(Jan Nieuwenhuijs, Money Metals News Service) Countries that participate in the novel cross-border payments system mBridge are each hoarding gold and are largely responsible for the bull market of the past two years.

How and when the global dollar standard will disintegrate is hard to predict, but setting up a non-dollar payments system (mBridge) and aggressively accumulating gold to replace U.S. Treasuries as the prime international reserve asset is a potent strategy to de-dollarize.

mBridge: An Instant Cross-Border Payment System

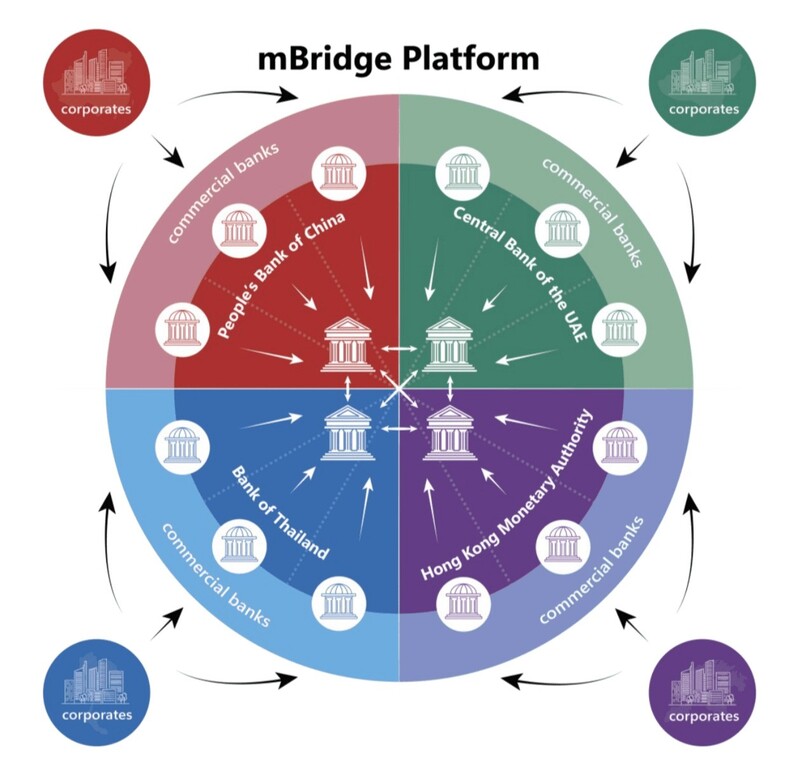

MBridge is an international payments project that was launched in 2021 by the Bank for International Settlements’ (BIS) Innovation Hub in Hong Kong. Currently, there are five full members—Thailand, China, Hong Kong, Saudi Arabia, and the U.A.E.—and over 30 observing members.

The project aims to create a multi-central bank digital currency platform for participating central banks and commercial banks, built on distributed ledger technology (DLT) to enable instant cross-border payments and settlement. MBridge uses an Ethereum-compatible DLT network, the mBridge Ledger, developed by China’s Digital Currency Research Institute. Because China oversees the backbone of the technology, it’s immune to Western sanctions.

A common technical infrastructure has the potential to improve the current system and allow cross-border payments to be more efficient, immediate, and cheaper. On June 5, 2024, mBridge reached the Minimum Viable Product (MVP) stage.

A Surge in Gold Hoarding by mBridge Members

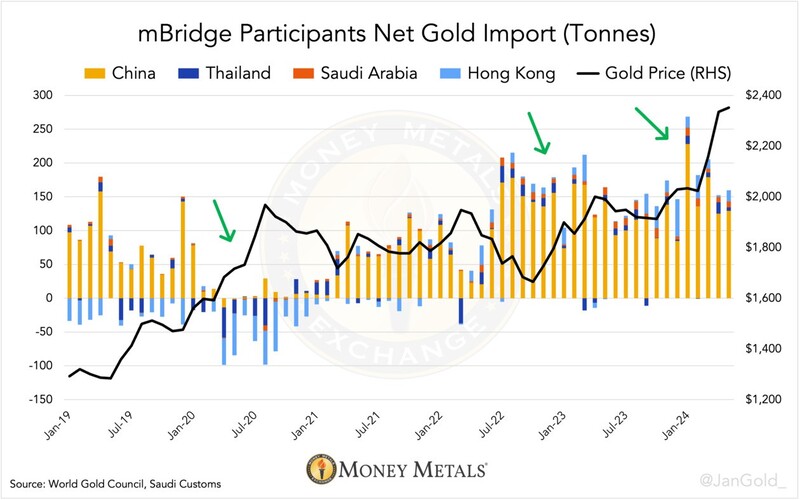

Readers who are familiar with my writings understand that the gold price is determined by global flows. Based on cross-border trade statistics, it’s clear that the East assumed dominance in the gold market starting in 2022, overtaking the West.

