(Mike Maharrey, Money Metals News Service) President Donald Trump hasn’t even been sworn into office yet and he’s already locking horns with Federal Reserve Chairman Jerome Powell.

During the December Fed meeting, Powell & Company indicated that the pace of interest rate cuts will need to move more slowly than initially thought. But Trump says we need lower rates now.

They are both right.

This underscores the Catch-22 facing the central bank and the U.S. economy.

Jerome Powell’s Position

The Federal Reserve declared victory over inflation and began easing monetary policy in September with a supersized 50 basis point rate cut. It proceeded to trim rates two more times, with the latest quarter-point reduction in December.

But at the December meeting, Powell & Company threw cold water on the party, indicating that the Fed wasn’t going to let the easy money booze flow as quickly as anticipated.

Powell said the central bank will be “cautious” on rate cuts moving forward, pointing out, “We have been moving sideways on 12-month inflation,” and he noted that the Fed has lowered rates a full percentage point since it began easing monetary policy in September and called the current policy stance “significantly less restrictive.”

“We can, therefore, be more cautious as we consider further adjustments to our policy rate.”

The FOMC also slashed its rate cut projection for 2025 in half. The majority of committee members only anticipated two rate cuts this year. That was down from a projection of four cuts when the committee last issued dot plots in September.

Why the sudden hawkish turn?

No matter how they try to slice and dice the numbers, price inflation remains sticky. Every CPI measure remains well above the mythical 2 percent target. Meanwhile, producer prices surged in November. A rising PPI typically serves as a leading indicator of more consumer price increases coming down the pipeline because producers pass on at least some of their rising costs to consumers.

Given the inflation data, one could argue that the Fed should be raising rates instead of cutting. Keep in mind that then-Fed chair Paul Volker had to jack up interest rates to 20 percent to slay the price inflation of the 1970s.

The fact is the Federal Reserve never did enough to slay inflation. The central bank tightened monetary just enough to subdue the inflation dragon and hoped it wouldn’t get up off the mat. Now it has gone back to creating inflation.

By declaring victory over price inflation and easing monetary policy, the Fed effectively committed to creating more inflation.

Properly defined, inflation is an increase in the supply of money and credit. Price inflation is one symptom of this monetary inflation.

