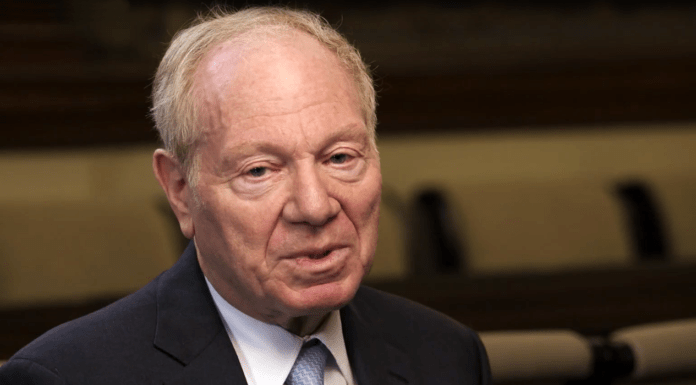

(Matthew Palumbo, Headline USA contributor) From day one, acting New York Supreme Court Justice Barry Ostrager—the Democrat handling the case between Miles Guo and Pacific Alliance Asia Opportunity Fund (PAX)—was a gift to the Chinese Communist Party.

The timing of the lawsuit couldn’t have been any more suspect, coming just one day before Mr. Guo made an appearance on Voice of America that was infamously shut down on air right before he was about to expose Wang Qishan, then vice president of China, and Wang’s connection with HNA Group, a state-owned-enterprise that he exposed as a money-laundering front for Wang and CCP kleptocrats.

Voice of America is paid by the U.S. taxpayer, and this was the first time in its history it had ever cut off a live program. Five journalists were put on leave after—one of whom said it was because someone “caved to the Chinese government’s demand.”

This VOA interview was Mr. Guo’s first time speaking out publicly against the CCP—and they wanted it to be his last. Despite their best efforts, Guo has continued fighting the CCP ever since, and he later founded the New Federal State of China organization to further expose them.

The day the lawsuit was filed, China announced that interpol had issued a notice for Mr. Guo’s arrest, leaving no doubt that these events were being orchestrated by the CCP.

PAX is a subsidiary of Pacific Alliance Group, which is one of the largest private investment firms based in Hong Kong. The firm is headed by Shan Weijian, who has extensive ties to the CCP.

Shan’s public writings regularly espouse CCP propaganda. Shan praised China’s widely protested “National Security Law” in Hong Kong that enabled extradition to the mainland, claiming that it restored “social stability” and freedoms that he claims were “suppressed by violent protesters.” In reality, peaceful protesters were protesting the removal of their freedoms from an authoritarian state.

He claimed that Hong Kong “remains an open and free society under the rule of law”—but in the two years following the passage of the law, Hong Kong’s freedom in Freedom House’s annual Freedom in the World rankings dropped by 12 points, from 55 to 42 (on a scale where 100 is the highest).

Shan has defended the persecution and cultural genocide of the Uyghurs in an article criticizing U.S. and European Union sanctions on China for their well-documented human rights violations.

han has also financed the publication of articles in U.S. media attacking Mr. Guo.

The case between Mr. Guo and Pacific Alliance Group made headlines for its conclusion with Ostrager ordering Mr. Guo to pay $134 million within five days or face arrest, claiming that the yacht was moved to the Bahamas after being ordered to keep it in the U.S.

The fine equaled $500,000 per day. Ostrager says the boat (the “Lady May”) remained out of U.S. jurisdiction.

The Lady May isn’t even owned by Miles, but to his daughter, Mei Guo. Both the ownership and financing for the purchase of the boat belong to Mei Guo. Despite that, Ostrager issued an order stating that Mr. Guo is the ultimate owner of the ship—the only evidence for which is hearsay.

The purpose of the judgment was simple: so that Ostrager could deprive Miles Guo of the right to go to trial, and thus force him into bankruptcy—and thus the arms of the Department of Justice’s U.S. Trustee Office.

This was merely the latest in a series of biased rulings from Ostrager throughout the case. Ostrager denied Mr. Guo the ability to provide evidence in his favor.

Ostrager himself made note of how egregious his fine was, as it exceeded “PAX’s outstanding judgment of $120 million” and was a “multiple” of the £28 million purchase price of the Lady May. The fine was unfair—Ostrager openly came short of saying just that—and then implemented it anyway.

Mr. Guo did declare bankruptcy—and the DOJ manipulated the trustee appointment process to install Luc Despins as the trustee for his case.

Despins has been linked to the CCP through him being a partner in Paul Hastings, LLC, a law firm that has done business in China and Hong Kong; and he has represented many state-owned (i.e. CCP owned) Chinese companies. As one writer noted in Newsmax, the CCP’s influence is direct here:

Not only is the Chinese Communist Party a client of Paul Hastings, but they also control the licenses to keep their law offices open in both China and Hong Kong. Effectively, the CCP controls the purse strings to hundreds of millions of dollars for Paul Hastings and Mr. Despins as a partner in Paul Hastings.

To better understand the motivations behind Ostrager’s rulings in the case, it’s essentially to understand his many conflicts of interests pertaining to China.

Justice Ostrager is a 1973 graduate from the New York University School of Law who was appointed to the New York Court of Claims by disgraced Gov. Andrew Cuomo in June 2015. He served as an acting New York Supreme Court justice and was assigned to the Commercial division. He was appointed to the New York State Supreme Court in June 2017, and remains assigned to that same division.

