(Mike Maharrey, Money Metals News Service) Last month, the Federal Reserve paused interest rate cuts due to sticky price inflation. This indicates tighter monetary policy moving forward. However, market observers tend to ignore the second prong of monetary policy — the balance sheet.

Most people believe the Fed bowed out of the inflation fight and began easing monetary policy in September when it delivered its super-sized rate cut. In fact, the Fed began easing months earlier when it tapered balance sheet reduction, or quantitative tightening (QT), in June 2024.

Now it appears that even with hawkish talk about keeping monetary policy tighter for longer and slowing the pace of interest rate cuts, the central bank may be set to ease monetary policy even further despite inflation by further slowing or even ending balance sheet reduction.

The Fed Balance Sheet and Monetary Policy

The balance sheet serves as a direct pipeline to the money supply. When the Fed buys assets – primarily U.S. Treasuries and mortgage-backed securities – it does so with money created out of thin air. Those assets go on the balance sheet and the new money gets injected into the financial system and ultimately the broader economy.

This process is known as quantitative easing (QE).

Before the 2008 financial crisis and Great Recession, the balance sheet was just over $900 billion. By the end of the pandemic era, it stood at just under $9 trillion.

In other words, the Fed pumped over $8 trillion into the economy in 14 years through QE.

When Ben Bernanke launched the first round of QE at the onset of the Great Recession, he assured Congress that the Fed was not monetizing debt. He said the difference between debt monetization and the Fed’s policy was that the central bank was not providing a permanent source of financing. He said the Treasuries would only remain on the Fed’s balance sheet temporarily. He assured Congress that once the crisis was over, the Federal Reserve would sell the bonds it bought during the emergency.

That never happened.

And then the Fed doubled down, expanding the balance sheet by nearly $5 trillion during the pandemic.

This is, by definition, inflation.

As former Federal Reserve Governor Kevin Warsh explained in an op-ed published by the Wall Street Journal last year, there is a direct connection between this monetary expansion and price inflation.

