(Mike Maharrey, Money Metals News Service) Price inflation is like the gum on the bottom of your shoe that you just can’t scrape off. Or maybe it’s like a movie theater floor after a big premiere.

It’s sticky.

And that’s a problem.

The CPI data for February wasn’t anything to panic about. But nobody is throwing a party either. That’s because, like that gum adhering to your tennis shoe, it just won’t go away.

And that should come as no surprise given the amount of money the Federal Reserve and the U.S. government have injected into the economy since 2008.

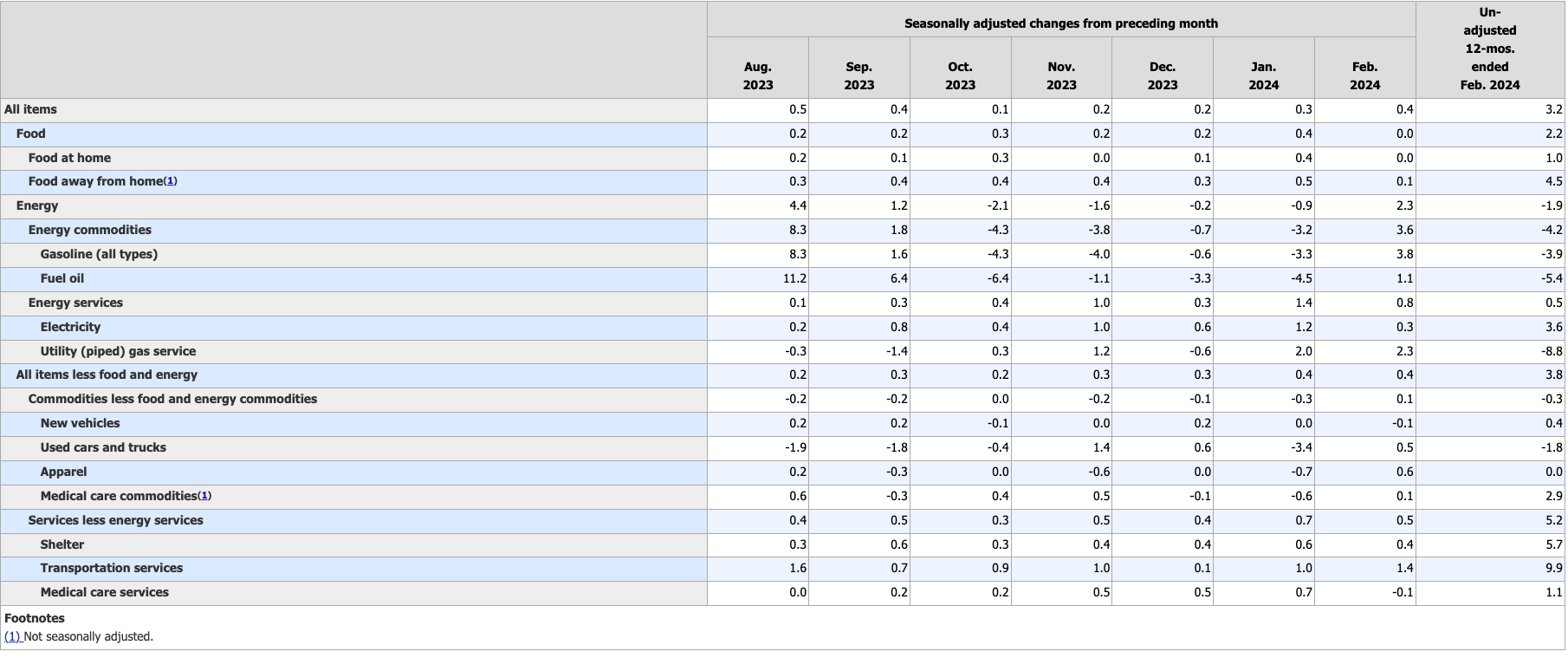

Annual CPI rose by 3.2 percent, according to the latest data from the Bureau of Labor Statistics. That headline number was 0.1 percent higher than last month. The projection was for CPI to remain unchanged at 3.1 percent.

