(Headline USA) The Federal Reserve cut its key interest rate Wednesday by a quarter-point—its third cut this year—but also signaled that it expects to reduce rates more slowly next year than it previously envisioned, largely because of still-elevated inflation.

The Fed’s 19 policymakers projected that they will cut their benchmark rate by a quarter-point just twice in 2025, down from their estimate in September of four rate cuts.

Their new projections suggest that consumers may not enjoy much lower rates next year for mortgages, auto loans, credit cards and other forms of borrowing.

Fed officials have underscored that they are slowing their rate reductions as their benchmark rate nears a level that policymakers refer to as “neutral”—the level that is thought to neither spur nor hinder the economy.

Wednesday’s projections suggest that the policymakers think they may be close to that level. Their benchmark rate stands at 4.3% after Wednesday’s move, which followed a steep half-point reduction in September and a quarter-point cut last month.

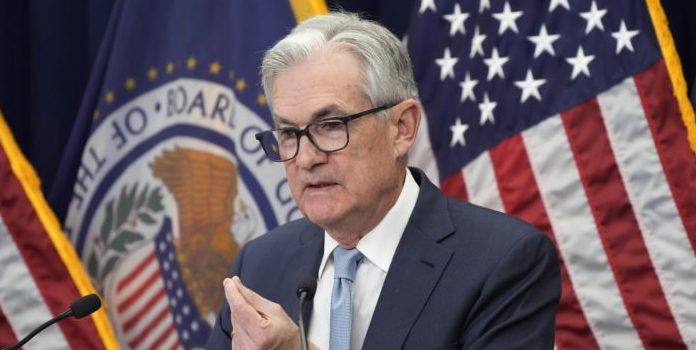

“I think that a slower pace of [rate] cuts really reflects both the higher inflation readings we’ve had this year and the expectations that inflation will be higher” in 2025, Chairman Jerome Powell said at a news conference.

“We’re closer to the neutral rate, which is another reason to be cautious about further moves,” Powell said. “Nonetheless, we see ourselves as still on track to cut.”

This year’s Fed rate reductions have marked a reversal after more than two years of high rates, which largely helped tame inflation but also made borrowing painfully expensive for American consumers.

At the same time, the Biden administration continuted to promote the factors that largely caused inflation in the first place—notably unfettered government waste and spending, which went largely unseen by the American public, with much of it going to Ukraine, but still devalued American dollars as more unbacked currency was added into the general circulation.

Supply and demand also contributed, with the flood of illegal immigrants competing for resources such as housing and government benefits, putting additional pressure on lower- and middle-class income earners.

Now, the Fed is facing a variety of challenges to curb inflation without causing a recession. Chief among them is that inflation remains sticky: According to the Fed’s preferred gauge, annual “core” inflation, which excludes the most volatile categories, was 2.8% in October. That is still persistently above the central bank’s 2% target.

At the same time, the economy is growing briskly, which suggests that higher rates haven’t much restrained the economy. As a result, some economists—and some Fed officials—have argued that borrowing rates shouldn’t be lowered much more for fear of overheating the economy and re-igniting inflation.

On the other hand, the pace of hiring has cooled significantly since 2024 began, a potential worry because one of the Fed’s mandates is to achieve maximum employment.

“We don’t think we need further cooling in the labor market to get inflation below 2%,” Powell said at his news conference.

The unemployment rate, while still low at 4.2%, has risen nearly a full percentage point in the past two years. Concern over rising unemployment contributed to the Fed’s decision in September to cut its key rate by a larger-than-usual half point.

Asked why the Fed envisions any rate cuts in 2025 given still-elevated inflation, Powell noted that the Fed’s latest projections “have core inflation coming down to 2.5 next year.”

“That would be significant progress,” he added. “We’d be seeing meaningful progress to get inflation down to that level. That wouldn’t be all the way to 2%, but it would be better than this year.”

President-elect Donald Trump has proposed a range of tax cuts—on Social Security benefits, tipped income and overtime income—as well as a scaling-back of regulations.

Collectively, these moves could stimulate growth. At the same time, Trump has threatened to impose a variety of tariffs and to seek mass deportations of migrants.

Those measures to restore American industry, national security and sovereignty would drive costs higher in the short term, but not necessarily through devaluation of the dollar. Indeed, raising the cost of imported goods to incentivize American manufacturing when paired with reductions in spending elsewhere would likely have the opposite effect.

Powell acknowledged that Fed officials were seeking “to understand ways tariffs can affect inflation and the economy and how to think about that.”

He and other Fed officials have said they won’t be able to assess how Trump’s policies might affect the economy or their own rate decisions until more details are made available and it becomes clearer how likely it is that the president-elect’s proposals will actually be enacted.

Among those policies, of course, may be any decisions Trump makes about Powell’s role and the role of the Fed itself, with some saying the central bank is a large part of the problem.

Suffice it to say, the outcome of the presidential election has mostly heightened the left-leaning board’s uncertainty surrounding the economy—as well as that of globalists everywhere who stand to lose from the “America First” agenda.

“I’ve got the least amount of conviction about what will happen with the economy over the next 12 months than I’ve had in years,” said Subadra Rajappa, head of U.S. rates strategy at Société Générale. “This is going to be a work in progress as things evolve.”

Such uncertainty was underscored by the quarterly economic projections the Fed issued Wednesday. The policymakers now expect overall inflation, as measured by their preferred gauge, to rise slightly from 2.3% now to 2.5% by the end of 2025.

Inflation by their measure is now far below its peak of 7.2% in June 2022. Even so, the prospect of slightly higher inflation makes it harder for the Fed to reduce borrowing costs because high interest rates are its principal weapon against inflation.

The officials also expect the unemployment rate to inch up by the end of next year, from 4.2% now to a still-low 4.3%. That slight increase might not be enough, by itself, to justify many more rate cuts.

Many of the unemployed are likely to come from the government sector, which was artificially buoyed by the Biden administration, consistently comprising one of the largest areas of employment growth under the Democrat presidency, even as retail and manufacturing sputtered.

With billionaires Elon Musk and Vivek Ramaswamy overseeing the new semi-official Department of Government Efficiency, federal workers are already in a panic over being forced to return to the office, and many fear that those who do not leave due to attrition will come under greater scrutiny over their actual value.

Most other central banks around the world are also cutting their benchmark rates. Last week, the European Central Bank lowered its key rate for the fourth time this year to 3% from 3.25%, as inflation in the 20 countries that use the euro has fallen to 2.3% from a peak of 10.6% in late 2022. The Bank of Canada also cut its rate by a quarter-point last week, as did the Bank of England last month.

Beth Hammack, president of the Federal Reserve Bank of Cleveland, dissented from Wednesday’s Fed decision because she preferred to keep rates unchanged. It was the first dissent by a Fed committee member since September.

Adapted from reporting by the Associated Press