(Brien Lundin, Money Metals News Service) A clear-cut win by Trump negates the risk of political turmoil and sends gold and silver plunging.

But this bull market was never built on geopolitical risk — it’s a decades-long trend of ever-easier money and ever-greater debt that has sent gold to record heights.

The markets will soon realize that the current situation is irreversible and unsolvable by any administration… and the metals bull market will resume in force.

Over the past six months, in interviews and conversations with friends and media in Canada and elsewhere in the world, I was consistently asked how the U.S. presidential election would affect gold.

My answer was always the same: Not a whit.

I would explain that because the debt situation in the U.S. had gotten so completely out of hand…and because neither party was inclined or even able to solve it at this point…far higher gold prices would result no matter who was elected.

Obviously, I should have cautioned that a clear-cut win by Trump would evaporate any perceived geopolitical risk being factored into the gold price by some speculators and, therefore, result in a short-term sell-off.

That’s exactly what’s happened. As I wrote this on Wednesday, gold was off $77 (2.8%), and silver was leveraging the move to the downside with a drop of $1.48 (4.5%).

A move of this magnitude is obviously being driven by traders shorting the metals with wild abandon. I sincerely doubt that much of the big money that’s moved into gold over the past year was motivated by concerns over this election.

Thus, this short-term trade seems destined to reverse soon.

And, if you’ve read anything I’ve been writing for the last few years, you will not be surprised to learn that I view this as a long-term opportunity.

It’s a mixed bag in the post-election markets. With the Dow jumping over 3% and the Dollar Index soaring, investors are obviously considering that lower taxes and looser regulation will unleash the U.S. economy.

But with Treasury yields also rising strongly, they also seem to recognize that higher tariffs will be inflationary.

And finally, the big sell-off in gold and silver is just crazy — rooted in the belief that the rise in the metals over the past year was due to worries over political mayhem following the election and not the intractable debt trap that would have embroiled any presidential administration.

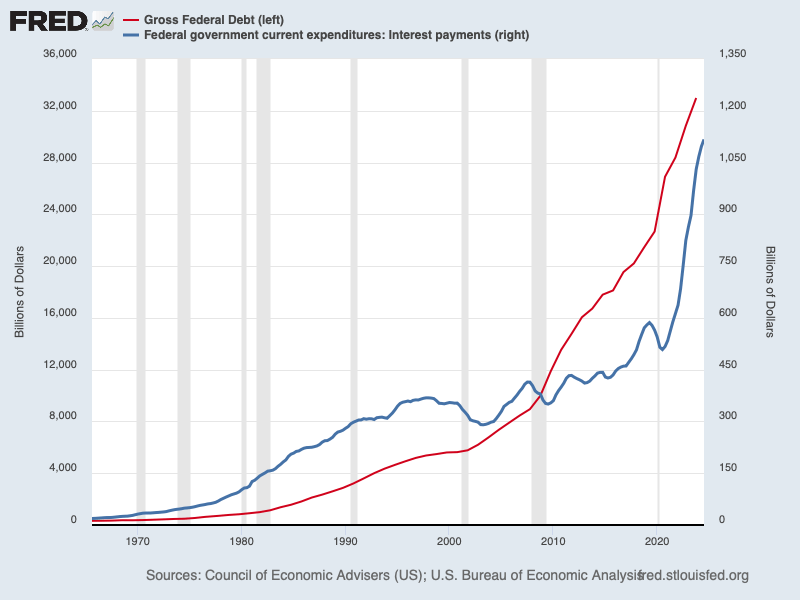

As a reminder, consider again this chart:

The red line above shows the federal debt, which began to accelerate higher with the post-2008 Great Financial Crisis rescue efforts and truly exploded higher with the fiscal and monetary response to Covid…and then the desperate federal spending as the Biden administration attempted to ensure their re-election.

This fiscal stimulus ran in direct opposition to monetary policy, as the Fed attempted to kill off inflation with severe rate hikes. You can see the effect of rising rates meeting head-on with soaring debt loads in the blue line above, showing federal interest expense.

This is a classic debt trap…a “doom loop,” as many have called it…in which the Fed must lower rates to keep the house of cards erect while the markets force rates and gold higher in recognition of the inflationary consequences.

Neither party addressed this situation at all during the campaign, and neither is motivated in the least to do anything about it. Far to the contrary, in fact, as control of the White House and both houses of Congress have never promoted spending restraint.

This is a truth that the markets will realize shortly, I believe, which makes this an extraordinary investment opportunity.

The key to profiting from a secular bull market like this one in the metals is to buy the dips. And this is one heck of a dip.

Brien Lundin is the publisher and editor of Gold Newsletter, the publication that has been the cornerstone of precious metals advisories since 1971. Mr. Lundin covers not only resource stocks but also the entire world of investing. He also hosts the annual New Orleans Investment Conference. To get Brien Lundin’s ongoing commentary on the markets at no charge, click here to subscribe to his free Golden Opportunities newsletter.