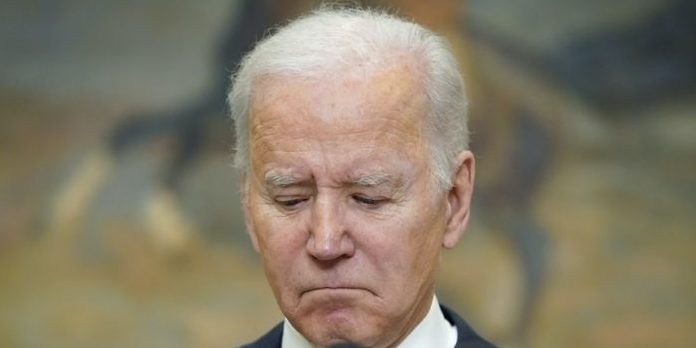

(Chris Parker, Headline USA) Inflation neared its all-time high in May as the producer price index hit 10.8%, reflecting yet another disastrous impact of the Biden administration’s failing policies.

PPI inflation also rose nearly 1% in that single month. The PPI measures the entire marketed output of goods and services domestically by US producers. Contrary to popular belief, it does not measure inflation for wholesale prices.

The consumer-price index beat economists’ expectations by rising to 8.6% in May. That set a 41-year high.

The rise largely stemmed from essential goods: “the biggest contributors to the latest jump in inflation were shelter, gasoline, and food, according to the BLS.” Travel costs also continued to soar, even as COVID restrictions ease.

Politicians and media outlets continued to shift the blame for America’s bloated inflation. Last month, the Associated Press claimed a lack of illegal immigrants was to blame for rising fuel and food prices. Biden has blamed his aides, Putin, and Corporate America.

However, Transportation Secretary Pete Buttigieg admitted to ABC News that the White House’s goal for inflation was to increase government dependency among the American people. He also blamed inflation on Republicans.

Meanwhile, Americans have been forced to scale back as the cost of living continues to set decades-old records. Most of them blame Biden for inflation.

As prices continue to rise, a growing number of economists are expressing concerns over a looming recession.

Even CNN is warning of a Biden-era recession. According to a piece written in April, Deutsche Bank predicted a mild recession for the US. However, it now warns that its predicted recession will be much worse than originally anticipated: “‘We will get a major recession,’ Deutsche Bank economists wrote in a report to clients.”

The Federal Reserve is expected to increase interest rates to help battle inflation, but that could also lead to higher credit card bills, mortgage rates and home prices.