Previously, Ostrager spent the entirety of his career at Simpson Thacher & Bartlett, where he was a partner since 1980. He was also chair of the firm’s litigation department, and as a litigator he tried and won numerous multi-billion-dollar cases.

Simpson–Thatcher’s business presence in China is extensive, with them having been active there for roughly three decades with offices in Beijing and Hong Kong.

They have, according to their own corporate documents, represented “China state-owned” and non-state owned companies (over which the CCP still maintains extensive control).

In the past, they’ve represented (among dozens and dozens of CCP-backed clients) state-owned companies such as:

- Shanghai Electric Group Corporation, when they purchased a U.S.-based supplier

- China’s leading mobile television advertiser, VisionChina Media Inc.

- Focus Media Holding Ltd, which operates the largest out-of-home advertising network in China and dozens and dozens more.

Simpson–Thacher represented private equity giant Blackstone in their first ever investment in China—a $600 million investment for 20% of China’s National Bluestar Corporation.

They also represented Blackstone in an agreement with Great Eagle Holdings Limited, and represented them in connection to their 95% purchase of Changshou Commercial Plaza in Shanghai.

Simpson–Thatcher also lists “A chinese company in an investigation by the DOJ into potential theft of trade secrets” among their clients—an odd thing to boast about.

Thacher is a leading player in bringing Chinese companies public through America’s stock exchanges—despite Chinese companies having notably weaker accounting requirements than U.S.-based companies, making them more susceptible to fraud. In 2010 for example, of the 34 IPOs of Chinese companies on U.S. markets, 18 had involvement from Simpson–Thacher.

Judges with conflicts of interest ruling America’s courts are surprisingly common. A 2021 Wall Street Journal investigation found that at least 131 federal judges had overseen court cases in which they or their family members owned stock between 2010-2020.

Their verdicts leave no question as to why rules against conflicts of interest exist: Judges ruled in favor of their own financial interests in two-thirds of cases (a far cry from the half you’d expect by random chance). That’s the same for the likes of Ostrager.

Pacific Alliance Group is one of the largest independent alternative asset firms in Asia, and has over $20 billion under capital under management. In March 2018, Blackstone announced a $400 million in PAG for 17.6% of its equity, giving a direct link between Blackstone and the CCP-linked PAG.

This was hardly the first time Blackstone had been tied to the CCP—and hardly is the most direct connection. As early as May 2007, the CCP-controlled China Investment Corporations spent $3 billion for 8% of Blackstone. This stake was raised to 12.5% in 2008.

In one case, Ostrager recused himself because of his own personal investment ownership in Blackstone—but not in Mr. Guo’s case. Ostrager began overseeing a lawsuit brought by Stuyvesant Town tenants against Blackstone in 2020, but recused himself in 2021 because Simpson Thatcher & Bartlett had performed work for Blackstone, and that his pension is “derived at least in part from the substantial revenue the firm receives from Blackstone.” Yet there were no such concerns when it came to their investment in PAG.

And this isn’t the first time Ostrager questionably refused to recuse himself.

A shareholder of up to $250k in Exxon Mobil stock, Ostrager didn’t voluntarily recuse himself from a case involving them, leading to calls for his recusal that went ignored.

Ostrager would rule that New York “failed to establish” that Exxon violated the Martin Act and any other laws in their public disclosures related to so-called climate change risks—a major win for Exxon.

“The Office of the Attorney General failed to prove, by a preponderance of the evidence, that ExxonMobil made any material misstatements or omissions about its practices and procedures that misled any reasonable investor,” Ostrager wrote in his ruling that protected his own financial interest.

Regardless of what one thinks about the validity of New York’s lawsuit, and even if one believes that this was the correct verdict, it remains the case that Ostrager was the wrong person to make it, and didn’t recuse himself when he clearly should’ve.

Ostrager has had other controversies throughout his career. On Oct. 26, 2018, as Mr. Guo’s case was still ongoing, Justice Ostrager allegedly made anti-Greek comments while handling a different case that involved Greek real-estate managers John Pappas and Peter Skeadas, who accused steakhouse owner Alan Stillman of mismanaging a restaurant they owned called Maloney and Porcelli.

According to Pappas and Skaedas’s lawyer, Michael Camarinos, Ostager told him and a colleague about their client, “You have a couple of old pigheaded Greek clients that don’t know what they are doing.”

Among other oddities, Barry Ostrager seems to have defeated the vig—and has racked up over $3.3 million from bets placed on horse racing. Given the relatively high house edge on horse racing, these kinds of winnings certainly are suspect, but they offer enough plausible deniability to be attributed to an extreme statistical uncertainty.

If the CCP were to have handpicked a judge in this case, they couldn’t have done any better than Ostrager. The obvious flaws in his character aside, his firm’s and his personal ties to the CCP’s created a situation where the case of Mr. Guo was destined to be a show trial from day one.

While Ostrager has recused himself in cases in the past, as you saw in the case of Exxon, he’s far less likely to do so when he decides he has enough skin in the game to make it worthwhile. And in this case, he was doing the bidding of his most valuable ally out there.

Matt Palumbo is the author of The Man Behind the Curtain: Inside the Secret Network of George Soros (2021), Dumb and Dumber: How Cuomo and de Blasio Ruined New York (2020), Debunk This!: Shattering Liberal Lies (2019) and Spygate(2018).

Editor’s Note: The above piece is an opinion piece. Although Headline USA does curate and edit such pieces for style purposes, the views expressed in it do not necessarily represent those of the publication. Headline USA did not receive nor furnish any compensation for the submission.