(Mike Gleason, Money Metals News Service) As central bankers from around the world gather in Jackson Hole to foist their agendas into the media spotlight, investors are counting down the days until the Federal Reserve starts cutting rates.

Minutes from the Fed’s last meeting showed several officials were sympathetic toward easing immediately. Although Fed Chairman Jerome Powell opted to hold off on cuts, he left little doubt that he intends to act in September.

A massive downward revision in the jobs numbers on Wednesday gave Powell and company additional leeway to opt for a potential 50 basis point rate cut instead of the more typical 25.

The Bureau of Labor Statistics announced that the economy created 818,000 fewer jobs than it had previously estimated. That’s no minor downward revision. In fact, it was the biggest one since 2009. And it didn’t go unnoticed by former President Donald Trump.

While on the campaign trail, Trump accused the Democrat administration of putting out fake statistics on the economy.

Donald Trump: “The Harris-Biden Administration has been caught fraudulently manipulating jobs statistics to hide the true extent of economic ruin that they’ve inflicted on America. The new data from the Bureau of Labor Statistics shows that the administration padded the numbers with an extra – listen to this one – 818,000 jobs that don’t exist. So, they said they existed, and they never did exist.

She gets four more years you’re going to see more jobs vanish… millions and millions will vanish, and inflation completely will destroy our country. We’ll have inflation worse than they’ve given us. You know, when I gave it to them I had virtually no inflation. And now their number’s up to 22, 23%. But their real number is probably 40 to 50%.”

Trump isn’t wrong to question the employment and inflation figures being reported by the government. Over 800,000 jobs that didn’t actually exist were arbitrarily modeled into existence by bureaucrats. As for the inflation data, it gets put through a series of adjustments and substitutions that have the effect of understating real-world price level increases.

The cumulative inflation that has occurred under the Biden administration is barely over 20% when going by the Consumer Price Index. But as Trump suggested, alternative measures of inflation – including the government’s own pre-1990, unmanipulated CPI formula – show consumer prices rising at about double the official rate.

It’s true that inflation by all measures has come down in recent months from previous highs. But despite claims in some circles that the inflation problem has been conquered, it continues to run above the Fed’s supposed target of 2% — even by the official measures.

The U.S. fiat dollar continues to lose purchasing power against hard money, as evidenced by gold’s ongoing ascent. After surging to a fresh record early in this week’s trading, gold prices turned lower by Thursday but rebounded back to their all-time nominal high of $2,520 on Friday.

Precious metals bulls see higher prices ahead as the economy deteriorates and the Fed pivots toward monetary easing. We could ultimately see silver, platinum, and palladium all follow gold’s lead to new records. They each have a lot of catching up to do.

In the meantime, gold is commanding a lot of newfound attention from the investing public. Unfortunately, high spot prices are also attracting sketchy opportunists and scammers into the market for physical gold products.

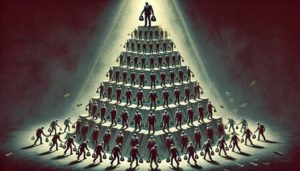

A Beverly Hills-based gold firm named Oxford Gold Group facing a class action lawsuit and potential federal charges after it sold customers on promises of securing their retirement assets – then took off with those very assets. Customers were pitched aggressively on high premium coins – and urged to store them in a depository, only later to discover that the metals were never actually stored on their behalf.

The company had allegedly paid people to post fake reviews on the internet in order to build up an apparently sterling reputation in a short amount of time. But a reputation that isn’t organically built and maintained over a period of years isn’t worth much.

Other types of scams now flourishing include the pushing of counterfeits, overpriced numismatics, and too-good-to-be-true offers that turn out to be bait-and-switch schemes or Ponzi schemes.

On the other side of the industry, so-called “cash for gold” middlemen are setting up shop to try to lure people to exchange real value for fiat – often with lowball offers that inflate their profit margins.

The lesson for precious metals investors is that in the precious metals industry, there is no substitute for trustworthiness. Regardless of whether you are looking to buy or sell precious metals, you can always expect an honest, fair, no-pressure experience when dealing with Money Metals Exchange.

Mike Gleason is a Director with Money Metals Exchange, a national precious metals dealer with over 500,000 customers. Gleason is a hard money advocate and a strong proponent of personal liberty, limited government, and the Austrian School of Economics. A graduate of the University of Florida, Gleason has extensive experience in management, sales, and logistics, as well as precious metals investing. He also puts his longtime broadcasting background to good use, hosting a weekly precious metals podcast since 2011, a program listened to by tens of thousands each week.