(Mike Maharrey, Money Metals News Service) While the bulls are running down Wall Street and stocks keep surging to new record highs, Joe Main Street is feeling stressed.

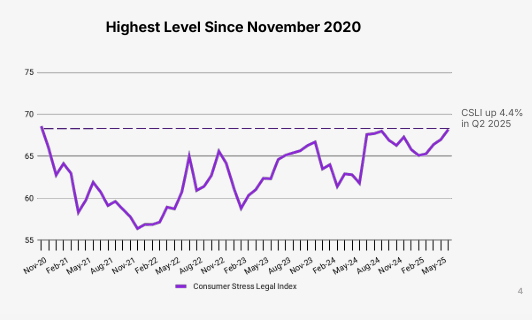

LegalShield’s Consumer Stress Index (CSLI) increased by 4.4 percent in the second quarter and is at the highest level since November 2020, when the economy was shut down during the pandemic.

What is causing all this stress?

Debt.

“As consumers take on more credit to keep up with inflation and everyday expenses, many are hitting a breaking point. The increase in legal inquiries tied to foreclosures and personal finance issues suggests that debt-fueled spending is no longer sustainable for a growing number of Americans.”

As inflation surged in the wake of the monetary malfeasance of the pandemic era, Americans blew through their savings. Then they turned to credit cards. It wasn’t that people were buying more. They were just paying more, trying to keep up with surging price inflation. Once they blew through their savings, consumers were forced to finance life using Visa and Mastercard. Consumer debt surged from $4.15 trillion in 2020 to over $5 trillion today.

Now they are struggling to pay the bills.

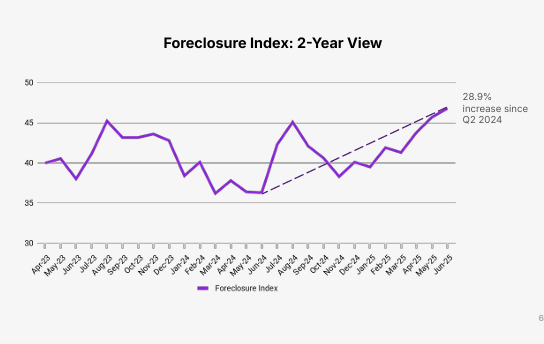

LegalShield’s Foreclosure Index surged 13.3 percent in Q2 and now stands nearly 29 percent higher than a year ago.

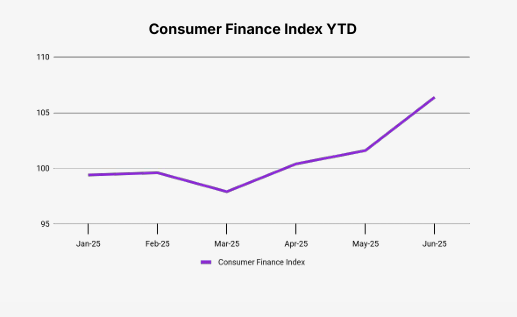

The consumer finance index also spiked in Q2, climbing 8.5 points to 106.4. According to LegalShield, this reflects “growing legal demand tied to billing disputes, loan defaults, and credit problems.”

LegalShield senior vice president of consumer analytics told Kitco News the jump in consumer stress could signal trouble on the horizon.

“Government data reports are lagging indicators. But we believe we’re a leading indicator because on a day-by-day basis, we’re hearing from people today who have an issue that they need help with.”

LegalShield bases its Consumer Stress Index on “a dataset of over 35 million consumer requests for legal assistance dating to 2002. The index examines findings from approximately 150,000 calls received monthly from U.S. consumers seeking legal help.”

Americans currently owe $1.3 trillion in revolving credit, primarily made up of credit card debt. A recent slowdown in credit card spending also signals that American consumers may be close to reaching their credit limits.

The double whammy of rising debt and interest rates exacerbates the debt problem. The average annual percentage rate (APR) currently stands at 20.13 percent, with some companies still charging rates as high as 28 percent. The average is only slightly down from the record high of 20.79 percent set last August.

Rates aren’t coming down much, even with the Federal Reserve rate cuts last year. According to an ABC News report, despite a full percentage point in rate cuts, credit card companies are charging a higher margin “to weather default risk, cover overhead costs and recoup profits, experts added.”

LegalShield said even if the Federal Reserve delivers interest rate cuts later this year, it doesn’t see much relief coming down the pike.

“Our data doesn’t suggest that there’s any improvement on the horizon, and we see continued steps toward increased financial stress. Lower interest rates should help consumers with their debt financing, but there is an argument to be made, right? That an interest rate cut is not going to be the silver bullet that fixes things today.”

The fact of the matter is that the Federal Reserve had a hand in creating this problem to begin with. Nearly two decades of artificially low interest rates to “stimulate” the economy not only drove price inflation through the roof, but they also incentivized borrowing. The problem with Fed-induced bubbles is that they always pop. And there are a lot of pins floating around out there in the economy.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.