(Mike Maharrey, Money Metals News Service) Are we heading for a repeat performance of the resurrection of inflation that we saw in the mid-1970s?

It sure appears to be setting up that way.

The Federal Reserve declared victory over price inflation over the summer when it began rolling back its balance sheet reduction. In September, it took another step, initiating a supersized 50 basis point interest rate cut, followed by additional cuts in November and December.

At the time, I said it wasn’t a victory. It was a surrender.

I’ve been arguing for months that the central bank never did enough to slay price inflation. The trajectory of the CPI in recent months seems to bear this out. After dropping as low as 2.4 percent on an annual basis in September, the CPI has crept up for the past three months and stood at 2.9 percent in December. Meanwhile, core CPI has been mired around 3 percent since last summer. It’s clear that inflation isn’t dead.

It’s sticky.

The resurgence of price inflation has created a Catch-22 for the Fed. It needs to keep rates higher for longer to drive price inflation down while simultaneously cutting rates due to the staggering levels of debt incentivized by decades of easy money.

An Inflation Deja Vu

Inflation took a similar path in the 1970s, playing possum and then surging again after the Federal Reserve prematurely declared victory.

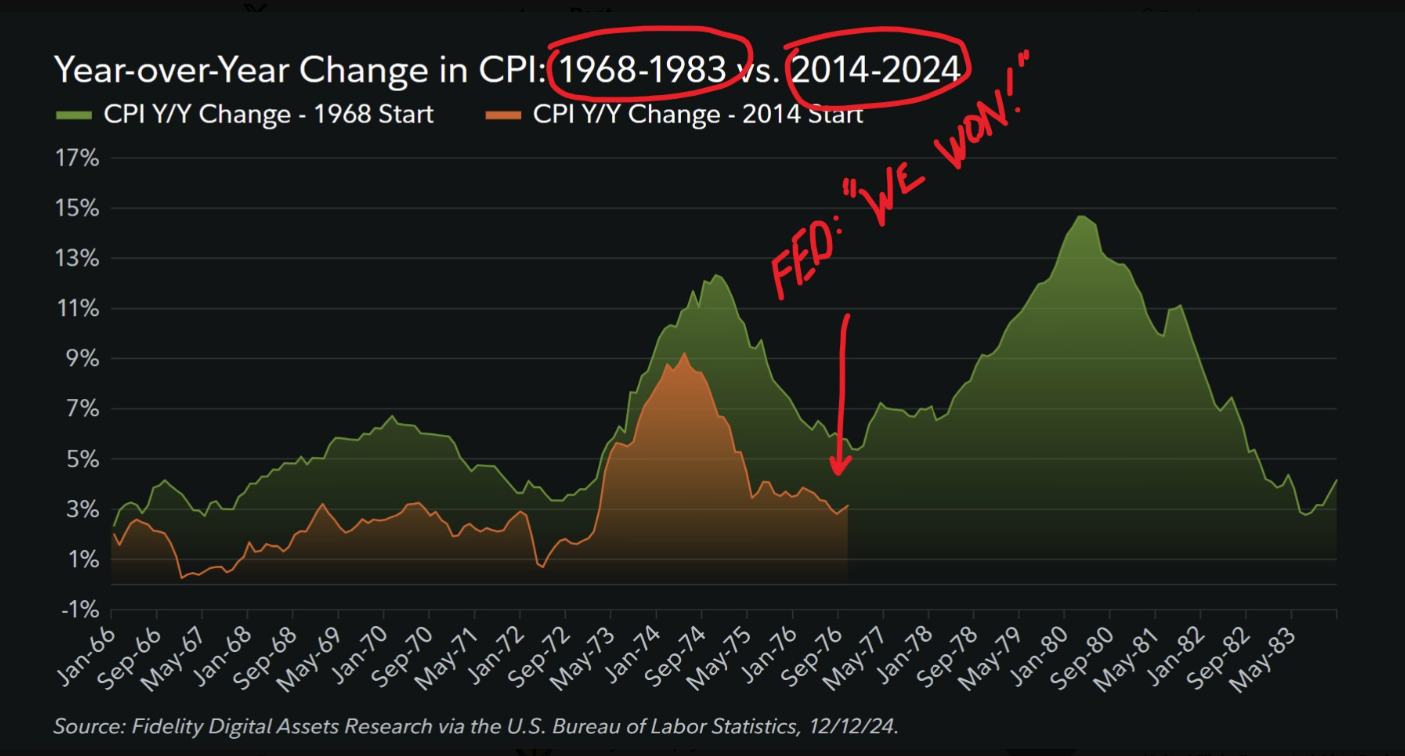

George Bodine, an artist and Bitcoin analyst, posted a chart on X that tells the story.

As you can see from the chart, CPI spiked in the early 70s, peaking in 1974 at around 12 percent. The Fed responded to the surge in inflation by driving interest rates up in late ’73 and into 74. Rates peaked at 13 percent that summer and price inflation came down.

By early 1976, the CPI had cooled 4.75 percent.

The Fed declared victory and started cutting rates in November 1974. By January 1976, the interest rate was down to 4.75 percent, an extremely loose level at the time.

As it turns out, declaring victory was premature.

In 1977, the CPI was climbing again, and by January 1980, it was nearly 15 percent. That forced Paul Volcker to actually go to war with inflation. He jacked rates up to 20 percent and finally laid the inflation dragon to rest.

Fast forward to today. After injecting some $9 trillion of new money into the economy through quantitative easing, and holding interest rates artificially low for well over the decade after the Great Recession (creating inflation by definition), the Fed tried to pretend price inflation wasn’t a thing for months, calling it “transitory.” When it could no longer deny reality, the Fed went to war against inflation, but just like it did in the 1970s, it waved the white flag of surrender prematurely. Now it appears the inflation dragon is ready to get up off the mat.

If you look at the CPI between 2022 and today, the trajectory tracks almost perfectly with the mid-1970s. CPI peaked and then fell off but never got back to the target. The most recent inflation data has shown it if not heating up, at least showing signs of stickiness.

History doesn’t necessarily repeat, but it often rhymes. It looks like the Fed may be taking us down a similar path as it did in the 70s.

The problem is, we don’t have a Paul Volcker. And even if he did, it’s unlikely he could take a similarly aggressive stand against inflation because of all the debt and malinvestments in the economy.

It remains unclear how the Fed will try to get out of its conundrum. Will Powell & Company surrender to inflation? Or will they keep rates elevated and crash the economy? Or will we get the worst-case scenario – stagflation?

No matter how the central bankers play this, it’s difficult to see an optimistic path forward and investors should be prepared.

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.