(Money Metals News Service) Host Mike Maharrey opens this Midweek Memo by joking that every day is Black Friday now. The episode drops on a Wednesday, yet he insists yesterday was Black Friday, tomorrow will be Black Friday, and last week probably was too.

He remembers when Black Friday meant one single day, the Friday after Thanksgiving, not a six-week marketing season stretching from early November into December. He admits nostalgia is part of it, but he still thinks we do not need to start the Christmas season the day after Halloween.

Even in this lighthearted mood, he pauses to thank listeners for tuning in. He encourages them to leave five-star reviews and share the show on platforms like Apple Podcasts and Spotify so the Midweek Memo can climb the algorithm and reach more people.

Inflation And Your Shrinking Dollar

A recent trip to Washington, D.C., brought the Federal Reserve back to mind for Maharrey. He mentions the Eccles Building, where Fed officials decide how much to devalue your money every few weeks, and uses that image to pivot into a discussion of inflation.

He quotes his friend Josh, who says it is “extremely helpful” to think of inflation as a decline in the purchasing power of the currency instead of just rising prices. Maharrey likes this because it shifts the question away from “why are prices going up” and toward “why is my money worth less.”

Traditionally, economists defined inflation as an expansion of the money supply and credit. That monetary inflation can show up as higher consumer prices, which we track with the CPI, and as asset price inflation in stocks and real estate. The exact mix depends on what is happening in the broader economy.

Maharrey argues that politicians, central bankers, academics, and much of the media have blurred this definition on purpose. When inflation is reduced to “prices are rising,” blame can be pinned on corporations, supply chains, or random shocks. When we frame it as money creation, responsibility lands on the central bank, the federal government, and their constant borrowing and spending.

Josh’s framing leads to a better question. Rather than asking why Safeway raised the price of milk, ask why two dollars no longer buys a gallon of milk. The resources and labor required to produce milk have not changed all that much. What has changed is the value of the money, steadily eroded by a central bank that keeps expanding the money supply, forcing down interest rates, and enabling ever more deficit spending.

For Maharrey, monetary expansion is the fuel for a huge warfare–welfare state. Without the Federal Reserve backstopping Washington with freshly created money and easy credit, the size and reach of the federal government would be nowhere near what we see today.

Thanksgiving, Christmas Creep, And The Lost Black Friday

From inflation, Maharrey swings back to the holidays. He has never enjoyed Black Friday crowds and turned it into a personal tradition to stay home. While people poured into malls and big box stores in the 1970s and 1980s, he avoided what he calls “too peopley” chaos.

The classic version of Black Friday required getting up before dawn, standing outside in the cold, and fighting for limited deals. Growing up in Kentucky, that often meant freezing temperatures on top of sleep deprivation. No discount laptop could lure him out the door at 5:00 a.m.

His mother and grandmother were the opposite. They were serious Black Friday shoppers who crammed most of their Christmas buying into one brutal day. He remembers them leaving before he woke up and returning around three or four in the afternoon, looking like they had just gone fifteen rounds with Mike Tyson.

Now Black Friday has melted into what he calls “Black November and beyond.” That bothers him even more because it tramples Thanksgiving, a holiday he genuinely enjoys and considers important.

He believes Thanksgiving serves a vital purpose. It pushes people to pause, recognize the good things in life, and, for religious listeners, offer thanks to God and remember that something greater than themselves exists. On top of that, it delivers all the perks. You can sleep in. You can watch the Macy’s Thanksgiving Day Parade, complete with floats, marching bands, and Santa’s finale. You can watch a full slate of football, with the Detroit Lions finally playing competitive games again. And then there is the food, from turkey and stuffing to corn pudding and sweet potatoes.

Maharrey jokes that the “war on Christmas” cannot end until Christmas ends its occupation of most of November. He is fine with Christmas music and decorations after Thanksgiving and usually starts his own Christmas playlist on Black Friday. This year, however, kittens in the house likely mean no Christmas tree at all.

