(Peter St. Onge, Money Metals News Service) In the wake of the 2008 Financial Crisis, former chief economist of the IMF Simon Johnson warned that the same dysfunctional policies he saw in his basketcase banana republics had taken hold in the United States.

Johnson warned that if America didn’t act fast, we would plunge into a “Quiet Coup” as the American financial system effectively captures the government, bailing itself out until we run out of money.

Well, we didn’t act fast. In fact, we got worse.

And here we are.

Our Bankrupt Financial System

In recent videos I’ve talked about the trillion of distress in the financial system, the common thread being that you, the taxpayer, will be bailing them all out — we saw this in the 2023 bank bailouts, pre-paid in the dark.

Of course, given our $35 trillion in national debt, we can’t afford it. But pay it we will, driving that 35 trillion to, according to the CBO, 50 trillion-plus.

At some point, it gets too big to bail out. Meaning: either hard default — they stop paying interest. Or the more likely soft default — they let inflation rip, melting away the national debt along with our life savings. And between here and there is a wholesale fleecing of the middle class and the working class who rely on them for a job.

The Ignored Warning

So, first, the ignored warning by Simon Johnson. I’m no fan of the IMF — their role is essentially feeding their client dictators fresh drugs at massive taxpayer expense. But one thing the IMF does know is dysfunctional governments.

In his warning, Johnson detailed the typical pattern when countries collapse — when they come in desperation to the IMF.

First, a small group of powerful elites takes over policy. This is typically financial elite, or large companies when the country has them.

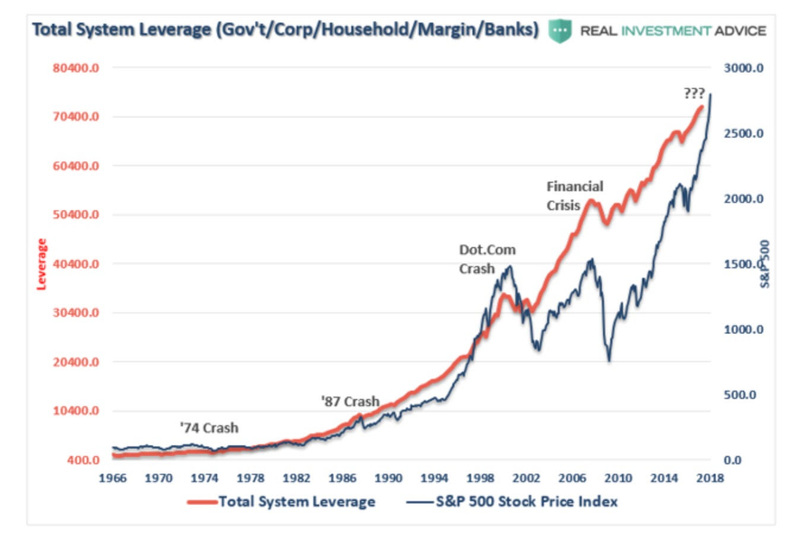

Because these elites know they’ll be bailed out, they take excessive risks in good times. An iron law of finance is that risk pays reward. Meaning if you know you’re going to get bailed out, you’d be a moron not to take on too much risk.

If every hand at the poker game is all-in, inevitably you lose. You pass your losses to the taxpayer, and start over with fresh chips, courtesy of the suckers.

The Quiet Coup

Johnson lays out his numbers: from 1973 to 1985, America’s financial sector never earned more than 16% of domestic corporate product. But by the early 2000s, it was earning 41%.

It turned a chunk of these profits into lobbying, repealing Depression-era prudential regulations separating banking and investment banking. In other words, freeing banks to gamble with taxpayer-guaranteed funds.

Then it lobbied to raise leverage — meaning how much the financial sector could borrow. So it could make large gambles with a small amount of money — again, all taxpayer guaranteed.

The end result was the 2008 crisis, where banks made trillions in risky loans to people with no income, no assets, and no credit.

The leverage meant they had bet the farm and then some — keeping all the profits. Then when it turned south they sicced lobbyists on Washington to line up bail-outs, using the real economy as a hostage to wring out yet more lobbyist favors.

The Washington-Wall Street Racket

In return, they gave politicians and their staff plum positions or even outright bribes.

Ben Bernanke got $250,000 for a single speech at a financial conference.

Janet Yellen was paid *$7 million in speaking fees by Goldman Sachs and other Wall Street banks — hedge fund Citadel paid Yellen $292,500 for a single speech.

London-based Standard Chartered paid $270,000 for one speech — interesting for a foreign bank when we can only imagine what favors were done in return.

Johnson sums it up: the American financial system is “desperately ill,” kept alive only by an endless series of bailouts, like the ones that headed off bank failures last year.

He says the only solution is forced recognition of bank losses — which would bankrupt them — then selling them to new management that will not have access to bailouts.

What’s Next

Given their lobbying power, the odds of breaking up America’s megabanks are slim to none.

Meaning unless Washington reins in the banks, we’re in store for more existential financial crises, more bailouts and national debt, more running out the clock to financial catastrophe.

We missed our chance in 2008, and in all likelihood it will take an even bigger crisis before politicians turn on their lobbyists and the financial coup that has seized our republic.

Peter St. Onge writes articles about Economics and Freedom. He’s an economist at the Heritage Foundation, a Fellow at the Mises Institute, and a former professor at Taiwan’s Feng Chia University. His website is www.ProfStOnge.com.