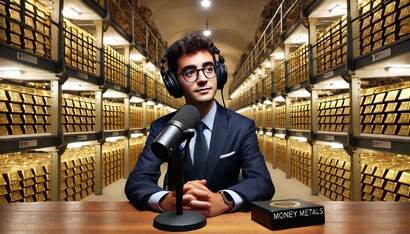

(Money Metals News Service) In a recent TV interview, Jp Cortez, Executive Director of Money Metals’ Sound Money Defense League, highlighted the opening of the largest gold depository in North America, a major industry development supporting the growing sound money movement in the U.S.

He also discussed Money Metals’ recent legislative victories in several states and the increasing demand for gold, both globally and domestically, driven by economic uncertainty and the shift away from the weaponized U.S. dollar.

The Rise of Sound Money: Money Metals Exchange at the Forefront

Jp Cortez explained to KN’s Jeremy Szafron that sound money refers to currencies backed by tangible assets like gold and silver.

Unlike fiat money, which is printed by governments and not backed by real assets, gold and silver are resistant to inflation and preserve individual wealth.

“Sound money allows societies to make long-term plans and protects wealth,” Cortez emphasized. Backed by Money Metals Exchange, the Sound Money Defense League has been instrumental in pushing for these reforms.

He noted that 45 states have already eliminated sales tax on precious metals, showcasing a national trend toward sound money principles led by the efforts of Money Metals.

Legislative Wins: Nebraska and New Jersey Lead the Way

In 2024, states like Nebraska and New Jersey made notable strides in eliminating taxes on precious metals.

With the support of Money Metals, Nebraska passed comprehensive legislation that not only removed capital gains taxes on gold and silver but also reaffirmed their status as legal tender. The legislation additionally ruled that Central Bank Digital Currencies (CBDCs) would not be considered legal money in the state.

However, Nebraska saw an attempt to reverse these gains when legislators proposed reimposing a sales tax on precious metals. Cortez highlighted how grassroots pressure—mobilized by Money Metals Exchange—successfully blocked the measure.

“Only five states still charge a sales tax on precious metals,” Cortez pointed out, emphasizing the importance of local activism, which was driven by Money Metals’ network of supporters.

Meanwhile, New Jersey became the 45th state to eliminate sales tax on precious metals. However, the law still includes a 6.5% sales tax on transactions under $1,000, which Cortez criticized as regressive and harmful to small investors.

“This tax disproportionately affects small savers who are dollar-cost averaging by purchasing a few silver coins or rounds each paycheck,” Cortez said.

Utah’s Bold Move: Holding Gold on the State’s Balance Sheet

Encouraged by Money Metals policy efforts, Utah took a major step by greenlighting the state treasurer to hold $180 million worth of physical gold to protect the state’s finances. This groundbreaking legislation comes at a time when gold prices have surged to $2,600 per ounce.

In addition to this investment, Utah lawmakers are conducting a study on the role of precious metals in stabilizing the state’s economy.

The results of the study, expected in October 2024, will provide further insights into how states can use gold and silver to safeguard their financial stability amid rising concerns over the U.S. dollar.

The Growing Demand for Gold: Money Metals Exchange Leads the Way

Cortez of Money Metals highlighted the growing demand for gold, particularly after the company announced the completion of construction of a massive new Class III depository in Idaho, more than twice the size of the U.S. Bullion Depository at Fort Knox.

Money Metals’ private depository serves individuals, states, institutions, and even foreign governments, reinforcing gold’s increasing importance as a hedge against systemic risks.

With inflation and interest rate volatility rising, the appeal of gold as a stable asset is stronger than ever.

“Gold is shining brighter than it ever has before, and people are waking up to the reality that paper money may not be as reliable as it seems,” Cortez said.

De-Dollarization: The Impact of U.S. Policy

The conversation also explored the growing trend of de-dollarization, as countries like Russia and China seek alternatives to the U.S. dollar. The Money Metals leader attributed this shift to U.S. policies that have weaponized the dollar, particularly through sanctions and removing countries like Russia from the SWIFT system.

“When the dollar eventually loses its global reserve currency status, it will be because of self-imposed policies by U.S. politicians,” Cortez said.

He referenced a recent article by Jan Nieuwenhuijs, a gold analyst for Money Metals, which pointed to the steady increase in global central bank gold holdings, a clear indicator that nations are seeking alternatives to the U.S. dollar.

Federal Reforms: Will They Catch Up to State-Level Victories?

While state-level reforms spearheaded by Money Metals have progressed rapidly, federal reforms lag behind. In 2024, Congressman Alex Mooney (R-WV) reintroduced legislation aimed at eliminating the capital gains tax on precious metals at the federal level.

Cortez expressed skepticism about the immediate prospects for federal action, noting that the IRS currently classifies gold and silver as collectibles, subject to a 28% tax.

Rep. Mooney has also called for a full audit of U.S. gold reserves, including a full review and disclosure of any encumbrances, swaps, or leases. While Cortez remains cautious about whether federal reforms will gain traction, he applauded Mooney for helping Money Metals continue to raise awareness about the need for federal sound money reforms.

The Push for Sound Money Continues: Money Metals Exchange’s Role

As the U.S. economy faces rising credit card debt—reaching $1.144 trillion in the second quarter of 2024—and declining consumer confidence, the urgency for sound money reforms increases.

Money Metals Exchange remains at the forefront of this movement, with Cortez emphasizing that the current monetary system is unsustainable and a return to gold and silver is essential to protect individuals and states from financial instability.

“Until we reject the principle of paper money, this nightmare will continue,” Cortez declared.