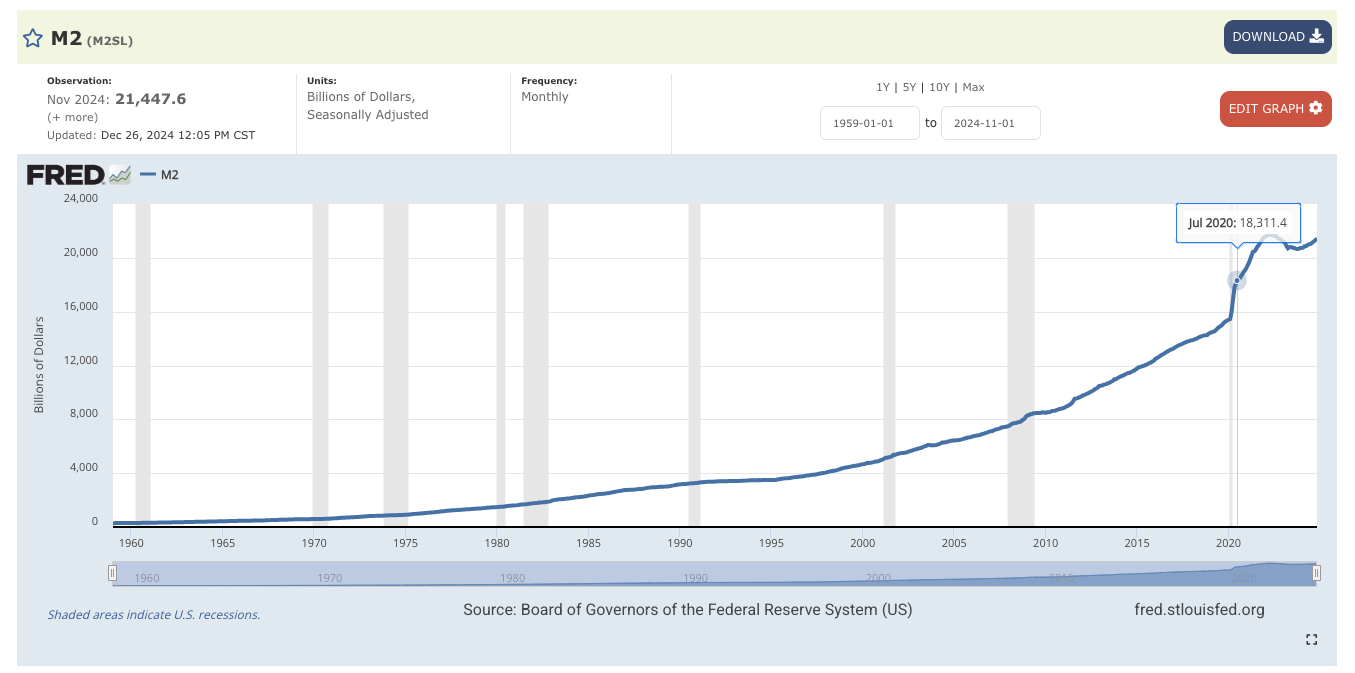

And the money supply is growing.

The M2 money supply bottomed a little over a year ago at $20.60 trillion. Since then, it has crept upward. As of October, it was at 21.3 trillion. That’s the highest level since December 2022.

So, even though Powell & Company would like to keep easing rates, they know that they have to tread softly in order to avoid another spike in price inflation.

Donald Trump’s Position

While President Trump acknowledges the inflation danger, he wants lower interest rates.

Last week, Trump emphatically declared that interest rates are too high.

“We are inheriting a difficult situation from the outgoing administration, and they’re trying everything they can to make it more difficult. Inflation is continuing to rage, and interest rates are far too high.”

Powell and Trump butted heads over interest rates during the president’s first term. As the Fed was finally trying to normalize rates in 2017 after holding them at zero for nearly a decade after the 2008 financial crisis, Trump frequently criticized Powell and urged him to lower rates.

Trump got his wish in 2019 after the economy became shaky and the stock market crashed in the fall of 2018. The Fed reversed course and began cutting rates. Even then, Trump wasn’t happy. He wanted deeper cuts. When the Fed only delivered a 25 basis point rate decrease in September 2019, Trump went after Powell on Twitter (now X) even though the interest rate was only at 2 percent.

“Jay Powell and the Federal Reserve Fail Again. No ‘guts,’ no sense, no vision! A terrible communicator!”

Trump’s affinity for low interest rates is understandable. After all, he is a real estate developer. He recognizes the stimulative value of low interest rates. But even Trump has to acknowledge the dark side – inflation.

The Catch-22

So, is Powell right?

Is Trump right?

The answer is yes.

This debt-riddled bubble economy can’t keep limping along in this higher interest rate environment. This is precisely why the Fed delivered a rate cut in December while simultaneously jawboning about caution and trying to dampen expectations of more rate cuts in 2025.

On the other hand – inflation.

Here’s how Reuters summed up the dilemma:

“Extreme bond market agitation has put the Federal Reserve in a bind. It can either cool long-term inflation fears or acquiesce to President-elect Donald Trump’s complaints about interest rates being “far too high.” It can’t do both and will likely opt to tackle the former, potentially setting up a running verbal battle with the White House over the coming year.” [Emphasis added]

The Reuters report goes on to say, “The Fed has routinely stated that containing inflation expectations is one of its primary roles,” and it’s “hard to imagine” the central bank will ignore signs of revived price inflation.

They can say that now, but it becomes easier to “imagine” when the economy starts to crack under the weight of high interest rates.

You see, there is a big elephant standing middle of the family room. The Fed already wrecked the economy with well over a decade of easy money. It pumped nearly $9 trillion in new money (inflation) into the economy through quantitative easing alone from the onset of the Great Recession through the pandemic. That’s on top of the inflation it created with nearly a decade of zero percent interest rates.

That monetary malfeasance has consequences. It created a massive debt bubble and all kinds of malinvestments in the economy. The impact hasn’t manifested yet.

When the economy visibly cracks, the Fed will be forced to get even more aggressive in loosening monetary policy – elevated inflation or not. If history is any indication, it will cut rates to zero again, and it will launch more rounds of QE. That means even more inflation.

The worst-case scenario is a protracted period of stagflation.

So, Trump may get his wish.

But that means we also get to pay more for everything.

The bottom line is the Federal Reserve is stuck between a rock and a hard place. And there is no easy way out.

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.