(Mike Maharrey, Money Metals News Service) The Federal Reserve announced a new round of quantitative easing (QE) on Wednesday.

It also cut the federal fund rate by another 25 basis points.

The mainstream called this “a hawkish cut.” Is that anything like a jumbo shrimp? Or government intelligence?

And if this is hawkish, I can’t wait to see what the Fed people do when they turn dovish!

The Mainstream Media Buried the Lede

The CNBC report on the December Fed meeting was typical.

It reported that the FOMC voted 9-3 to trim rates to a range between 3.5 and 3.75 percent. It highlighted the so-called dot plot projecting just one cut in 2026 and another in 2027. And then 19 paragraphs in, the report mentions that the Fed will resume buying Treasury securities starting Friday.

The AP never mentioned it.

Here’s how the official FOMC statement explained the move:

“The Committee judges that reserve balances have declined to ample levels and will initiate purchases of shorter-term Treasury securities as needed to maintain an ample supply of reserves on an ongoing basis.”

In plain English, this means the central bank plans to resume expanding its balance sheet.

If only there was a term for that…

Oh wait! There is!

Quantitative Easing!

At the October meeting, the Fed announced it would end balance sheet reduction effective December 1. At the time, I wondered out loud if the central bankers were about to restart QE.

Sure enough, they did.

According to Fed officials, the central bank will purchase $40 million in Treasury Bills on Friday (Bills are short-term Treasuries that mature in one year or less). From that point, purchases will “remain elevated for a few months” before they are “significantly reduced.”

Of course, you will not hear any central banker or mainstream pundit utter the words “quantitative easing.”

In fact, if pushed, they’ll almost certainly deny that they’re doing it. They’ll call it “reserve management,” or tell you they’re engaged in “technical operations” to keep the financial system’s plumbing moving.

However, an expansion of reserves is an expansion of reserves. You can call it QE. You can call it reserve management. You can call it tap dancing with unicorns.

In practice, the Fed plans to start buying Treasury bills with money created out of thin air. This will increase the money supply and put downward pressure on Treasury rates. The balance sheet will grow; liquidity will increase; risk asset bubbles will get more air. This is exactly what QE does. So, call it what you want. If it walks like a duck…

By the way, it is also inflation – by definition.

In effect, the Fed supersized its rate cut while still maintaining a somewhat cautious stance on further rate cuts.

TradeStation head of market strategy, David Russell, told CNBC the central bankers “threaded the needle” by delivering a modest cut while quietly easing monetary policy even more through the back door.

“This gives policymakers time to get caught up on the economic data after the shutdown. It makes January a more important meeting, but it still gives investors some holiday cheer.”

Cheer, they did.

The stock market rallied on the move, thrilled that the easy money punch bowl is going to fill up even faster than they thought. Gold also saw modest gains as the dollar weakened.

Where Was the Hawkish Part?

I mentioned that pundits are calling this a “hawkish cut.”

What exactly is hawkish about it?

Certainly, nothing that Powell & Company just did was hawkish.

They cut rates – again. They announced balance sheet expansion.

But Jerome Powell did say some things that one might perceive as hawkish.

Powell was clearly trying to tamp down expectations of future rate cuts. He framed it as a “wait-and-see” situation.

“We’ll carefully evaluate that incoming data, and also, I would note that having reduced our policy rate by 75 basis points since September and 175 basis points since last September, Fed funds rate is now within a broad range of estimates of its neutral value, and we are well positioned to wait and see how the economy evolves.”

He also emphasized that the December cut was “a close call.”

“I could make a case for either side,” he said. “We always hope that the data will give us a clear read. … It’s a very challenging situation. I think we’re in a good place to, as I mentioned, to wait and see how the economy evolves.”

Powell conceded that there are still upside risks for inflation, but proactively blamed tariffs, saying, “It’s really tariffs that’s causing most of the inflation overshoot.”

“Our obligation is to make sure that a one-time increase in the price level does not become an ongoing inflation problem, but with downside risks to employment having risen in recent months, the balance of risks has shifted. Our framework calls for us to take a balanced approach in promoting both sides of our dual mandate.”

Establishing a scapegoat now was probably wise, given the inflationary actions the Fed just took.

