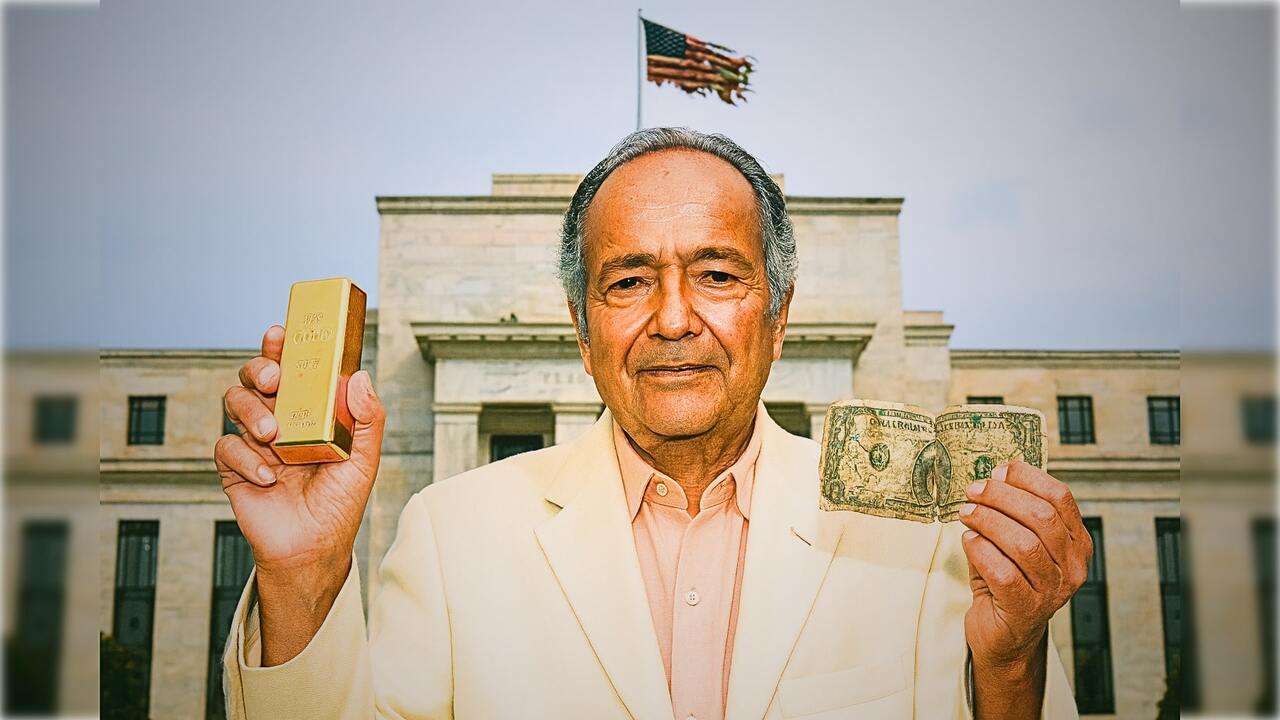

(Money Metals News Service) In this episode of the Money Metals podcast, host Mike Maharrey sits down with Gerald Celente, publisher of the Trends Journal and one of the world’s most outspoken trend forecasters.

The wide-ranging conversation covers the state of U.S. politics, the fragility of the global economy, the rise of China in artificial intelligence, the suppression of gold in mainstream media, and the looming risks facing investors.

Celente also outlines his peace movement, his belief that Americans are dangerously uninformed, and his forecast that gold could break through $5,000 an ounce before the end of the year.

(Interview Starts Around 6:25 Mark)

The Decline of Politics and Media

In a fiery discussion with host Mike Maharrey, Gerald Celente, publisher of the Trends Journal, lambasted U.S. politics as a “crime syndicate.”

He recalled the 2008 financial crisis, criticizing the Federal Reserve for bailing out banks with an estimated $29 trillion while ordinary Americans suffered.

Celente accused Wall Street giants like JPMorgan Chase—convicted of multiple felonies, including market rigging in 2019—of corruption without accountability.

He extended his criticism to global leaders like Emmanuel Macron and Boris Johnson, and to mainstream outlets he derisively called “presstitutes,” claiming journalism has died in favor of corporate-driven propaganda.

Dragflation, Not Stagflation

Turning to the economy, Celente rejected the term “stagflation,” arguing instead for “dragflation.”

He explained that the economy is not stagnant—it is declining—while inflation continues to rise.

He pointed to recent job numbers: only 22,000 jobs created in a nation of 347 million, concentrated in low-wage sectors like healthcare and hospitality.