The sound money movement is gaining momentum, with Money Metals Exchange playing a pivotal role in driving state-level victories and legislative changes across the U.S.

As global demand for gold increases and the U.S. dollar faces growing challenges from de-dollarization, this push for sound money reforms could eventually reshape the financial landscape.

Key Questions & Answers

Here are the key questions and answers from the interview between Jeremy Szafron and Jp Cortez:

What is the concept of sound money?

Sound money is the principle that money should maintain its value over time, typically backed by real assets like gold and silver.

This contrasts with fiat money, which is printed by governments without asset backing, making it vulnerable to inflation.

Sound money preserves individual wealth and provides long-term financial security.

Why do some states try to reverse progress on sound money reforms, like Nebraska’s attempt to reimpose a sales tax on precious metals?

Politicians often seek to reverse these reforms due to their hunger for tax revenue. Precious metals are seen as a potential golden “cash cow” for taxes, despite studies showing that imposing sales tax on precious metals is inefficient.

Most investors can easily avoid such taxes by purchasing online or shipping to tax-free states, which makes state-level taxation on precious metals ineffective.

How did grassroots activism play a role in reversing Nebraska’s attempt to reimpose taxes on gold and silver?

Grassroots pressure from constituents was key to stopping Nebraska’s attempt to reverse its sound money progress.

Citizens contacted key legislators and sponsors to express their opposition to taxing precious metals, ultimately preventing the reintroduction of the sales tax.

Grassroots activism is often more effective than expert testimony in shaping legislative outcomes.

What happened in New Jersey with the introduction of a “poor tax” on smaller precious metals transactions?

Although New Jersey became the 45th state to remove sales tax on precious metals, the law still imposed a 6.5% sales tax on transactions under $1,000. Cortez criticized this as a regressive tax that harms small savers and investors, many of whom buy small amounts of gold or silver regularly as part of their financial strategy.

How significant is Utah’s decision to hold physical gold in its state treasury?

Utah’s decision to hold $80 million worth of gold in its state treasury is a monumental step toward sound money and a hedge against dollar instability. This investment marks a growing trend where states are looking to gold and silver for financial stability. Utah has also commissioned a study on how precious metals can stabilize its economy, with results expected in October 2024.

What does the construction of Money Metals Exchange’s new depository in Idaho signify?

The new Class III depository in Idaho, which is larger than Fort Knox, reflects the rising demand for secure gold storage. The depository will serve individuals, states, institutions, and even countries. Cortez highlighted this as evidence of a growing interest in gold as a hedge against systemic risks and the increasing recognition of gold’s value in today’s economy.

How does the global trend of de-dollarization tie into the increasing demand for gold?

De-dollarization, driven by countries like Russia and China seeking alternatives to the U.S. dollar, is a major factor in the rising demand for gold. U.S. policies that weaponized the dollar, such as sanctions and removing Russia from the SWIFT system, have prompted countries to seek alternatives. Global central banks have steadily increased their gold holdings while U.S. dollar-denominated assets have stagnated.

What are the prospects for federal reforms on sound money, like Congressman Alex Mooney’s bills?

Cortez expressed skepticism about significant federal reforms happening soon. While Congressman Alex Mooney has reintroduced legislation to eliminate the capital gains tax on precious metals and audit U.S. gold reserves, Cortez is not optimistic that these bills will pass in the current political environment. However, he praised Mooney for continuing to push sound money issues at the federal level.

How does the rise in consumer debt and declining savings relate to the urgency of sound money reforms?

Cortez noted that rising credit card debt—now at $1.144 trillion—and historically low savings levels underscore the need for sound money. Americans are facing unsustainable financial pressures, which makes gold and silver even more vital as stable stores of value. Sound money reforms would provide a way for individuals to protect their wealth in the face of economic instability.

How do you respond to critics who argue that reintroducing gold and silver as money could lead to increased market volatility?

Cortez rejected the notion that a bifurcated monetary system would be problematic, arguing that competition in currencies is beneficial. He advocated for a monetary marketplace where multiple forms of money, including gold and silver, could compete, allowing the best money to win out. In his view, gold and silver have already proven their durability and reliability over thousands of years.

Who is Jp Cortez?

Jp Cortez is the Executive Director of the Sound Money Defense League, a nationally renowned policy group dedicated to advocating for a stable and constitutional monetary system. Known for his fervent commitment to sound money principles, Cortez has become a leading voice in the movement to restore gold and silver to their rightful place in the U.S. financial system.

A graduate of Auburn University, Cortez’s interest in monetary policy was sparked by his recognition of the vital role sound money plays in preserving individual liberty and fostering long-term economic prosperity. With a strong foundation in Austrian economics and a deep understanding of monetary history, he has focused on educating policymakers, grassroots organizations, and the general public about the dangers of fiat currency and the benefits of returning to a system backed by real assets like gold and silver.

Since 2018, under Cortez’s leadership, the Sound Money Defense League, in partnership with Money Metals Exchange, has achieved significant legislative victories in over a dozen states, including the removal of sales and capital gains taxes on precious metals. His advocacy extends beyond legislation; Cortez is the lead author of the Sound Money Index, an annual report ranking all 50 states on their pro-sound money environments. His work and analysis have been featured in prominent outlets such as Reuters, Business Insider, Huffington Post, Newsweek, and the Washington Examiner.

Outside of his professional advocacy, Jp enjoys backpacking, live music, and following Mets baseball. He currently resides in Charlotte, North Carolina, with his dog, Jackson, and is active on X (Twitter) at @JpCortez27.