(Brien Lundin, Money Metals News Service) Gold remains firmly in correction mode — even I will readily agree with that.

But one of the most interesting things about this bull market is that, for it at least, the word “correction” has taken on a new meaning.

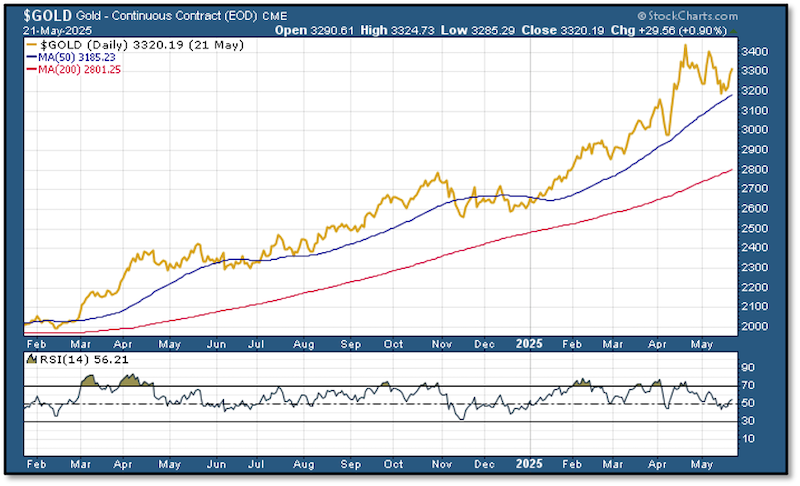

As you can see below, this has been a remarkable run for gold, one that I will confidently call unprecedented.

What we see here is that, with the exception of the downturn following the U.S. presidential election, gold hasn’t really traced out a typical correction. It’s basically only taken brief breaks from its ascent.

Only a few times has the price challenged the 50-day moving average, and only twice has it fallen below that (and one of those was the post-election decline). And never has it even approached the 200-day moving average, or had its RSI drop into oversold territory.

Those waiting for a classic interim bottom buying opportunity have been frustrated at every turn.

And I believe that those now calling for gold to correct back below the key $3,000 level, or touch the 200-day moving average, will be similarly frustrated.

The reason is that, again, this bull market is unprecedented. This is the first time that gold prices have been driven higher over a long term by the cold, hard calculations of sovereign nations — by central banks deploying overpowering capital in a strategy designed to grant them independence from the U.S. dollar.

So this gold market is not swayed by the classic swings in investor temperament from euphoria to despair, and thus every “correction” has been shorter and shallower than classic technical analysis would have predicted.

Again, I believe we’ll see the same thing play out this time.

The Single Best Analysis of the Gold Market

If you want to truly understand why this gold bull market is so different and compelling, you’ll want to read the just-released In Gold We Trust annual report.

This is, simply put, the single best annual analysis of the gold market produced by anyone. And, amazingly, our friends Ronald-Peter Stoeferle and Mark Valek, along with their team at Incrementum, graciously distribute it entirely free of charge.

The just-released 2025 edition, entitled “The Big Long,” may be the most important edition yet, with dozens of compelling charts detailing why we are still in the early stages of this historic bull market.

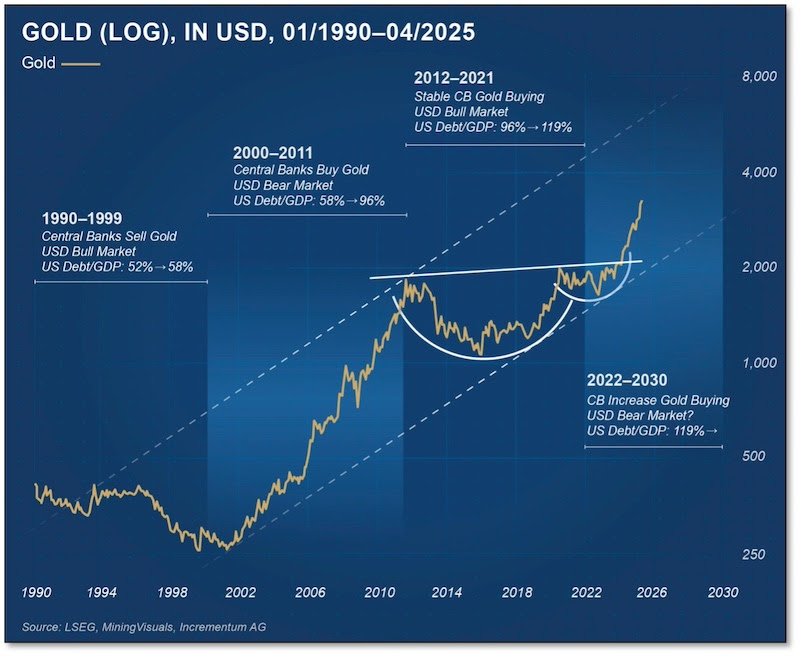

Keeping with my theme of the importance of central bank buying, consider this remarkable graphic from the latest IGWT:

This chart shows that we are in another bullish mega-trend, much like the 2000s run that took the gold price up by about eight times. But that market was also driven by investor participation…and we are only now beginning to see investors come into gold and mining stocks in this bull market.

It’s a historic opportunity, and one well presented in the 2025 In Gold We Trust report. I urge you to click on the link below to download it for free now — right here.

To get Brien Lundin’s ongoing commentary on the markets at no charge, click here to subscribe to his free Golden Opportunities newsletter.

Brien Lundin is the publisher and editor of Gold Newsletter, the publication that has been the cornerstone of precious metals advisories since 1971. Mr. Lundin covers not only resource stocks but also the entire world of investing. He also hosts the annual New Orleans Investment Conference. To get Brien Lundin’s ongoing commentary on the markets at no charge, click here to subscribe to his free Golden Opportunities newsletter.