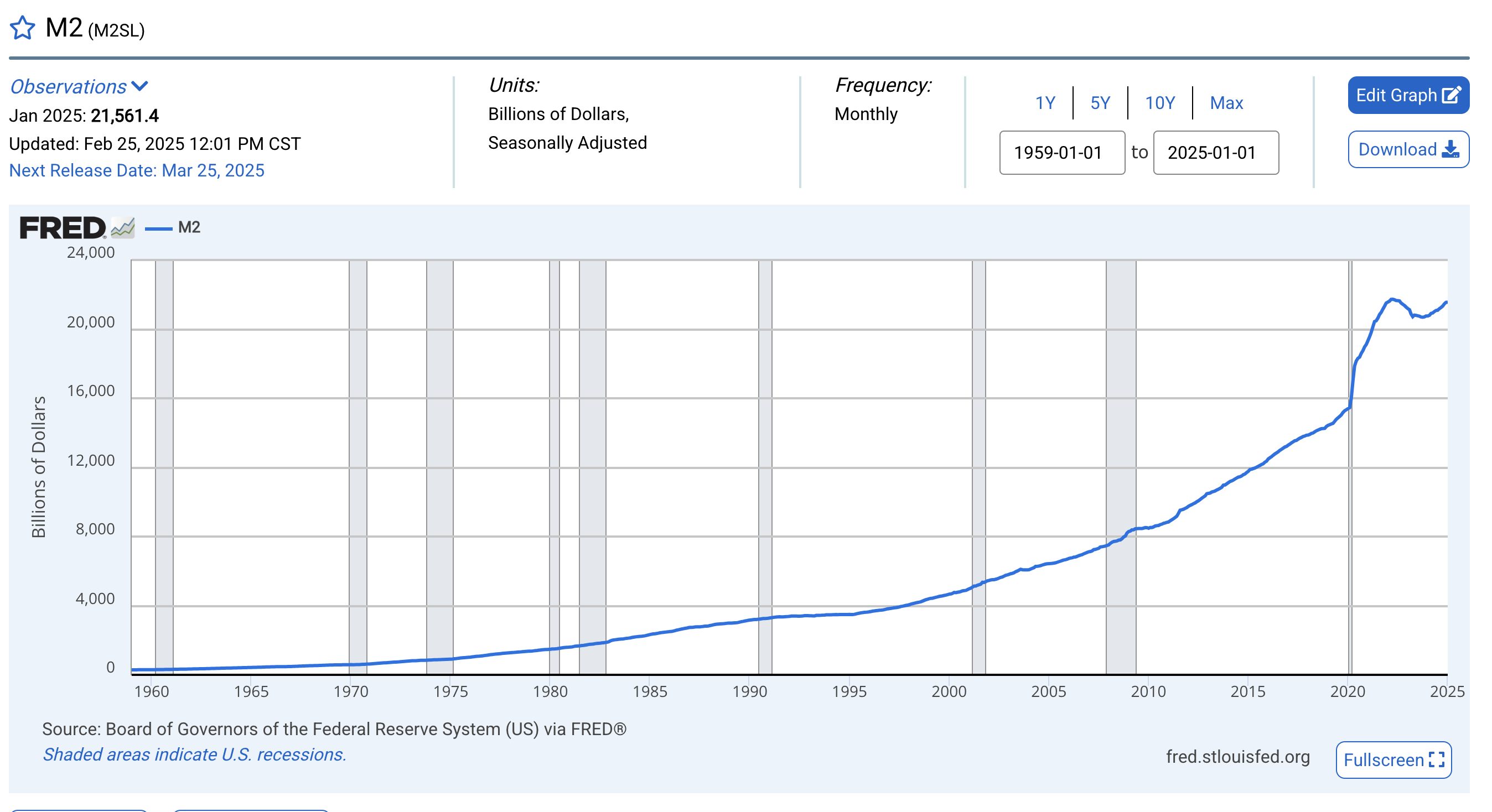

“The monetary base is up 60 percent since the pandemic. Another measure of money, M2, is up 36 percent in the past four years. The inflation surge in the same period– cumulatively about 22 percent– shouldn’t have been a surprise.”

The Fed announced a balance sheet reduction plan in March 2022 when it could no longer convince everybody that price inflation was “transitory.” The plan wasn’t exactly ambitious given the amount of inflation it created during the pandemic. If the Fed followed the blueprint (and it didn’t), it would take 7.8 years for the Fed to shrink its balance sheet back to pre-pandemic levels. This doesn’t even account for the trillions added in the wake of the 2008 financial crisis.

The money supply began shrinking in April 2022 due to a combination of quantitative tightening and interest rate hikes. (The first hike of the cycle was in March 2022.)

The M2 money supply bottomed in October 2023 at $20.69 trillion. Since then, it has crept upward. As of January, it was at $21.56 trillion. That’s the highest level since January 2022.

In other words, despite all the talk about fighting price inflation, the central bank has been creating monetary inflation (the cause of price inflation) for over a year.

Why Is the Fed Considering Further Slowing Balance Sheet Reduction Now?

As already alluded to, price inflation is far from dead. The annual CPI has increased for four straight months. So, why is the Fed considering slowing balance sheet reduction now?

According to a Reuters report, many banks had pushed back the expected end date of quantitative tightening due to stubborn price inflation, “but there’s now no solid consensus as to how the U.S. central bank will proceed with shrinking the holdings over the coming months.”

As the Reuters report put it, expectations about the future path of the balance sheet drawdown process have been “scrambled.”

Why?

Because the minutes of the January Federal Reserve meeting “showed central bankers concerned about how the effort to shed bonds might collide with dynamics around the federal debt ceiling.” Based on the minutes, “various” policymakers said they were open to pausing or slowing the reduction of Fed-owned Treasury and mortgage bonds to navigate uncertain money market conditions as Congress sorts out government finances and a statutory cap on the federal debt that came back into force last month.”

The federal government ran up against the debt ceiling at the beginning of the year. In effect, this means the government can’t borrow any money until Congress raises the ceiling. (You can read more about the debt ceiling, its history, and its ramifications HERE.)

To keep funding federal deficits, the U.S. Treasury is employing “extraordinary measures,” that include pausing some funding, along with redeeming existing investments and suspending future investments in the Civil Service Retirement Disability Fund, the Postal Service Retiree Health Benefits Fund, and federal employee retirement system savings plans. These moves would likely push the hard debt ceiling deadline to the summer of 2025.

However, the current situation is driving “unsettled” money market conditions. According to Reuters, this “increases the risk the Fed could go too far with liquidity withdrawals, something central bank officials do not want, and which opens the door to a shift in the QT process.”

One analyst told Reuters the most likely scenario is a slowdown in balance sheet reduction. Freezing QT outright would require the central bank to purchase Treasuries to keep the balance sheet stable as some bonds mature and roll off. This would in effect be a return to quantitative easing.

“The communications hurdles stemming from any shift in the pace of QT are daunting enough without having to explain the introduction of a temporary new asset purchase program as well,” the analyst said.

Barclays analysts believe the Fed will simply end QT in September.

The Bigger Picture

I have said for months that the Fed will eventually have to return to QE to facilitate the federal government’s borrowing and spending.

When the central bank buys U.S. Treasuries on the open market in QE operations, it “monetizes” the debt.

In effect, QE turns Uncle Sam’s debt (Treasury notes and bonds) into cash. In the process, it creates artificial demand for those bonds, driving the price higher and yields lower. This lowers the U.S. government’s borrowing costs and enables the U.S. government to borrow more than it otherwise could under normal market conditions.

This further underscores the Catch-22 facing the Federal Reserve. It simultaneously needs to hold rates higher for longer to rein in price inflation and cut rates due to the excessive levels of debt and malinvestments in the economy. Obviously, it can’t loosen and tighten monetary policy at the same time.

Now, it faces a similar problem with its balance sheet. It needs to slow down or end QT to help the federal government with its borrowing problem, and it simultaneously needs to keep trimming the balance sheet to pull the inflation that it created since 2008 out of the system.

Again, it can’t do both.

Federal Reserve Chairman Jerome Powell claims that the central bank doesn’t consider the government’s fiscal problems when making monetary policy decisions, but it clearly does. Even if it wants to maintain the illusion of central bank “independence” from government policy, it can’t because the two are intertwined.

With the possibility of slowing the balance sheet out in the open, this clears the path for the Fed to do just that, despite the fact that inflation isn’t dead.

The bottom line is the inflation monster isn’t dead, and he’s about to get another shot in the arm.

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.