Since 2019, real wages have not increased, while housing costs are up 50% and cars nearly 39%. Meanwhile, billionaires thrive—Celente cited a Wall Street Journal report showing 1,135 billionaires in the U.S.—while small businesses have been wiped out by corporate chains.

Billionaires, War, and Peace

Celente criticized the “military-industrial complex” and its trillion-dollar budget, contrasting it with a lack of investment in peace.

He highlighted his Occupy Peace movement and announced a rally in Kingston, New York, scheduled for September 27, featuring speakers such as Judge Andrew Napolitano, Dennis Kucinich, Scott Ritter, Joe Lauria, and Roger Waters.

He blasted America’s billionaires and corporate elite as indifferent to peace, arguing their wealth has come at the expense of national decline.

Media Silence on Gold

Despite gold recently surging past $3,500 per ounce, Celente noted the media’s silence. He said CNBC and The Wall Street Journal ignored gold’s breakout, fearing it signals broader economic and geopolitical weakness.

By contrast, his Trends Journal—priced at $2.59 a week for over 200 pages—covers global developments in detail. Celente warned that stock market valuations, especially among the “Magnificent Seven” tech giants, are dangerously inflated, predicting a “dot-com bust 2.0.”

He noted that in 1999 his forecasts predicted the original dot-com crash by Q2 of 2000, and he believes history is about to repeat.

The AI Boom and China’s Advantage

Celente traced the Artificial Intelligence (AI) frenzy back only three years, calling it an “infant industry” that has received trillions in speculative investment. He cited the rise of China, where the share of 18-year-olds attending college has grown from 10% in 2000 to nearly 70% today.

With 1.4 billion people and heavy state investment in high-tech, Celente argued China is poised to dominate AI. He warned that overinvestment in U.S. AI companies will trigger another crash, which in turn will send gold prices higher.

The Dollar’s Decline and Digital Gold

Celente predicted falling U.S. interest rates will weaken the dollar, pushing gold higher.

He described the dollar as “dying” and foresaw the advent of digital currencies, including a “digital gold” backed by bullion that could upend cryptocurrencies.

He also emphasized that gold’s dollar-based pricing makes it more attractive to foreign buyers when the greenback weakens.

Fed Policy, Trump, and Political Theater

On interest rates, Celente noted the Fed faces a dilemma: cutting rates could stimulate the economy but drive inflation higher, while holding rates risks further economic slowdown.

He dismissed the idea of Fed independence, pointing to examples like Trump pressuring Jerome Powell to cut rates in December 2018—the worst Dow December since the Great Depression.

Celente recounted a 1989 meeting with John Connally, the Texas governor who was wounded in JFK’s assassination and later Nixon’s Treasury Secretary. Connally told him Americans were clueless about the system’s corruption, warning that if they knew the truth, there would be a revolution.

Why Americans Ignore Gold

Despite record highs, American gold investment remains tepid, unlike strong demand from Asian and European buyers.

Celente attributed this to ignorance, distraction, and media misdirection.

He recalled buying gold in the late 1970s at $163 per ounce and making huge gains during the Iranian crisis, though later losing much as a young trader.

He argued Americans remain unaware of global crises—whether in Argentina, Turkey, or Somalia—while being fed trivial stories about celebrities like Taylor Swift or Jeff Bezos.

COVID, Freedom, and a New Political Movement

Celente blasted political leaders’ handling of COVID-19, ridiculing lockdowns and mask mandates as arbitrary and destructive to liberty.

He noted that when the World Health Organization declared a pandemic on March 11, 2020, only 4,290 people had died worldwide out of 8 billion.

He announced his creation of “We the People’s Party,” saying the domain name’s availability reflected Americans’ passivity.

For Celente, politicians have ceased to be public servants; instead, citizens serve the politicians.

Gold to $5,000 and Beyond

In closing, Celente reiterated his bullish stance on gold, forecasting it could break $5,000 an ounce before the year’s end.

He warned that the worst economic and geopolitical crises are still to come, emphasizing that only by “tracking trends” can people prepare, prevail, and prosper.

His Trends Journal aims to provide “history before it happens,” countering the mainstream narratives that leave most Americans blind to unfolding realities.

Conclusion

Gerald Celente’s conversation with Mike Maharrey painted a stark picture of corruption in politics, distortion in media, and fragility in the economy.

He connected the dots between Wall Street fraud, manipulated statistics, overvalued tech markets, and the rise of China, while urging Americans to pay closer attention to global trends. His call for peace, a new political movement, and preparation for the dollar’s decline underscores his belief that profound change is coming.

For Celente, gold remains the ultimate safeguard, and he warns that ignoring it—like ignoring history—will leave Americans unprepared for what lies ahead.