Why The Day Is Really Called Black Friday

Maharrey then tackles the familiar claim that Black Friday gets its name from the moment retailers move “out of the red and into the black.” He calls that story a myth pushed by the retail industry to clean up the day’s image.

He traces the history as best we know it. In 1951, the journal Factory Management and Maintenance used “Black Friday” to describe workers calling in sick the day after Thanksgiving. Around that same period, Philadelphia police began using “Black Friday” and “Black Saturday” to describe the gridlock and crowds as the Christmas shopping season kicked off.

The nicer “out of the red and into the black” explanation did not appear until a 1981 article in the Philadelphia Inquirer, roughly thirty years after the term first surfaced. By then, retailers and public relations experts were clearly trying to rebrand a phrase that sounded negative.

He mentions a 1985 Philadelphia Inquirer story featuring Irwin Greenberg of Hess’s department store in Allentown. Greenberg was furious about the term and called it “sinful” and “disgusting,” asking why anyone would label a supposedly happy shopping day as “black.” Maharrey jokes that Greenberg must not have spent much time in his own store that day, given how tense and unhappy Black Friday crowds can be.

By the mid-1970s, the New York Times was using “Black Friday” to describe the busiest shopping and traffic day of the year. Traffic jams, long lines, irritable shoppers, and worn-out clerks show up again and again in the term’s history.

For Maharrey, the meaning is straightforward. They call it Black Friday because it is a miserable day to be in a store. He backs that up with his own experience in the 1990s at Toys R Us, when the Power Rangers craze triggered a physical fight between two women over the last must-have toy. He personally helped break it up.

Trading Black Friday Madness For Gold And Silver

After shredding the Black Friday myth, Maharrey jokes that listeners have two options. If they enjoy the chaos, they can dive in, but they should at least be polite while shoving people aside and use horizontal video when filming any brawls so the footage looks better.

If they hate crowds as he does, there is another path. Skip the mall and give real money instead of what he calls worthless paper from Washington, D.C. That means gold and silver. He points listeners to Money Metals’ Black Friday and holiday offerings at moneymetals.com.

At the top of the homepage, there is a holiday gift shop link that leads to Christmas-themed products, including a half-ounce silver ornament. These are genuine precious metals items, not disposable knick-knacks, and they make gifts that also serve as savings.

He reminds listeners that gold was one of the original Christmas gifts more than 2,000 years ago and is still prized and sought after today. That continuity underscores his broader message. Gold is real money and holds its value across centuries.

Maharrey also notes the “Specials” section of the site, where buyers can find discounted items and low-premium products. All of it can be ordered online and shipped directly or stored in the company’s depository, no crowds required.

