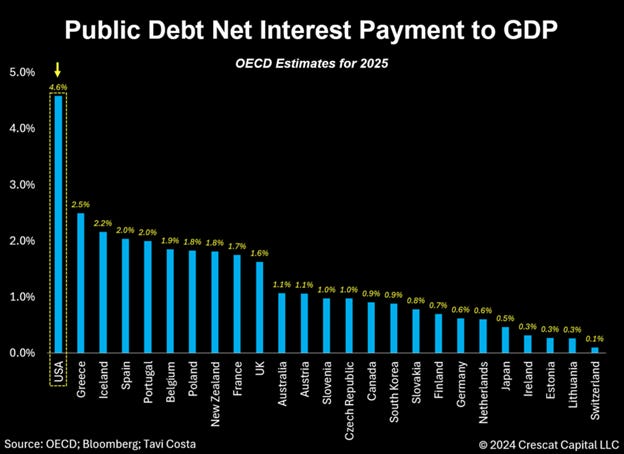

Even worse, as this excellent chart from my friend Tavi Costa of Crescat Capital shows, the US is suffering from the highest rate of Public Debt Net Interest Payments as a percentage of GDP among OECD countries, as estimated for 2025.

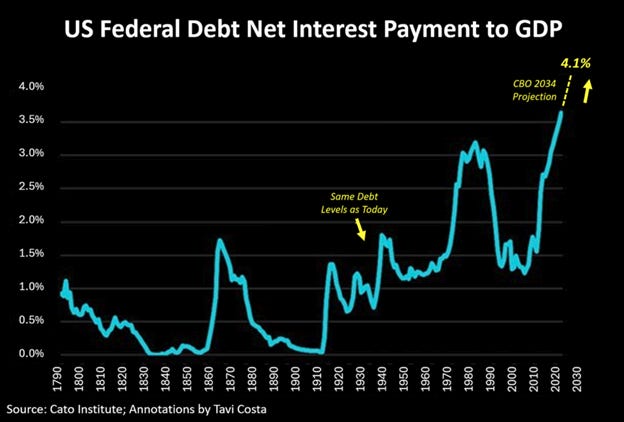

And this next chart shows, according to the Congressional Budget Office’s own projections, that it clearly is expected to continue in the wrong direction.

Which leads me to think the Fed is anxious to cut rates, despite inflation near 3% (officially) while they continue to claim their target is 2%.

This combination of sustained high inflation and falling real rates (interest rate minus inflation rate) are the ideal setup for precious metals.

The Fed is about to cut rates – bullish. Inflation remains high – bullish. There will be years of pressure on the Fed to keep rates low (to help pay interest on the debt) as the debt continues to soar – bullish.

This means we should expect the US dollar to remain weak for quite some time – bullish.

It’s this kind of environment that has allowed subscribers to bank a 100% return in recent weeks in a top-notch silver producer…in just 18 months.

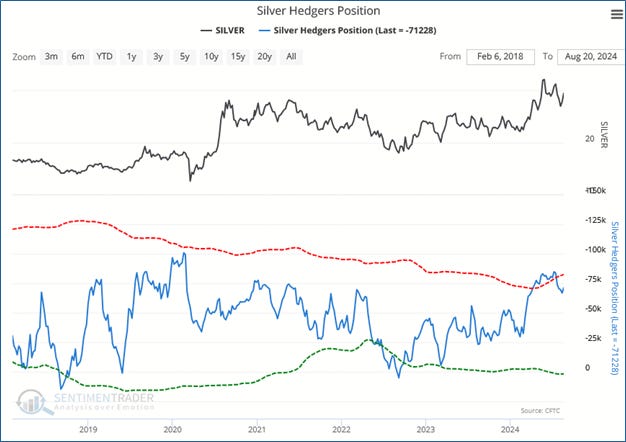

In the very near term, I continue to see silver (and gold) as potentially overbought. The bottom line is the positioning of “smart money” commercial hedgers in the futures market is still near peak short levels in the silver market.

In other words, they see silver prices as elevated and are overwhelmingly projecting a drop. The last time their positioning was at such elevated levels was back in early 2020, when we saw a large, swift correction. I don’t know if that will happen this time, but the odds favour some sort of correction.

That’s why I remain cautious in the near term. I continue to see overbought sentiment in precious metals and their related equities.

If I’m right, and we get a correction potentially over the next few weeks, I expect that will be a tremendous opportunity to load up on these assets. Perhaps even the last such opportunity for some time.

In my recent newsletter issue, I answered an excellent question from a subscriber on permitting concerns in Mexico.

Then I delve into the latest bullish developments for silver in India, a rising market to watch closely. That’s followed by the technical chart analysis, the portfolio table, and rounded out with company updates.

I recently had the pleasure to do interviews with Antonio Atanasov:

And Peter Grandich:

To receive regular commentary from Peter Krauth, get on his email list here.

Peter Krauth is the author of the bestselling book The Great Silver Bull, publisher of the silver-focused investment newsletter Silver Stock Investor, and is affiliated with TheGoldAdvisor.com.