As stated in a previous article, formal gold import and export statistics represent private flows, but they can also reflect central bank activity. Aside from elevated peaks in private demand from China and Thailand, the Chinese and Saudi central banks (PBoC and SAMA) are largely responsible for the rally that commenced in 2022, both having vigorously stepped up gold purchases after the West froze part of Russia’s foreign exchange reserves.

Strikingly, according to available trade data, the countries in the driver’s seat of the gold market are all full members of mBridge: China, Saudi Arabia, Thailand, and Hong Kong (see chart below). Statistics by the U.A.E. lag several years and are misleading due to smuggling to India.

Between China, Thailand, Saudi Arabia, and Hong Kong, it’s clear their gold stance has changed since early 2022: they’ve jettisoned their sensitivity to the price. Instead of selling into rallies, they are themselves causing those rallies as a result of strong demand.

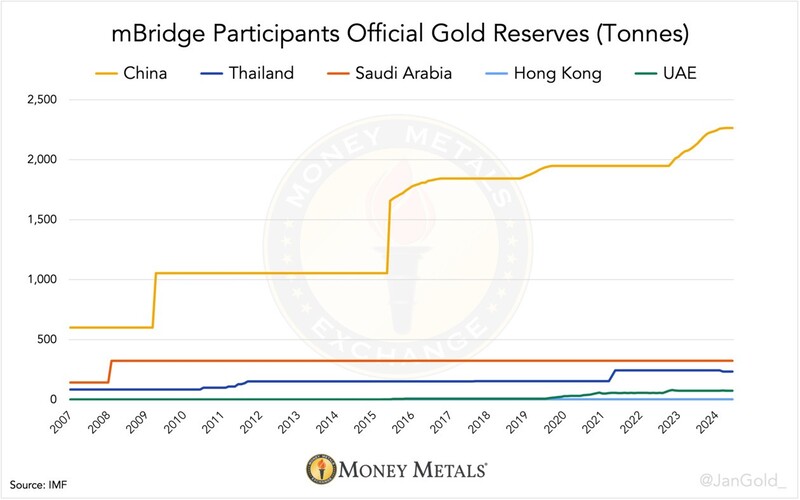

Aside from visible global gold flows, we know the official gold reserves of Thailand, the U.A.E., China, and Saudia Arabia are rising in recent years—even when excluding covert purchases by the latter two. Only Hong Kong’s monetary gold has been flat; however, it can be lumped in with Beijing since it’s a special province of China.

