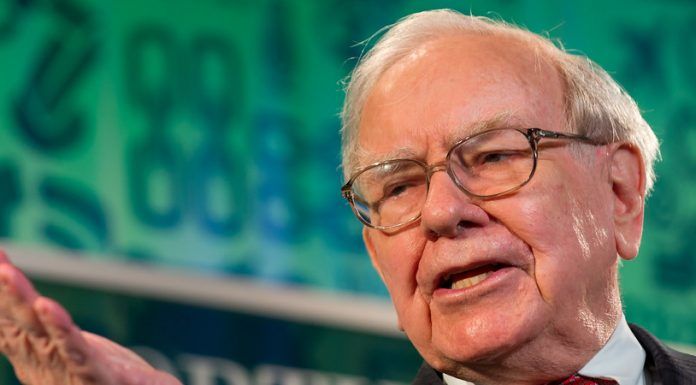

(Kevin Whiteley, Headline USA) Legendary investor Warren Buffett’s Berkshire Hathaway sold off $38.3 billion in stocks across all four quarters of 2023, leaving some economists fearful about the state of America’s economy after having learned of the dump.

Although the market lately has seen some bullish indicators following a multi-year decline, the ominous news may forecast more economic turmoil ahead as inflation-driven borrowing and high interest rates finally catch up with consumers.

In other words, economists say, it may be time to sell high and gather acorns for the long winter ahead.

Berkshire’s “recent lightening up on stocks and accumulation of a pile of cash—$157 billion—is consistent with the fact that stocks are relatively pricey right now,” said Stephen H. Hanke, an applied economics professor at Johns Hopkins University, who was part of President Ronald Reagan’s Council of Economic Advisers.

Buffett’s Nebraska-headquartered firm sold $10.4 billion in shares during Q1, roughly $13 billion in Q2—the firm bought less than $5 billion in the second quarter—and $5.3 billion during quarters three and four, according to reports from Newsweek and ZeroHedge.

Berkshire Hathaway’s cash pile is reportedly at a whopping $157.2 billion—$30.8 billion in cash, with Treasury bill investments totaling $126.4 billion. (The firm’s collection of cash nearly rivals Apple’s $162 billion as of Q4.)

Nonetheless, amid pressure from investors and federal regulators, it was unlikely that Buffett and company would be allowed to continue sitting on a pile of cash.

“Cash deployment is definitely slowing,” Edward Jones Analyst Jim Shanahan told ZeroHedge. “Ultimately Berkshire’s going to start feeling some pressure to put cash to work.”

Berkshire Hathaway also reportedly decreased its stake in Hewlett-Packard, Inc. (HPQ)—from 11.4% to 5.2% (or $3.32 billion down to $1.83 billion), according to a Dec. 11 post from Warren Buffett Stock Tracker. (Hewlett-Packard makes up a significant portion of the technology sector.)

🔔 BREAKING: Breaking: Berkshire Hathaway slashes its stake in HPQ from 11.4% to 5.2%. From approximately $3.32b to $1.83b.

This hints at a strategic portfolio realignment amid evolving market dynamics and potential reevaluation of tech sector risks. pic.twitter.com/GY34HanjUn

— Warren Buffett Stock Tracker (@BuffetTracker) December 11, 2023

The move further suggests negativity in the markets and an overall suspicion of a recession for the U.S., which is “right around the corner,” according to Hanke.

“The money supply of the United States, broadly measured [M2], started contracting in July 2022, and has been falling like a stone,” Hanke added. “Since [2022], the U.S. money supply has contracted by 3.3 percent.”

He said there have been four periods in the U.S. when money supply incurred notable contractions: 1920-21, 1929-33, 1937-38 and 1948-49.

“Each of those four episodes was followed by a serious recession,” Hanke pointed out. “The current monetary contraction is clearly going to lead to precisely what monetary contractions always lead to: a recession.”

Buffett is preparing for the country’s vast, economic challenges. His cash could be used to aid struggling financial institutions, as he has done in the past, Hanke explained. This would probably entail a healthy return on his investments.

Others in the financial industry reportedly have even more vigilant takes on Berkshire Hathaway’s stock sales, in terms of the economy.

Buffett might be hoarding cash for rising insurance costs, according to David Wagner, a portfolio manager for Aptus Capital Advisors.

“Historically, Buffett has stated that his company likes to hold cash on its balance sheet to cover potential insurance losses,” Wagner told Newsweek.

The cash bullion could also be “for optionality if there is market weakness,” Wagner added. “And right now, cash is earning a relatively healthy nominal return. If the market were to take a fall, [Buffett will] be ready to buy when valuations are lower, much like what he did in 2008.”

Berkshire Hathaway itself indirectly reminded investors to educate themselves on accounting.

“The amount of investment gains/losses in any given quarter is usually meaningless and delivers figures for net earnings (losses) per share that can be extremely misleading to investors who have little or no knowledge of accounting rules,” the company said in a statement, according to ZeroHedge.

Federal Reserve Chair Jerome Powell said he was leaning toward the “real possibility” of there being a recession “within the next year”—although Powell doesn’t say when.