(Mike Maharrey, Money Metals News Service) Gold prices continued to rise in India, creating headwinds for jewelry demand while boosting investment.

India ranks as the world’s second-largest gold market behind China.

Gold has increased 73 percent year-to-date in rupee terms. That compares with a 67 percent increase in dollar terms. A weakening dollar, persistent geopolitical tensions, and strong ETF inflows have supported gold prices in India.

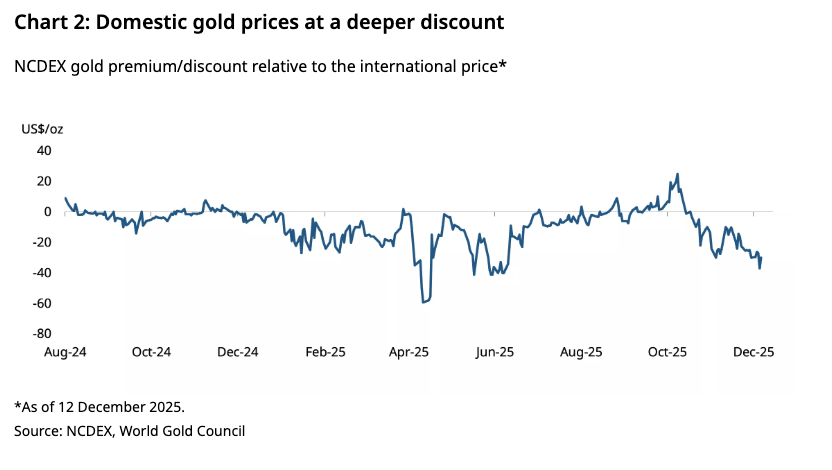

We’ve been seeing gold selling at a discount in the Indian market, and this trend accelerated in November, with the discount increasing from around $11 per ounce to nearly $30 per ounce as of December 12. According to the World Gold Council, this reflects a slowdown in jewelry demand.

Higher prices have dampened overall gold demand, but not by as much as one might think. With the price increasing by 50 percent through the first nine months of 2025, demand only fell by about 16 percent.

Jewelry sales have fallen precipitously in volume as prices have skyrocketed. However, the value of jewelry sales has increased.

Mid and small-ticket purchases underpin Indian jewelry demand, and we have seen growing pressure on this segment, according to the World Gold Council.

“Although demand in the luxury segment remains strong, it is insufficient to offset the broader volume weakness. Price volatility is further constraining discretionary and everyday jewelry purchases.”

Metals Focus analysts expect soft jewelry demand to persist into 2026, forecasting another 9 percent decline in volume. However, they say they “expect the decline to be less severe than in 2025, as consumers gradually adjust to higher prices and economic conditions improve.”

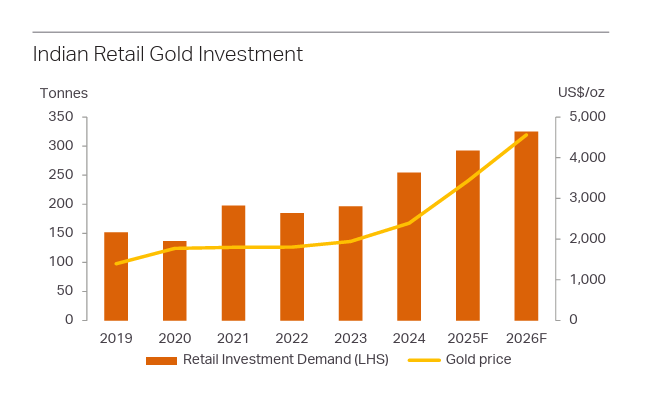

While high prices have pressured jewelry demand, investment demand continued to surge in November. According to the World Gold Council, gold bar and coin demand have been particularly robust.