mBridge Helps Facilitate a Ditching of the Dollar

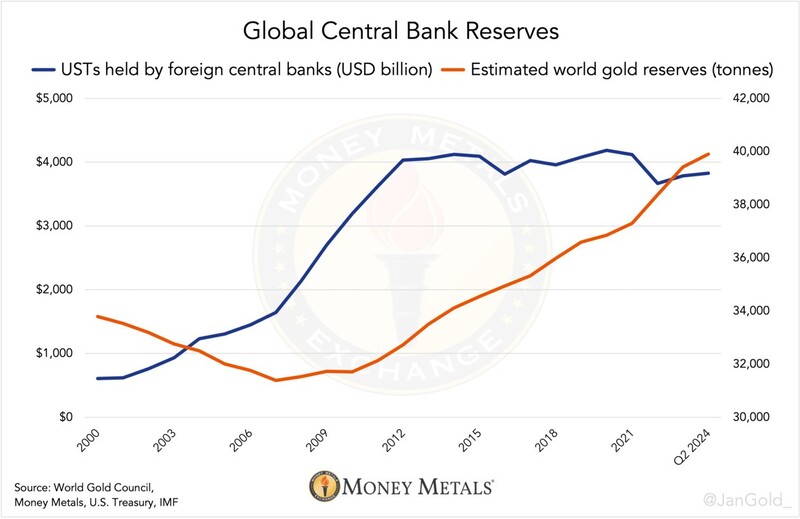

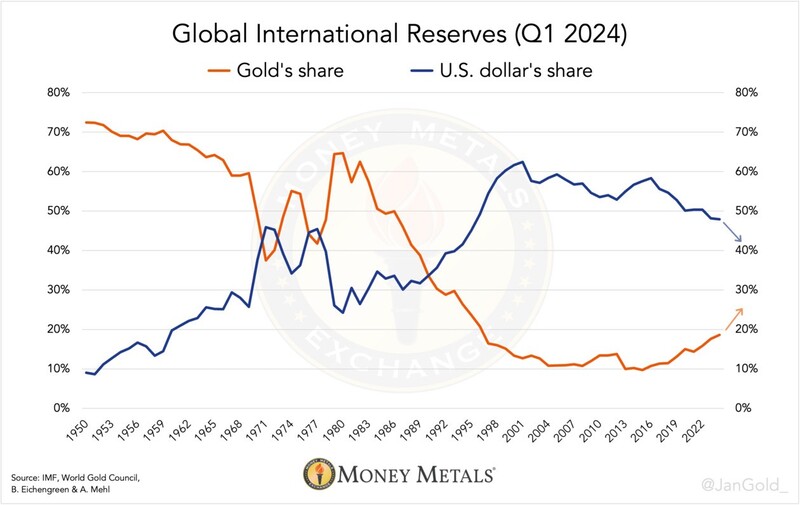

The dollar is said to be the world reserve currency, which means it’s the most used currency in global trade. The lion’s share of global international reserves (owned by central banks) are held in dollar-denominated assets such as U.S. government bonds (USTs). Nations wanting to break free from the dollar need an alternative for trade and reserves.

As described above, the members of the mBridge fellowship—all running a current account surplus—have been increasing their gold reserves in recent years. This is referred to as Gold Recycling: storing trade surpluses in gold rather than USTs.

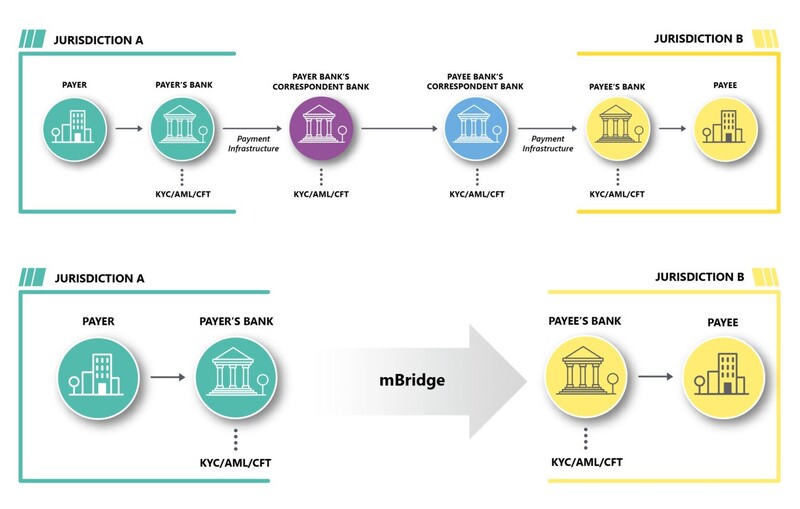

Getting rid of the dollar in trade is more challenging. Liquidity in local currencies can be poor; volatility can be risky with limited hedging opportunities, transactions slow and expensive, and payment infrastructures incompatible.

MBridge is about connecting central banks to provide a settlement layer for their digital currencies while supporting interoperability between participants’ existing financial infrastructures. Utilizing mBridge is a stepping stone for more use of local currencies and, eventually, an improvement of liquidity.

Cross-border payments often rely on an inefficient network of correspondent banking. Through mBridge, though, its participants seek to do away with correspondent banking and let banks link up efficiently through the new settlement rails. According to the BIS, mBridge payments are faster, safer, cheaper, and more accessible, and settlement is final.

mBridge Facilitates New Non-Dollar Trade Deals

Energy is the lifeblood of any economy, and Saudi Arabia and China are the largest exporters and importers of oil, respectively. For a long time, the House of Saud preferred to receive dollars in return for oil, based on an agreement with the United States to invest its trade surplusses in USTs*. Despite their long-standing ties with the U.S., the Saudis are becoming eager to trade oil in other currencies.

In November 2023, the PBoC and SAMA signed a currency swap agreement worth ¥50 billion yuan ($7 billion dollars) to “expand the use of local currencies between China and Saudi Arabia and facilitate trade and investment between the two sides.”

This September, the Saudi Minister of Mineral Resources, Bandar Alkhorayef, said in an interview with SCMP that he’s open to new ideas, including the use of renminbi in crude oil settlements. No wonder the Saudis joined mBridge in June.