The 2026 Sound Money Index

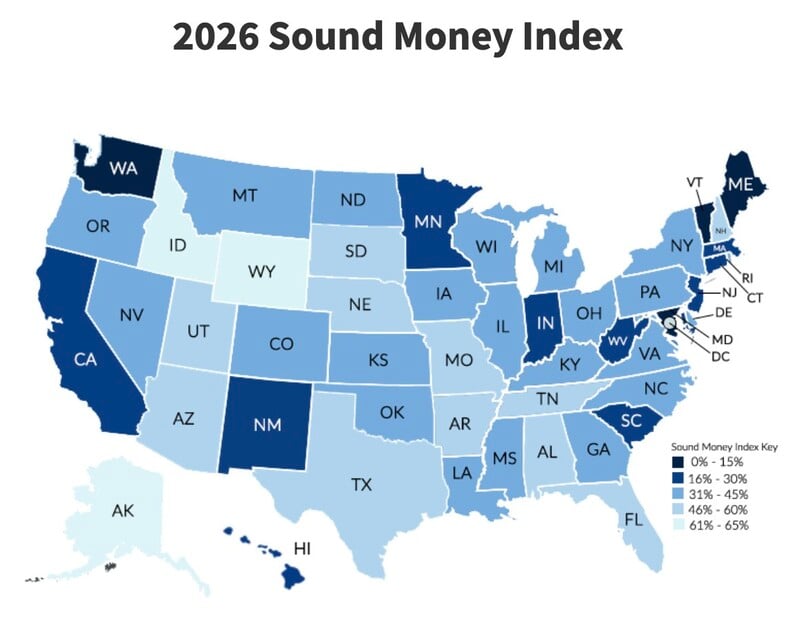

The episode then shifts from holiday shopping to public policy. Maharrey highlights the 2026 Sound Money Index, produced by the Sound Money Defense League in partnership with Money Metals. The Index ranks all 50 states using more than a dozen criteria to determine how friendly they are to sound money.

States receive points for pro sound money policies. About 42 percent of the score is tied to tax treatment, such as whether a state charges sales tax on gold and silver bullion or imposes income or gross receipts taxes on precious metals transactions. The remaining points reward actions like recognizing gold and silver’s constitutional role as money, allowing state reserves or pensions to hold metal, and enacting dealer and investor-friendly regulations.

Maharrey shares key results. Wyoming sits at the top of the 2026 rankings and has held that top position for some time. In the latest session, lawmakers passed SF96, sponsored by Senator Bob Ide, which puts the Cowboy State on a path to building state gold reserves with an initial ten-million-dollar allocation.

Idaho climbed from fourteenth in 2025 to second place in 2026 after passing new sound money legislation. Missouri jumped from twenty-third to third by enacting a bill that delivered broad reforms. At the bottom of the list sits Washington state, which ranks last and, in Maharrey’s view, holds the title of worst state in America for sound money this year.

Listeners can view the full map and rankings on the Sound Money Index page hosted by Money Metals and see exactly how and why their state received its score.

Why State-Level Action Matters Most

Maharrey argues that this kind of state-level work is crucial. He is not optimistic about sweeping monetary reform coming from Washington, D.C., in the near future. Unless you are a powerful lobbyist, your calls to Congress rarely move the needle. Most people get a quick conversation with an intern and a generic email weeks later.

State politics look very different. Many state legislators rarely hear from their constituents on specific bills. He recalls a Kentucky lawmaker who told him he could go through an entire legislative session without hearing a single comment from a constituent about pending legislation. In that environment, thirty or forty calls on one bill can change votes.

That is why the Sound Money Defense League focuses on repealing state taxes on precious metals, recognizing gold and silver as money, easing barriers to their use in transactions, and encouraging states to hold metal in reserves. Those actions create a working alternative to the federal system, even if Washington continues to erode the dollar.

Maharrey is blunt here. Inflation is an intentional policy choice. Money creation is the engine that powers big government, and federal officials are not about to give up that tool voluntarily. But if states make it easier to buy, hold, and use gold and silver, individuals can protect themselves from the ongoing devaluation of their savings.

He directs listeners to soundmoneydefense.org, where they can follow bills, check their state’s ranking, and learn how to support legislation that pushes their state higher on the Sound Money Index.

Protecting Yourself With Real Money

Maharrey closes with practical advice. No matter where you live, he believes you should own real money in the form of gold and silver, because the federal government will not stop devaluing the dollar any time soon.

He notes that Money Metals can help both new and seasoned buyers. Listeners can call 1-800-800-1865 to speak with a precious metals specialist, ask about the best silver products, and find the lowest premium options. Those who dislike phone calls can use the online chat at moneymetals.com or order directly through the website if they already know what they want.

Customers can have metals shipped to their homes or stored in Money Metals’ state-of-the-art bullion depository in Eagle, Idaho, which offers added security and convenience.

Maharrey wraps up by inviting listeners to subscribe to the Midweek Memo and the Friday Market Wrap podcast, sign up for email news at moneymetals.com/news, and enjoy the Thanksgiving holiday. For anyone brave enough to face Black Friday crowds, he adds one last bit of advice. Try not to get into a fistfight over a toy.