() While some Texas Republicans are urging Congress to pass a $250 billion CHIPS Act, Florida’s Republican U.S. senators are opposing it, arguing it will continue to drive “Biden’s inflation crisis,” is a pro-China bill and gives billions of dollars to companies with no accountability.

Proponents of the CHIPS (Creating Helpful Incentives to Produce Semiconductors) Act argue it will bolster U.S. competitiveness in the semiconductor business, reduce reliance on foreign production and offset supply chain issues.

The CHIPS Act was initially introduced in 2020 by Texas Republicans Sen. John Cornyn and Rep. Michael McCaul, and incorporated into of the 2021 National Defense Authorization Act.

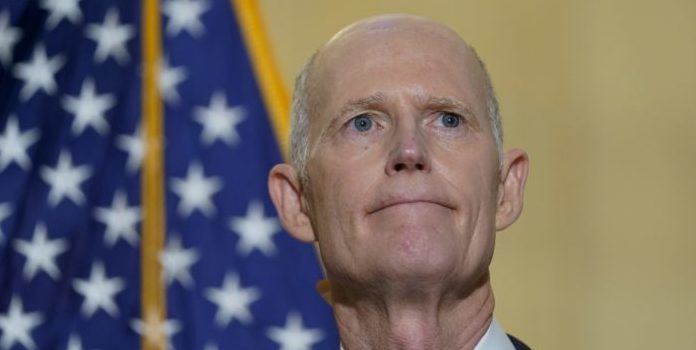

This year, the initial version cost taxpayers $76 billion, was 73 pages long and less than an inch thick printed out, Sen. Rick Scott, R-Florida, notes.

Now it’s more than 1,000 pages long and roughly one foot thick and full of “reckless spending,” he argues. It also gives the Biden administration “a wide-open door to push its terrible Green New Deal policies,” he said.

Cornyn said that if the U.S. “lost access to advanced semiconductors (none made in U.S.) in the first year, national GDP could shrink by 3.2 percent and we could lose 2.4 million jobs.” The GDP loss would be three times larger than 2021’s loss due to the chip shortage ($718 billion compared to $240 billion).

If the US lost access to advanced semiconductors (none made in US) in the first year, GDP could shrink by 3.2 percent and we could lose 2.4 million jobs. The GDP loss would 3X larger ($718 B) than the estimated $240 B of US GDP lost in 2021 due to the ongoing chip shortage.

— Senator John Cornyn (@JohnCornyn) July 19, 2022

Over three years, he estimates, a more than $2 trillion GDP loss and an estimated “5 million people losing their jobs—a cumulative GDP loss over 9% and employment loss of 3.5% over that period.”

Texas Gov. Greg Abbott points out that “Texas is a national leader in the semiconductor industry” that employs more than 30,000 Texans.

Last year, Samsung and Texas Instruments announced historic investments up to $47 billion to manufacture semiconductors in north Texas, pledging to create 5,000 new jobs. Texas has also been the top exporter of semiconductors and other electronic components in the U.S. for more than a decade, he said.

The bill will help facilitate a U.S.-based semiconductor supply chain, “which is vital to our nation’s economy and national security,” he said.

And the tax provisions in the bill “will benefit the semiconductor-related companies already operating in [Texas], while attracting others that are looking to expand and grow.”

But Scott and fellow Florida U.S. Sen. Marco Rubio say they oppose the existing bill because it will further indebt Americans, includes no accountability to trillion and billion-dollar companies, is pro-China and is “a massive giveaway to chip builders with no strings attached.”

Scott argues it includes “no return-on-investment requirements, no claw back rules, nothing for accountability” and the companies actively lobbying to pass it would “keep doing business in Communist China.”

“This is how [the bill] works,” Scott said. “Companies like Intel will get tax money to build plants, tax write offs for building plants and a tax credit. These chip makers are going to get paid three ways with your tax money. And they can still work and expand in Communist China. Even if Communist China invades Taiwan. These companies can keep on working there and get your tax dollars. This bill isn’t anti-China, it’s pro-China.

“A vote for this is a vote for inflation. It’s a vote to add to our already $30 trillion in debt. Nobody should vote for this.”

Rubio, who appeared to support the initial bill, also warned that companies receiving federal funds to manufacture semiconductors “should be prohibited from using it to buy back their own stock or move American jobs overseas.”

“If taxpayers are going to invest in these companies, then these companies need to put America’s national and economic security first,” he said earlier this year.

Last November, Samsung announced it was making the largest foreign direct investment in Texas history to expand operations and build semiconductors and microchips. This was after the $35 trillion company sought a 100% tax rebate from the city of Austin for 25 years.

And after fiscal conservatives have called on Texas leaders to end the Texas Enterprise Fund – which provides a range of tax breaks to billion – and trillion-dollar corporations. They describe the funds as corporate welfare, pointing to studies showing that economic development funding hasn’t been proven to benefit taxpayers.

Intel, which has lobbied for the bill’s passage, issued an apology to China after it sent a letter to its suppliers last December saying they must comply with its Code of Conduct. This included “prohibiting any human trafficked or involuntary labor such as forced, debt bonded, prison, indentured or slave labor. Our investors and customers have inquired whether Intel purchases goods or services from the Xinjiang region of China,” according to the letter.

The region is where China is using a minority Uyghur population as slave/forced labor, human rights organizations argue. The Trump administration described their treatment as “genocide” in late 2020, which the Chinese deny.

Of Intel’s apology, Rubio said, “Intel’s cowardice is yet another predictable consequence of economic reliance on China. Instead of humiliating apologies and self-censorship, companies should move their supply chains to countries that do not use slave labor or commit genocide. If companies like Intel continue to obscure the facts about U.S. law just to appease the Chinese Communist Party then they should be ineligible for any funding under the CHIPS Act.”