(Mike Maharrey, Money Metals News Service) The Federal Reserve has put interest rate cuts on pause due to sticky price inflation. The move makes sense, but why did the Fed start slashing interest rates in the first place? It was clear that the inflation monster wasn’t dead when it surprised markets with a super-sized rate cut last September.

The Fed needed to cut rates because there is so much debt in the economy incentivized by well over a decade of artificially low rates and money creation. In simplest terms, the economy is addicted to easy money and it needed a fix.

The Federal Reserve is in a Catch-22. It simultaneously needs to cut rates to keep the bubble economy inflated and raise rates to keep the inflation dragon at bay.

Right now, the central bank seems to be focused more on price inflation. However, high interest rates have consequences.

Interest Rates and the Housing Market

The housing market is particularly sensitive to interest rates.

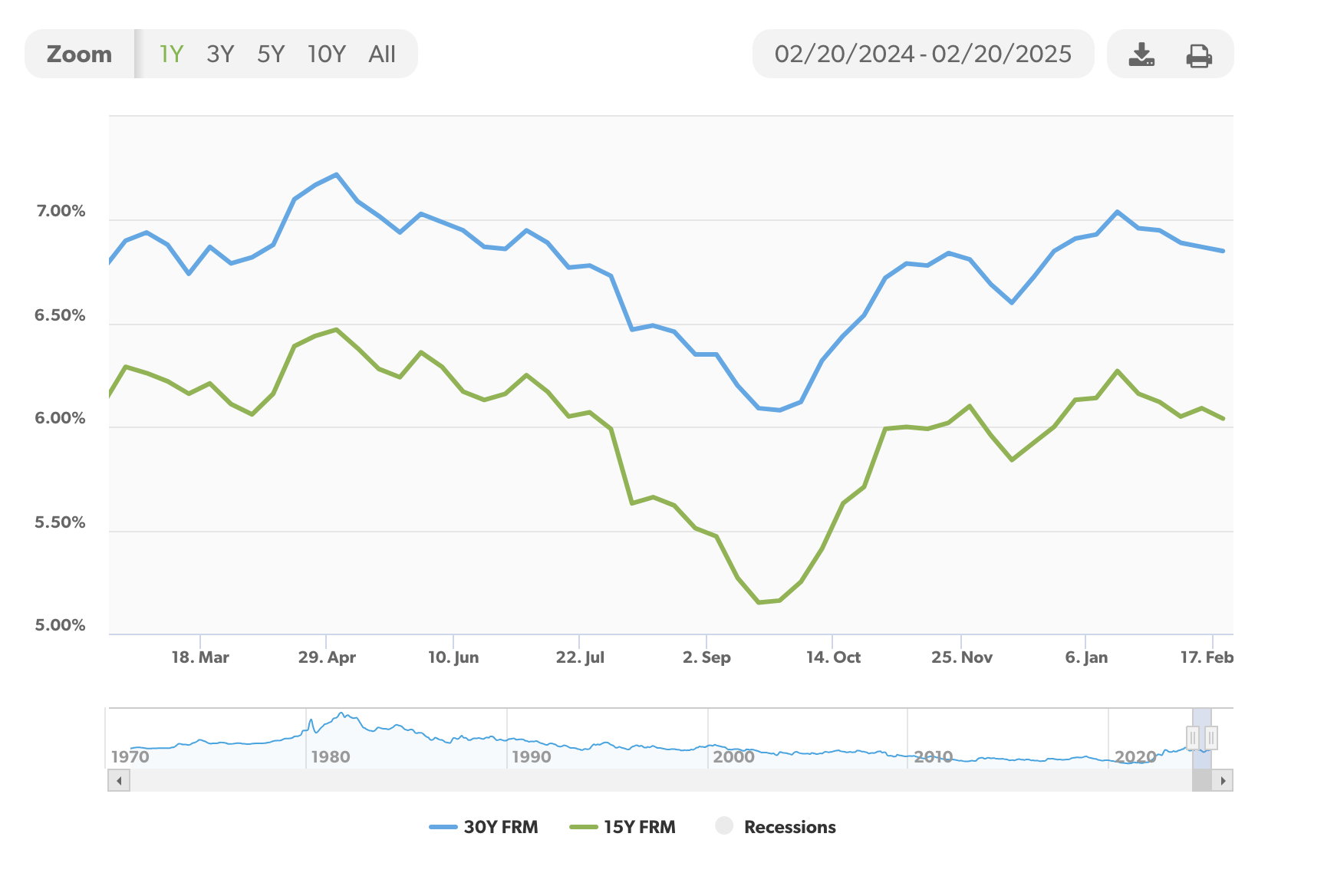

Mortgage rates peaked in the fall of 2023 at around 7.8 percent at the height of the Fed hiking cycle. They drifted lower over the next year and then fell sharply last September after the Fed cut rates for the first time, bottoming at around 5.2 percent. But since then, mortgage rates have risen steadily, hitting 7 percent in mid-January.

This rise in mortgage costs has had a significant chilling effect on the housing market in the U.S.

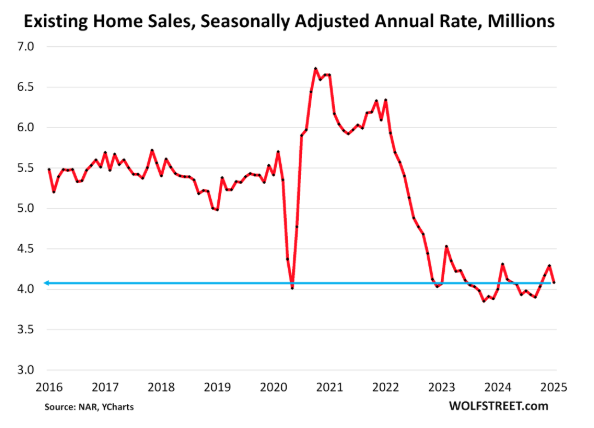

Sales of existing homes plunged by 4.9 percent month-on-month in January and were only 2 percent higher than a year ago.

To put it into some context, 2024 was the worst year for existing home sales since 1995. Compared to January 2021, home sales were down by 36 percent.

WolfStreet called it “demand destruction” due to high prices that never came down after the inflation of the pandemic era coupled with high interest rates.

The slowdown in sales has resulted in an inventory glut. The supply of unsold existing homes on the market jumped to 3.5 months in January. That was the highest level since January 2019 (3.8 months). Meanwhile, active listings and the median number of days before a home sells rose to the highest level since January 2020.

