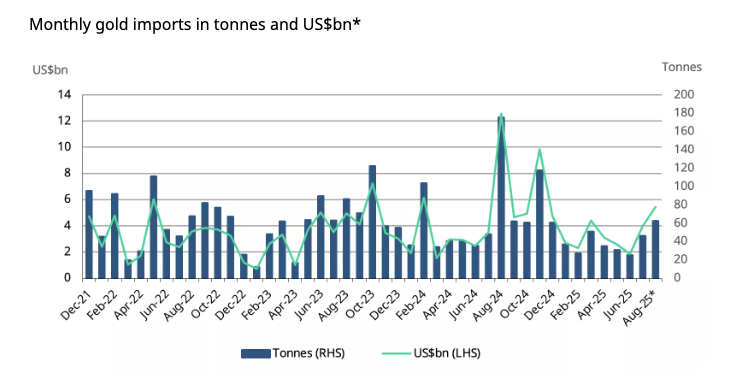

(Mike Maharrey, Money Metals News Service) After rebounding in July, Indian gold imports hit a 9-month high in August, reflecting resilient demand.

India ranks as the world’s second-largest gold market.

August imports totaled $5.2 billion, a 37 percent month-on-month increase. The World Gold Council estimates India imported between 60 and 65 tonnes of gold. That was up from between 42 and 48 tonnes in July.

According to the World Gold Council, the surge in gold imports reflects “seasonal buying interest despite elevated prices.”

Gold prices rose sharply last month and accelerated through the first half of September, hitting a fresh set of all-time highs. According to the World Gold Council, the most recent gold rally is being driven by “a weaker U.S. dollar, elevated geopolitical tensions, and strong inflows into global gold ETFs.”

“The continued momentum in September was supported by positive investor positioning – evidenced by rising futures net longs and sustained ETF inflows. Lower U.S. Treasury yields, amid growing expectations of a Fed rate cut and concerns around the Fed’s independence, have provided additional tailwinds.”

A weaker rupee has magnified domestic gold price gains. Priced in the Indian currency, gold was up 7 percent month-on-month as of mid-September. Since the beginning of the year, gold has surged by 44 percent in rupee terms.

This higher price has created headwinds for demand, especially in the jewelry sector, but there has been renewed interest in the yellow metal in recent weeks. This is reflected by narrowing domestic price discounts. We even saw a brief period with a marginal premium in late August.

The World Gold Council notes, “This marks a noteworthy change, as domestic gold prices had been trading at a near-sustained discount since December.”

Gold demand is picking up as India moves into a festive season. This is traditionally considered an auspicious time to buy gold.

World Gold Council analysts say early-season buying has primarily manifested in demand for gold bars and coins.

“Investment interest is reportedly outpacing jewelry purchases, as consumers are drawn in by the renewed uptrend in prices and expectations of further increases.”

Anecdotal evidence suggests bullion dealers have stepped up purchases to beef up inventory in anticipation of strong seasonal demand.

Gold demand could also get a boost from a reduction in the Goods and Services Tax that went into effect on Sept. 22.

A surge of inflows of gold into Indian ETFs also reflects strong investment demand.

Cumulative net inflows totaled ₹21.9 billion (US$250 million), up 74 percent month-on-month. It was the second-highest level of monthly gold inflows this year.

The total assets under management (AUM) by Indian gold ETFs reached record highs of ₹724 billion (US$8.3 billion), with holdings increasing by 2.1 tonnes to 70 tonnes.

According to the World Gold Council, “The increase is likely driven by the sustained demand for safe-haven assets by investors seeking stability amid weak domestic equities and persistent global trade and geopolitical risks. Initial observations point to a continuation of this momentum, with strong positive net inflows during the first two weeks of September.”

There was also a drop-off in ETF redemptions, indicating that investors are adopting a longer-term perspective, choosing to stay invested rather than cashing out, despite the recent price gains.”

There were 164,000 new ETF accounts established in August. That pushed the total number of active folios to 8.03 million, a 24 percent increase since the beginning of the year.

A gold ETF is backed by a trust company that holds metal owned and stored by the trust. In most cases, investing in an ETF does not entitle you to any amount of physical gold. You own a share of the ETF, not gold itself. ETFs are a convenient way for investors to play the gold market, but owning ETF shares is not the same as holding physical gold.

Indian gold jewelry demand has also picked up, but the WGC characterizes it as “uneven.”

“High-value, wedding-related purchases have begun and are holding steady, while high prices have dampened lower-ticket daily-wear and discretionary buying, prompting a shift to lower carat products. Large retailers are reporting higher footfalls, supported by aggressive marketing and promotional campaigns, along with plans for new store openings. Smaller retailers, in contrast, continue to face muted demand.”

Indians have a longstanding love affair with gold.

The yellow metal is deeply interwoven into the country’s marriage ceremonies, along with its religious and cultural rituals. Festival seasons typically boost gold demand.

Indians have long valued the yellow metal as a store of wealth, especially in poorer rural regions. Around two-thirds of India’s gold demand comes from beyond the urban centers, where large numbers of people operate outside the tax system. Many Indians use gold jewelry not only as an adornment but as a way to preserve wealth.

In the West, gold is generally viewed as a luxury item.

Not in India. Even poor Indians buy gold.

According to a 2018 ICE360 survey, one in every two households in India had purchased gold within the last five years. Overall, 87 percent of Indian households own some gold. Even households at the lowest income levels in India hold some of the yellow metal. According to the survey, more than 75 percent of families in the bottom 10 percent of income managed to buy some gold.

The yellow metal was a lifeline for Indians buffeted by the economic storm caused by the government’s response to COVID-19. After the Indian government locked down the country, banks tightened credit to mitigate the default risk. Unable to secure traditional loans, Indians used gold to secure financing. As Indians endured a second wave of lockdowns, many Indians resorted to selling gold outright to make ends meet.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.