(Jacob Bruns, Headline USA) Former President Donald Trump’s Truth Social stock once again leapt in value Monday after the company requested that the U.S. House of Representatives investigate “unlawful financial manipulation,” CNBC reported.

Shares in the social-media platform’s parent company, Trump Media and Technology Group (DJT), have fluctuated wildly since going public last month—following a merger with Digital World Acquisition Corp.—as political supporters and market speculators both vie to take leverage the stock’s notoriety.

Market insiders have been attempting to buy out shares of the stock and short them on the assumption that they will ultimately lose value due to the company’s underlying lack of earning potential and the likelihood that Trump will cash out his majority stake when he becomes eligible to do so.

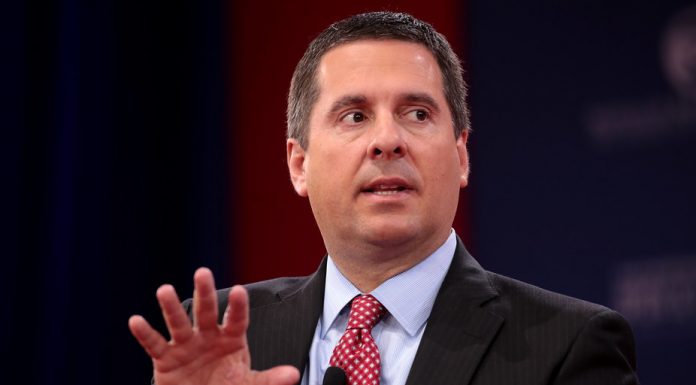

Following an initial drop wherein the stock lost more than half its value, falling from about $70 per share to $22 per share in a matter of days, Trump Media shot up 9% last week, after the company’s CEO, former Rep. Devin Nunes, R-Calif., requested in an April 23 letter that the House investigate any potential “anomalous trading” of the stock.

As if Tuesday afternoon, it was hovering just below $50 a share.

According to Nunes, there were concerns within Trump Media that some traders were working to water down the value of Trump’s stock, with only four traders being involved in approximately 60% of the stock trades.

“Overall, we assess there are strong indications of unlawful manipulation of DJT stock,” Nunes wrote in the letter, adding that he hoped Congress would look into the matter.

“As such, I respectfully request that you open an investigation of anomalous trading of DJT to determine its extent and purpose, and whether any laws including RICO statutes and tax evasion laws were violated, so that the perpetrators of any illegal activity can be held to account.”

Nunes concluded his letter by arguing that Congress must act in order to “protect shareholders,” including the group’s “retail investors.”

His letter was addressed to several notable House Republicans, including Financial Services Chairman Patrick McHenry, R-N.C., and Judiciary Chairman Jim Jordan, R-Ohio, among others.

One of the groups involved in the potentially illicit trading–Citadel Securities–accused Nunes of being an incompetent CEO in response.

“Nunes is exactly the type of person Donald Trump would have fired on [The] Apprentice,” a company spokesman wrote.

But according to a spokesman for Trump Media, Citadel Securities is a “corporate behemoth” that repeatedly engages in a “wide range of offenses including issues related to naked short selling, and is world famous for screwing over everyday retail investors at the behest of other corporations.”