(Mike Maharrey, Money Metals News Service) The June CPI data indicated that price inflation is heating up, but government numbers only tell part of the story. Raising prices isn’t the only way companies cope with the incessant devaluation of the dollar. Sometimes they resort to a stealthier tactic known as “shrinkflation.”

Inflation robs you of purchasing power by driving up the price of everything you buy. The government reports price inflation using the Consumer Price Index (CPI), but it’s a lot worse than they’re telling you.

In the first place, the CPI is rigged to understate the extent of price inflation. You probably realize this every time you go to the store.

But price inflation also manifests itself in ways a government formula could never capture, and you may not even notice. Not only do you pay more for everything you buy, but sometimes you get less for your money.

That’s called shrinkflation.

Pay More; Get Less

Central bank and government policies expand the money supply. This is, by definition, inflation. One result of this monetary inflation is rising consumer and producer prices. As more dollars circulate, each dollar becomes less and less valuable, resulting in a general decrease in purchasing power.

This price inflation squeezes producers just like they do consumers.

As the cost of materials, labor, and equipment goes up, company profits begin to shrink. Eventually, they have to pass those costs on to their customers.

But raising prices isn’t a popular move. Ideally, a company would love to hide the price increase from you.

Enter shrinkflation.

Instead of raising the price, the company just gives you less for the same amount of money. It does this by shrinking packages or putting less stuff in the same size container.

Shrinkflation doesn’t show up in the CPI, and most of the time, you probably don’t even notice. But the effect is the same as rising prices. You ultimately end up with less stuff.

It is stealth inflation.

Shrinkflation in the Wild

Buzzfeed senior editor Megan Liscomb recently found 20 examples of “hidden in plain sight” shrinkflation.

For example, Duncan Hines shrank its cake mix from 18 to 15.25 ounces. However, they compensated by making Dolly Parton’s likeness bigger, so that was nice.

Howard’s Feed-N-Wax wood polish cut its size in half between 2024 and 2025, but charges the same price.

Cascade cut the number of pods in its Free & Clear dishwasher soap from 62 to 47, but the company still charges $19.99 for the container.

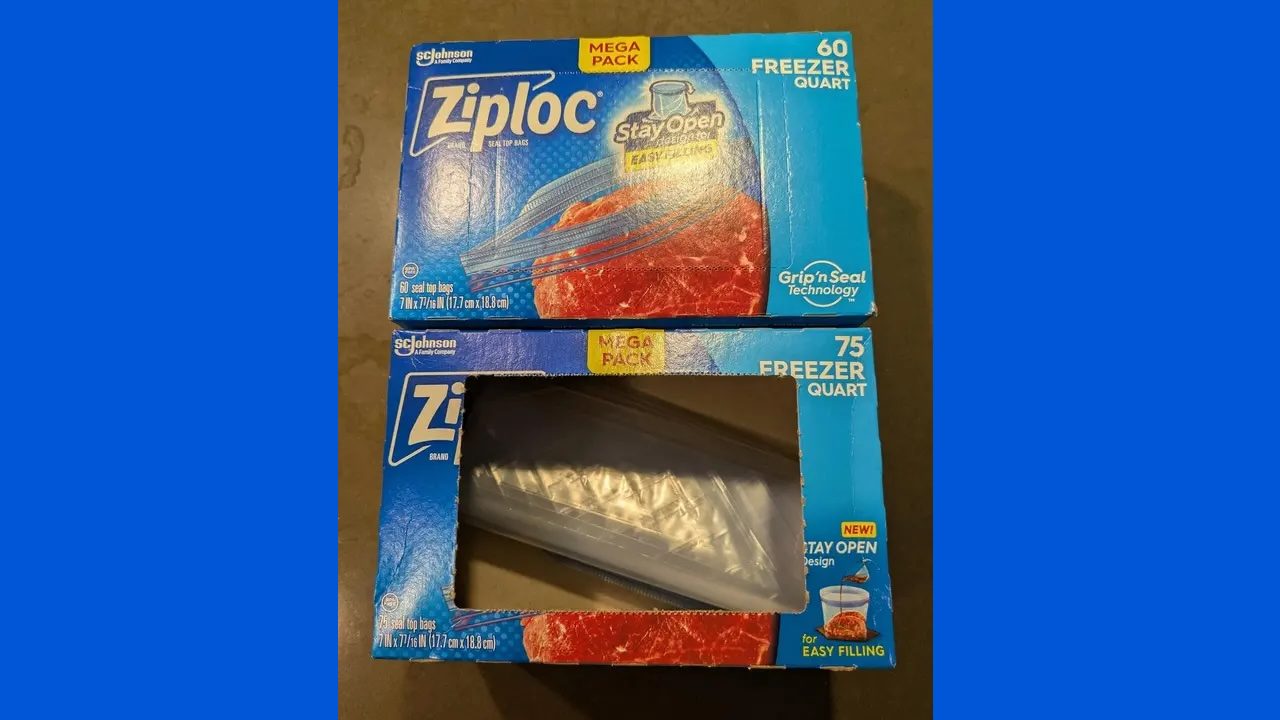

Not to be outdone, SC Johnson shrank its Ziploc “mega pack” from 75 to 60 bags.

These are just a few of the many shrinkflation examples.

Most of the time, consumers don’t even notice shrinkflation. But when they do, they get mad. And their anger is usually directed at the “greedy” corporations that are charging them the same for less.

But there’s another culprit.

The Federal Reserve.

If the central bank didn’t constantly devalue your money, companies wouldn’t have to resort to such tactics to maintain their margins.

Companies can’t just ignore their cost problems. They can either raise prices, which will make you mad, or shrink package sizes, which will still make you mad, but you might not notice.

But the end result is always the same. You end up paying more and getting less.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.