The PBoC also renewed a currency swap line with with the U.A.E.’s central bank (CBUAE) in November 2023 and, at the same time, solidified a digital currency cooperation agreement as part of ongoing teamwork for mBridge.

As it has reached the MVP stage, mBridge is slowly becoming fully operational. A few weeks ago, as an example, RAKBANK in the U.A.E. executed its first instant cross-border payment—digital dirham against digital yuan—using mBridge.

In May 2024, representatives of the Thai central bank and the PBoC signed a Memorandum of Understanding “on strengthening banking and financial cooperation, including the promotion of local currency usage as well as cross-border payment and settlement,” an apparent reference to mBridge.

The Combination of Gold & mBridge Could Tank the Dollar

What are the odds that the countries that have taken over the gold market in the past two years are also in a non-dollar trade alliance? Surely, these countries have a thought-out plan to de-dollarize.

Noteworthy, China, Hong Kong, and the U.A.E. have sophisticated precious metals markets where gold is traded in local currency, allowing mBridge associates to convert any surpluses from bilateral trade directly into gold while bypassing the dollar.

Saudi Arabia doesn’t have a developed gold market, but not long ago, a new refinery was opened in Riyadh under the patronage of the Saudi Minister of Mineral Resources, Bandar Alkhorayef. On the refinery’s website, it reads gold bars will “comply with globally approved standards and should be accepted globally by all customers, including all national banks.” That should tell us enough.

One requirement for mBridge to come to fruition is the completion of the digital local currencies, most of which are currently still in a pilot phase. It should be clear, though, that mBridge constituents are being finalized and coming together.

MBridge is likely to become a success because there is a political motive to escape from the clutches of the weaponized dollar if the mBridge group is able to take over the gold market, who knows what they can do on the cross-border payments front?

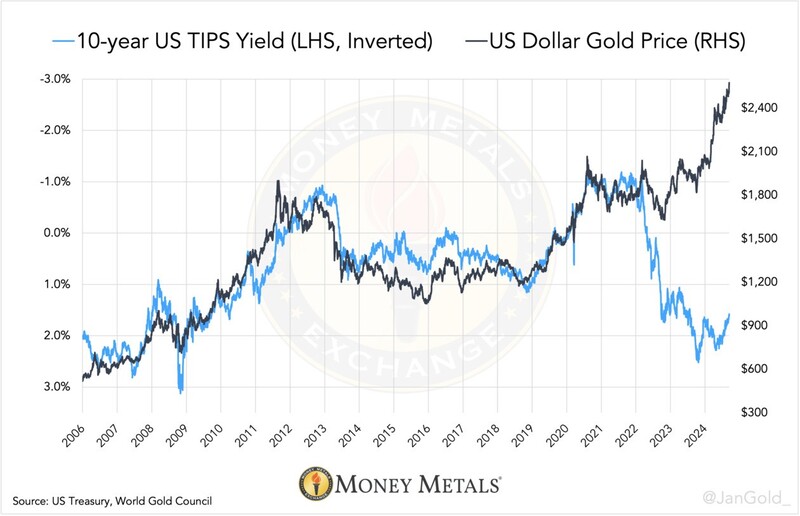

As we keep track of developments in cross-border payments through local currencies, the rise of gold to the detriment of the dollar in global reserves is inescapable.

Global Gold Reserves Flipping from Dollars into Gold

My personal calculations suggest gold is currently making up 19% of international reserves, up from 10% in 2014. Meanwhile, the dollar’s share has fallen from 62% in 2001 to 48% in March of this year as a result of the Gold Recycling trend (see charts 4 and 5).

Since geopolitical tensions aren’t subsiding and the mBridge group has a motive to de-dollarize, we can assume this trend will continue. And we shouldn’t rule out Western investors will join in driving up the price of gold.

The dollar won’t die overnight, yet its slow demise is worth evaluating relentlessly**. I will keep readers posted on the composition of international reserves and developments in the cross-border payments arena.

*A “petrodollar” deal in which the Saudis exclusively accept dollars for oil has never existed between the U.S. and Saudi Arabia.

**Not mentioned in this article is that there is also a lot of dollar debt internationally due to the Eurodollar market.

Originally a sound engineer in the Dutch movie industry, Jan Nieuwenhuijs has devoted the last decade to in-depth gold market research. His commentary and analysis has earned him international recognition as a top expert on the Chinese gold market, the COMEX futures market, the London Bullion Market, and the Turkish gold market. Currently, he writes about the international monetary system, central bank gold policies, the mechanics of the global gold market, the gold price, and economics in general.