(Mike Maharrey, Money Metals News Service) The road out of my neighborhood looks like a war zone. Helene did quite a number on us here in the Tampa Bay Area (and elsewhere).

Storm surge flooding inundated thousands of homes and businesses with up to four feet of water in some areas. As I drive around the area, I see house after house with all the residents’ worldly possessions in a soggy pile on the curb.

But we should be grateful, right? After all, this will create an economic boom!

At least, according to some silly Keynesians.

If we believe this economic theory (fallacy), vast sums of money spent to repair damage caused by national disasters stimulate the economy.

A good war will do the trick as well.

In fact, economist (political hack) Paul Krugman once suggested a fake alien invasion would benefit the economy because it would boost government spending.

I’m not making this up. Krugman actually said this:

“If we discovered that, you know, space aliens were planning to attack and we needed a massive buildup to counter the space alien threat and really inflation and budget deficits took secondary place to that, this slump would be over in 18 months,” he said. “And then if we discovered, oops, we made a mistake, there aren’t any aliens, we’d be better—”

I think he was going to say we would be better off.

Ummm. Yeah. OK.

I’m pretty sure building weapons to fight off fake aliens would make my life at least 45 percent better.

And if a fake alien war is good, how great is a hurricane?

I can answer that.

Not great at all.

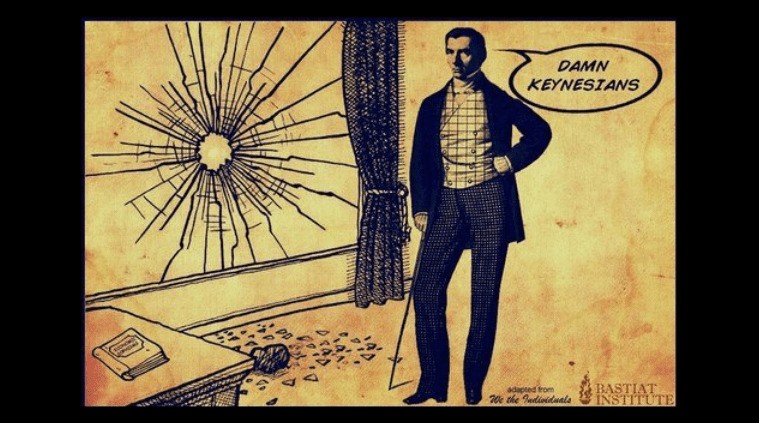

The notion that disasters have a silver lining stems from the “broken window fallacy.”

Economist Frédéric Bastiat first exposed this fallacy in his essay “That Which Is Seen, and That Which Is Not Seen.”

Imagine a kid throws a rock through a shop window. The theory is that it’s good for the economy because the shop owner will have to pay somebody for the repair window. As Bastiat explained it:

“If you have been present at such a scene, you will most assuredly bear witness to the fact, that every one of the spectators, were there even thirty of them, by common consent apparently, offered the unfortunate owner this invariable consolation: ‘It is an ill wind that blows nobody good. Everybody must live, and what would become of the glaziers if panes of glass were never broken?’”

In other words, the shopowner’s misfortune is the glass fixer’s good luck.

With the money he makes fixing the window, the glazier can buy a new suit. A tailor will then have money in his pocket to go to a football game. The owner of the football team benefits from another fan in the seats, and on and on it goes. The broken window led to a string of economic transactions. As Bastiat put it, the careless child “spurred trade.”

This seems plausible, right? On the surface, it does appear as if the broken window led to a small economic boom. But we’re missing something, as Bastiat explained:

“But if, on the other hand, you come to the conclusion, as is too often the case, that it is a good thing to break windows, that it causes money to circulate, and that the encouragement of industry in general will be the result of it, you will oblige me to call out, ‘Stop there! Your theory is confined to that which is seen; it takes no account of that which is not seen.’”

So, what have we missed?

We don’t see the money that was never spent.

If the shopkeeper hadn’t had to spend 6 franks on a new window, he might have bought a pair of shoes. Now, that transaction won’t happen, and the cobbler won’t receive that income. As a result, the cobbler will have to postpone buying a new book for his library.

Bastiat summed it up this way:

“Let us take a view of industry in general, as affected by this circumstance. The window being broken, the glazier’s trade is encouraged to the amount of six francs: this is that which is seen.

“If the window had not been broken, the shoemaker’s trade (or some other) would have been encouraged to the amount of six francs: this is that which is not seen.”

A good economist always tries to account for the unseen. But as I said when I explained why price gouging laws during a disaster aren’t helpful, most people aren’t good economists — and that includes a lot of economists.

It should be clear breaking a window does not make society better off. It becomes even more clear when you magnify the destruction to the level produced by a Hurricane.

Yes, billions will be spent to repair and clean up. Roofers, builders, and others will make a lot of money. But you have to stop and consider the cost to others. I doubt anybody in Florida, North Carolina, and other places impacted by Helene will claim they’re better off because their house filled up with water. And just stop and imagine what could have been done with those billions had the hurricane never materialized.

Destruction isn’t progress. This is just a silly Keynesian claptrap.

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.