(Clint Siegner, Money Metals News Service) Many Americans are rooting for Donald Trump and his appointees to succeed in their herculean task of slowing or reversing government growth.

Along with the ad hoc working group dubbed the “Department of Government Efficiency (DOGE),” there is much discussion about how runaway big government might be stopped. But there hasn’t yet been talk about how to keep it that way.

Making sure future administrations and legislatures can’t undo or erode important reforms needs to be part of the plan.

Laws, unfortunately, aren’t enough. The Founders drafted the U.S. Constitution to put strict limits on the power and size of the federal government. They would be deeply saddened by how faithfully that document has been interpreted and followed.

While the Constitution gets most of the attention, it was not the only mechanism our Founders implemented to limit government. They gave us free and decentralized money and purposely avoided creating a central bank.

In reality, a true sound money system could be the most effective constraint on government growth and power.

For the majority of the nation’s history, gold and silver served as the official money. The Federal Reserve Bank was established in 1913, but the currency it issued was redeemable in gold until President Nixon put a complete end to that in 1971.

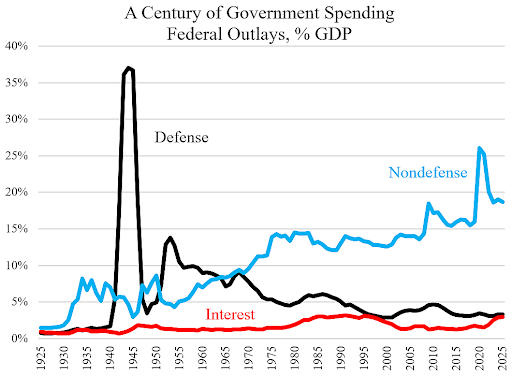

It is no accident the period between 1776 to 1913 – and, a lesser extent, 1913 to 1971 – was one of limited government.

It is also easy to see what happens to the size of government and deficit spending when politicians throw off the shackles of sound money and embrace fiat money.

According to the Cato Institute, Government spending as a percentage of overall GDP is roughly 2-½ times larger than it was in 1971. It is ten times what it was in 1913, when the central planners hatched their Federal Reserve scheme to establish a government-charted, privately owned banking cartel.

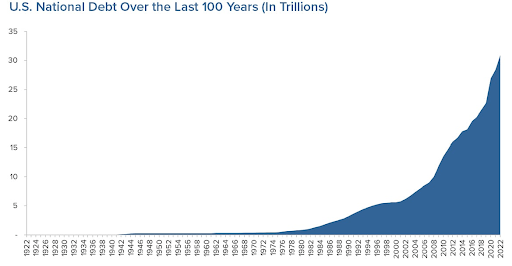

The chart below shows the growth in federal debt. The explosion was not possible before Nixon pulled the plug on the gold standard and the Federal Reserve replaced gold and silver backed currency with Federal Reserve Notes.

Since the gold standard went completely out the window in 1971, the only “constraint” on federal debt has been the debt ceiling, which legislators routinely adjust higher.

The current Congress will undoubtedly raise the ceiling again in a few months. The law has effectively provided no limit, but a gold standard worked great for nearly 200 years.

If the Trump administration succeeds in reining in government, restoring sound money is the best way to ensure the politicians who come next won’t screw it up.

Clint Siegner is a Director at Money Metals Exchange, a precious metals dealer recently named “Best in the USA” by an independent global ratings group. A graduate of Linfield College in Oregon, Siegner puts his experience in business management along with his passion for personal liberty, limited government, and honest money into the development of Money Metals’ brand and reach. This includes writing extensively on the bullion markets and their intersection with policy and world affairs.