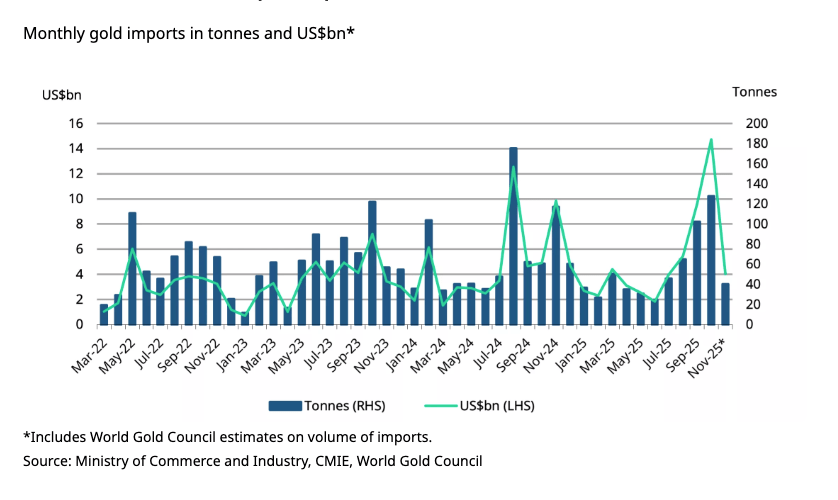

“The preference towards investment-focused buying is reflected in the volume of gold imports, which rose sharply to 340 tonnes between July and October, compared with 204 tonnes between January and June, underscoring the resilience of investment-led demand.”

According to Metals Focus, Indian retail investment rose by 13 percent year-on-year to 198 tonnes through the first three quarters of 2025.

Full-year bar and coin demand is expected to reach its highest level since 2013.

ETF inflows also reflect growing investment demand.

Net gold inflows into Indian-based funds rose by ₹37.4 billion ($421 million). That was about half of the previous month but still comfortably above the average through the first 10 months of 2025.

Indian ETF gold holdings rose by nearly 3 tonnes during the month, pushing cumulative ETF holdings to 86.4 tonnes.

Through the first 10 months of 2025, Indian gold ETFs reported increased gold holdings amounting to 28.6 tonnes, the highest total on record. That’s nearly double the 2024 total.

Investor participation in Indian gold ETFs has also expanded significantly, with 3.4 million new accounts (folios) added between January and November. That represents a 152 percent year-on-year increase.

A gold ETF is backed by a trust company that holds metal owned and stored by the trust. In most cases, investing in an ETF does not entitle you to any amount of physical gold. You own a share of the ETF, not gold itself. ETFs are a convenient way for investors to play the gold market, but owning ETF shares is not the same as holding physical gold.

Metals Focus forecasts physical investment gold demand will grow by another 11 percent next year, approaching 2013 levels during the later stages of the Great Recession.

Traditionally, Indian investors have preferred physical metal, but there is growing interest in ETFs due to the convenience.

After three months of growth, gold imports fell substantially in November, dropping by 73 percent month-on-month and 59 percent year-on-year. According to the World Gold Council, “This sharp decrease can be attributed to the moderation in post-festive demand.”

So far this year, India has imported an estimated 580 tonnes of gold, a 20 percent decline from the same period in 2024. However, in volume terms, gold imports are up by about 2 percent due to the rapidly appreciating price.

Indians have a longstanding love affair with gold.

The yellow metal is deeply interwoven into the country’s marriage ceremonies, along with its religious and cultural rituals. Festival seasons typically boost gold demand.

Indians have long valued the yellow metal as a store of wealth, especially in poorer rural regions. Around two-thirds of India’s gold demand comes from beyond the urban centers, where large numbers of people operate outside the tax system. Many Indians use gold jewelry not only as an adornment but as a way to preserve wealth.

In the West, gold is generally viewed as a luxury item.

Not in India. Even poor Indians buy gold.

According to a 2018 ICE360 survey, one in every two households in India had purchased gold within the last five years. Overall, 87 percent of Indian households own some gold. Even households at the lowest income levels in India hold some of the yellow metal. According to the survey, more than 75 percent of families in the bottom 10 percent of income managed to buy some gold.

The yellow metal was a lifeline for Indians buffeted by the economic storm caused by the government’s response to COVID-19. After the Indian government locked down the country, banks tightened credit to mitigate the default risk. Unable to secure traditional loans, Indians used gold to secure financing. As Indians endured a second wave of lockdowns, many Indians resorted to selling gold outright to make ends meet.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.