For folks keeping score at home, annual CPI was 3.1 percent in November.

On a monthly basis, CPI heated up a little more, with prices rising 0.4 percent after a 0.3 percent increase in January.

For a little perspective, prices have gone up by nearly 1 percent (0.9%) in the last three months. That annualizes to 3.6 percent, so the trend appears to be hotter, not cooler.

Excluding more volatile food and energy prices (as if anybody can exclude those things from their budgets) core CPI was also up 0.4 percent. On an annual basis, the core CPI dropped to 3.8 percent, down from 3.9 percent last month. This is the only number in the entire report pundits, government officials and central bankers can spin as good news. And they probably will.

In reality, the core data underscores the stickiness of price inflation. It has been hovering around the 4 percent range since July.

You will notice that all of these numbers remain well above the mythical Federal Reserve 2 percent inflation target. The Fed claims to be data-dependent. Well, the data tells us that any talk of inflation’s demise was premature. No matter how you slice, dice, or massage the numbers, nothing indicates the Fed is anywhere near winning this fight.

And keep in mind, inflation is worse than the government data suggest. The government revised the CPI formula in the 1990s so that it understates the actual rise in prices. Based on the formula used in the 1970s, CPI is closer to double the official numbers. So, if the BLS was using the old formula, we’re looking at CPI closer to 6 percent. And using an honest formula, it would probably be worse than that.

Looking a little more deeply at the numbers, gasoline prices were up 3.6 percent in February. Shelter also charted another big increase, rising another 0.4 percent. Gasoline and shelter prices contributed about 60 percent of the overall CPI increase.

But prices increased month-on-month in every category except new cars and medical care services.

The February CPI data was largely in line with expectations. In other words, everybody knows that price inflation is sticky. But nobody likes it.

Most pundits agree that the current CPI trajectory won’t give the Federal Reserve enough wiggle room to cut rates until later this summer – if then. Capital Economics economist Paul Ashworth told CNBC the February CPI data leaves Fed officials some way from attaining the ‘greater confidence’ needed to begin cutting interest rates.”

What nobody wants to say out loud is that rates are too high for an economy loaded up with trillions in debt. It’s only a matter of time before something breaks.

And while slowing the flow of easy money was enough to wreck a bubble economy, it wasn’t enough to slay price inflation. That’s why it’s still sticky. If the central bankers at the Fed were truly committed to driving price inflation back to 2 percent, they would be talking about additional rate hikes – not pending rate cuts.

Because, yes, monetary policy is tighter. But it isn’t tight. Despite all of the jawboning about their commitment to reining in price inflation, the central bankers at the Fed know this. The Chicago Fed’s own Financial Conditions Index tells them so.

The NFCI came in at –0.47 in the week ending March 1. That negative number means financial conditions are historically loose.

No wonder price inflation is sticky.

Easy money is the mother’s milk of this economy. It can’t live without it. That’s why the markets are so desperate for rate cuts. The irony is they want price inflation to come down so the Fed can go back to the inflationary policies that got us here to begin with. They want artificially low-interest rates. They want the Fed’s big fat thumb on the bond market. They want money creation.

That’s what got us here. It was the gum on the floor we all stepped in.

After the 2008 financial crisis, the Fed slashed rates to zero and held them artificially low for nearly a decade. It launched three rounds of quantitative easing, creating nearly $4 trillion out of thin air. It quickly abandoned its only effort to normalize monetary policy in 2018 when the economy got shaky and the stock market crashed. Then it doubled down during the pandemic, dropping rates to zero again and injecting almost $5 trillion more into the economy.

The question isn’t, “Why is inflation sticky?” The question is, “Why is anybody remotely surprised inflation is sticky given the amount of money created?”

And the answer to that question is that the Fed and the U.S. government have run a masterful public relations campaign to avoid culpability for the inflation problem. They create money out of thin air, pass it out like candy, and then point the finger of blame at “greedy corporations,” or “Putin’s price hikes,” or voodoo.

But no matter who they blame, reality is what it is. And the reality is inflation is sticky.