(Headline USA) President Joe Biden hit a new low this week, with an approval rating of 37.4% as he desperately clings to his reelection campaign with a growing number of Democrats quietly discussing their desires to replace him.

Joe Biden just hit a new, all-time LOW approval rating of 37.4% on 538's average.

Now, Nate Silver is openly asking if the "threshold" has been reached where Joe Biden cannot recover and should be replaced.

Wild. pic.twitter.com/XMNLaDOesr

— Charlie Kirk (@charliekirk11) June 10, 2024

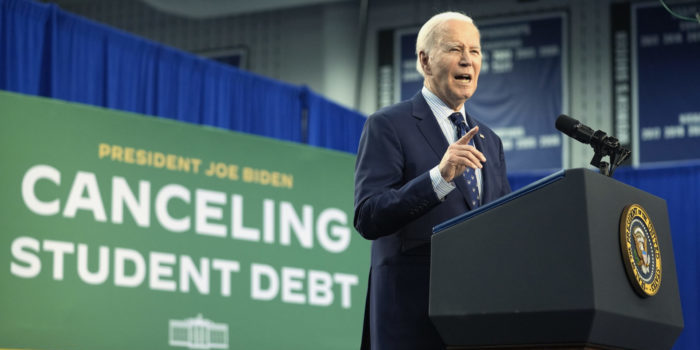

Among Biden’s failures are the controversial effort to buy votes from young people by transferring their student-loan debt to the taxpayers at large. The Supreme Court previously ruled Biden’s executive action without congressional approval to be unconstitutional.

Nonetheless, he plowed ahead on new plans, assuming the student debt obligations for about 4 million people through existing programs, while operating under the assumption that any legal challenges would be too time consuming and costly, and would only reiterate what the court already ruled.

Yet, Biden’s plan, which has added significantly to the inflationary economy that all Americans are suffering under and the increased interest rates imposed by the Federal Reserve to address it, appears to have backfired in large part, with fewer people supporting his so-called student-loan amnesty than even support the president himself, even among those who have student loans.

Only Three in 10 U.S. adults say they approve of how Biden has handled the issue, while 4 in 10 disapprove, according to a new poll from the University of Chicago Harris School of Public Policy and The Associated Press-NORC Center for Public Affairs Research.

The other 30% are neutral or don’t know enough to say.

The outlook wasn’t much better for the Democratic president among those responsible for unpaid student loan debt, either for themselves or for a family member: 36% approve, while 34% disapprove.

The poll reveals a deep divide over the issue of student debt relief even as Biden makes it a campaign priority.

The president is pressing ahead with his plan while he strives to stave off major losses in young adults and black and Hispanic Americans—groups that are more likely to support student-loan amnesty but have flocked to GOP rival Donald Trump for a variety of other reasons.

Asher Marshall was rooting for Biden’s first cancellation plan. It would have chipped away at his $52,000 in student loans. But in hindsight, Marshall says it’s clear Biden made a promise he couldn’t deliver without going through Congress.

“He suggested something that sounded good to a lot of individuals in this country, but there was no way for it to move forward from the onset,” said Marshall, 33, of Jacksonville, Illinois.

Melissa Mata also feels let down by the president. The Houston resident has $14,000 in student loans from a program she never finished, and she could have used the help that Biden promised.

Now she plans to sit out the November election or vote independent.

“They make these promises to get votes, but they don’t deliver. So I think for me, I wouldn’t trust it,” said Mata, 34, a bookkeeper.

Younger adults are more likely to prioritize government action on student debt, with about half under 45 saying it’s extremely or very important, compared to 3 in 10 older adults who said the same.

That is likely because those 45 and older already paid their debt off in full and resent the next generation not only taking a short cut, but doing so at their expense through lost federal revenues that ultimately belonged to taxpayers, not Biden.

Yet it is clear that the President and his supporters would like to muddle the message and claim it as a perk of his presidency, a sort of quid pro quo in return for votes.

Not surprisingly, only 15% of Republicans say loan amnesty is extremely or very important, compared to 58% of Democrats.

Neil Wolf, 49, repaid his student loans for two associate degrees, including a $23,000 loan he repaid in the 1990s. No one forces students to take out loans, and taxpayers shouldn’t be on the hook to repay them, said Wolf, a Republican.

“We give too much away. You give everything away, nobody appreciates what they have,” said Wolf, of Denton, North Carolina. “Why should I pay for somebody else’s loans?”

Steve Lesyk, a Republican in Gap, Pennsylvania, said he could support cancellation in some cases. It makes sense for people who have racked up big sums of interest or have been paying off loans for decades, he said—two categories targeted in Biden’s new plan.

But in general, he opposes cancellation, saying it doesn’t do anything to prevent students from getting buried in debt in the first place.

“They’re asking people who’ve never had loans to pay back their loans,” said Lesyk, 58, who never had student loans. “This money doesn’t just appear out of the sky, it comes from somewhere, and there’s so many other things that people need right now.”

Biden’s new plan would erase some or all debt for several groups:

- those with so much accrued interest that they owe more than they originally borrowed

- those who have been repaying undergraduate loans for at least 20 years

- borrowers who went to low-value college programs that leave graduates with large sums of debt compared to their earnings

- those who face other kinds of financial hardship

None of those categories have support from a majority of Americans, the poll found. Just under half support relief for those who have made on-time payments for 20 years, and 44% support it for people who now owe more on their loan than they originally borrowed.

About 4 in 10 support it for those who went to an institution that left borrowers with large amounts of debt compared to their incomes or those facing other forms of financial hardship.

For each category, however, majorities of Democrats approved of the debt-redistribution scheme.

Support was also higher among those who are now repaying student debt compared to those who already paid it off. Almost 7 in 10 current borrowers support relief for people who have older loans, compared to half of Americans who previously paid student loans.

The highest support among previous loan holders was for those defrauded by their educational institution at 56%.

The poll of 1,309 adults was conducted May 16-21, 2024, using a sample drawn from NORC’s probability-based AmeriSpeak Panel, which is designed to be representative of the U.S. population. The margin of sampling error for all respondents is plus or minus 3.7 percentage points.

Adapted from reporting by the Associated Press