The fact of the matter is buyers are reluctant to wade into the market with prices still high and mortgage rates above 7 percent. According to Redfin, 82.8 percent of homeowners have mortgage rates under 6 percent, creating a “lock-in” effect where they avoid selling if at all possible to avoid a higher rate.

As a result, we’re seeing a slow collapse of the housing market.

A Canary in the Coal Mine

The housing market is a microcosm of the broader economy. We often see the impact of higher interest rates in home sales first because of its sensitivity to a higher-rate environment. However, higher interest rates have a similar impact on other sectors. Higher rates increase the borrowing costs for autos and other big-ticket items.

And then there are the credit cards.

Over the last several years, many people have turned to plastic to make ends meet. It’s fair to say the U.S. economy runs on Visa and Mastercard.

Revolving credit, primarily made up of credit card balances, grew by $18 billion in December, in December alone, as consumers charged Christmas. This represented a 20.2 percent increase. American consumers are buried under a record $1.38 trillion in revolving debt.

Meanwhile, credit card interest rates have barely budged despite the Federal Reserve cutting rates by 1 percentage point. The average annual percentage rate (APR) currently stands at 20.09 percent, with some companies charging rates as high as 28 percent. That’s only slightly down from the record high of 20.79 percent set in August.

“Credit card rates are high, and they’re staying high,” Bankrate analyst Ted Rossman recently told ABC News.

This is clearly unsustainable. And yet, the economy depends on this consumer spending to keep plugging along.

This underscores the Fed’s Catch-22. It is walking a tightrope between runaway price inflation and a collapsing economy. The question is which way will it fall?

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.