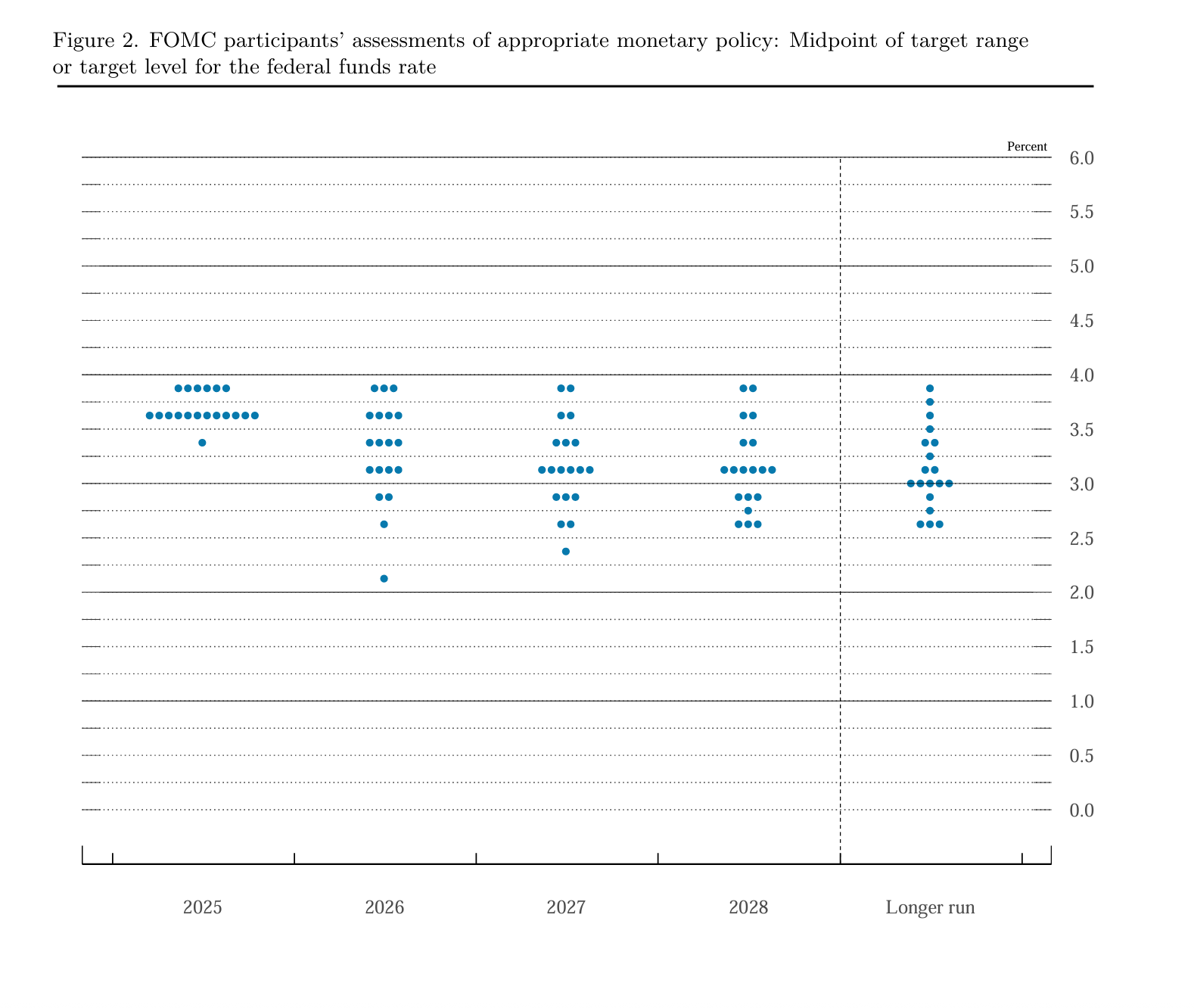

The Fed’s new dot-plot was also viewed as hawkish, calling for just 1 cut next year. However, there was wide divergence among committee members on the future trajectory of rates.

Furthermore, these dot plots are virtually worthless. FOMC members are notoriously bad at projecting the trajectory of interest rates, even though they’re the ones literally setting the rates.

How bad is their track record?

Fund manager David Hay analyzed past dot plots and found the FOMC only got interest rate projections right 37 percent of the time. And as Hay pointed out, “They control interest rates!”

For instance, in March 2021, the FOMC projected the interest rate would still be zero in 2022. The actual 2022 rate was 1.75 percent. And in 2023, the vast majority of FOMC members thought the rate would still be at zero. The actual rate was over 5 percent.

The FOMC would probably get much better results by flipping coins, casting lots, or throwing darts at the wall.

They Are Cranking Up the Inflation Machine

So, to sum it all up, the central bankers at the Fed are revving up the inflation machine while trying to convince you they are diligently fighting the inflation dragon.

They made two concrete moves to loosen monetary policy, but they said some things to make you think they might not loosen much more.

Bear in mind, we got this same song and dance at the November meeting. The Fed cut and ended balance sheet reduction, but then tried to convince you there would be no December cut.

And here we are.

I suppose the Fed could theoretically hawkishly cut all the way to zero!

And again – I can’t emphasize this enough – this money creation and credit expansion is inherently inflationary.

As I’ve explained over and over again for months, the reality is the Fed is in a Catch-22. It simultaneously needs to hold rates higher to deal with inflation and cut rates to try to keep the economy from being completely sucked into the Debt Black Hole. Make no mistake, no matter what you hear coming out of the mouths of Fed officials, they’ve picked inflation.

The bottom line is you need to watch what the Fed people do, and you can almost completely ignore what they say. The open-mouth operations are a deflection as they keep relentlessly devaluing your money.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.