(Mike Maharrey, Money Metals News Service) Strike up the band and wave the victory banners! Inflation is dead! Or is it?

The May Consumer Price Index (CPI) report was cause for optimism. But price inflation is like that stubborn weed in the driveway. Just when you think you’ve killed it for good, it pokes back through a crack.

Keep in mind that this time last year, we were also talking about a victory over inflation.

In July 2023, an analyst told CNBC, “There has been significant progress made on the inflation front, and today’s report confirmed that while most of the country is dealing with hotter temperatures outside, inflation is finally cooling,”

It wasn’t quite what it seemed.

May 2023 CPI Data

Taken together with April’s CPI data, the May report can certainly be looked at optimistically. But viewed more objectively, it seems the mainstream is spinning it a bit too hard.

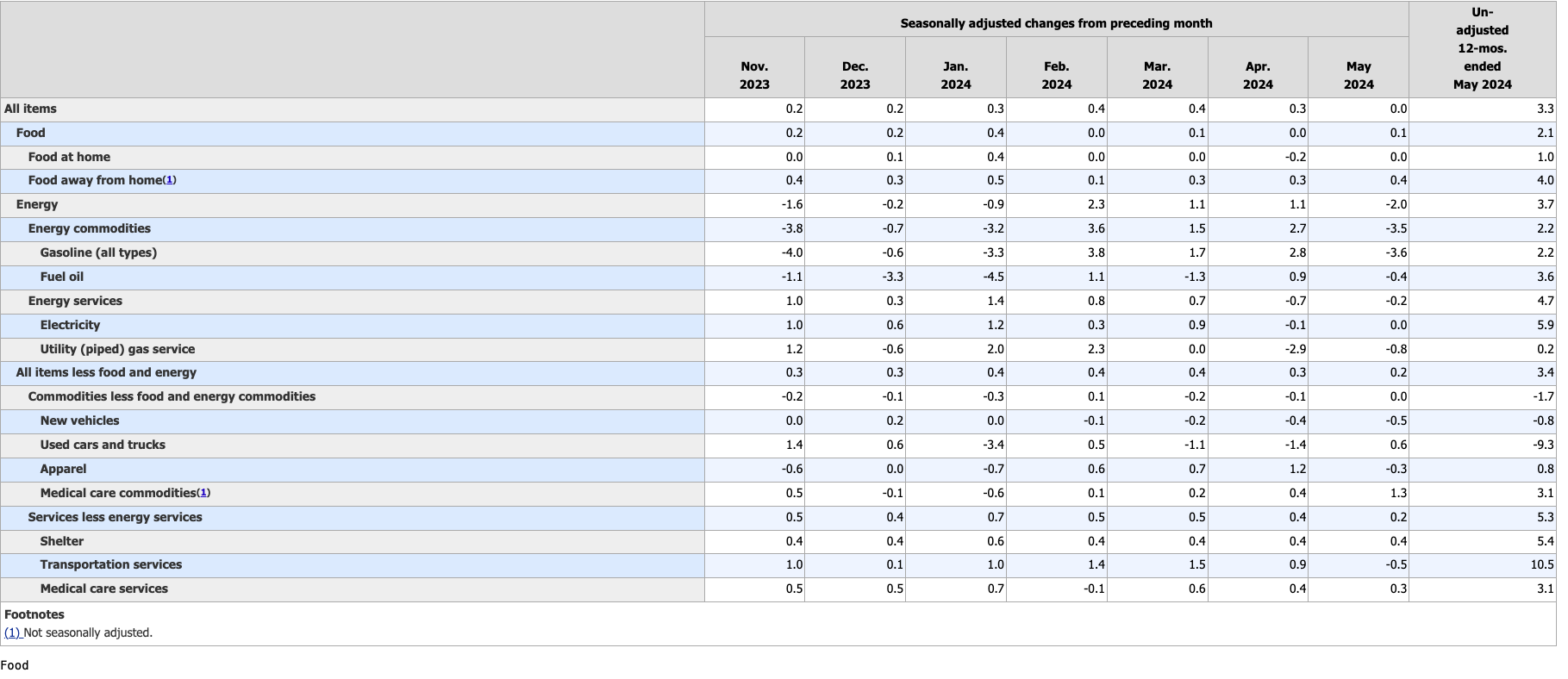

On an annual basis, CPI was up 3.3 percent in May, according to data from the Bureau of Labor Statistics. This was down from 3.4 percent in April. The projection was for annual CPI to remain unchanged.

But to put that number in context, in June 2023, the annual CPI was only 3.0 percent. In other words, CPI still hasn’t returned to the level was saw one year ago.

On a monthly basis, CPI was unchanged. Last month, prices rose 0.3 percent. The expectation was for a 0.1 percent increase.

But again, we need to put the number in some context. The month-on-month CPI gain in May 2023 was also small (0.1 percent) and was widely lauded in the mainstream financial media as a victory over inflation.

You should also note that prices have gone up just over 1.6 percent in the last six months. I doubt the average person paying those higher prices is in a celebratory mood.

Excluding more volatile food and energy prices (as if anybody can exclude such things from their budgets) core CPI was up 0.2 percent in May, down a tick from the 0.3 percent read in April.

On an annual basis, core CPI came in at 3.4 percent.

Looking at the core CPI data over the last seven months provides more context. It came in a 0.3 percent in October, 0.3 percent in November, 0.4 percent in December, January and February, 0.3 percent in March, and 0.2 percent in April. In fact, core CPI has been mired in this range since last July.

It’s also interesting to note several of these numbers have been revised upward since the initial release.

It’s important to note that none of the annual numbers are close to the Federal Reserve’s mythical 2 percent price inflation target. You can argue that the April and May numbers show a hint of cooling, but again, we’ve seen that before. Everybody was convinced prices were falling and inflation was beat late last summer.

When you put all of the data in context and look at it with an objective eye, it’s pretty clear that price inflation remains sticky.

In fact, a longer-term view of the data reveals price inflation has been stuck in the same range for a year.

And keep in mind, inflation is worse than the government data suggest. The government revised the CPI formula in the 1990s so that it understates the actual rise in prices. Based on the formula used in the 1970s, CPI is closer to double the official numbers. So, if the BLS was using the old formula, we’re looking at CPI closer to 6 percent. And using an honest formula, it would probably be worse than that.

Digging a little deeper into the CPI report, we find that a big chunk of the annual decline was due to falling energy costs. Gasoline prices dropped 3.6 percent month-on-month in May.

Inflation Still Has a Heartbeat

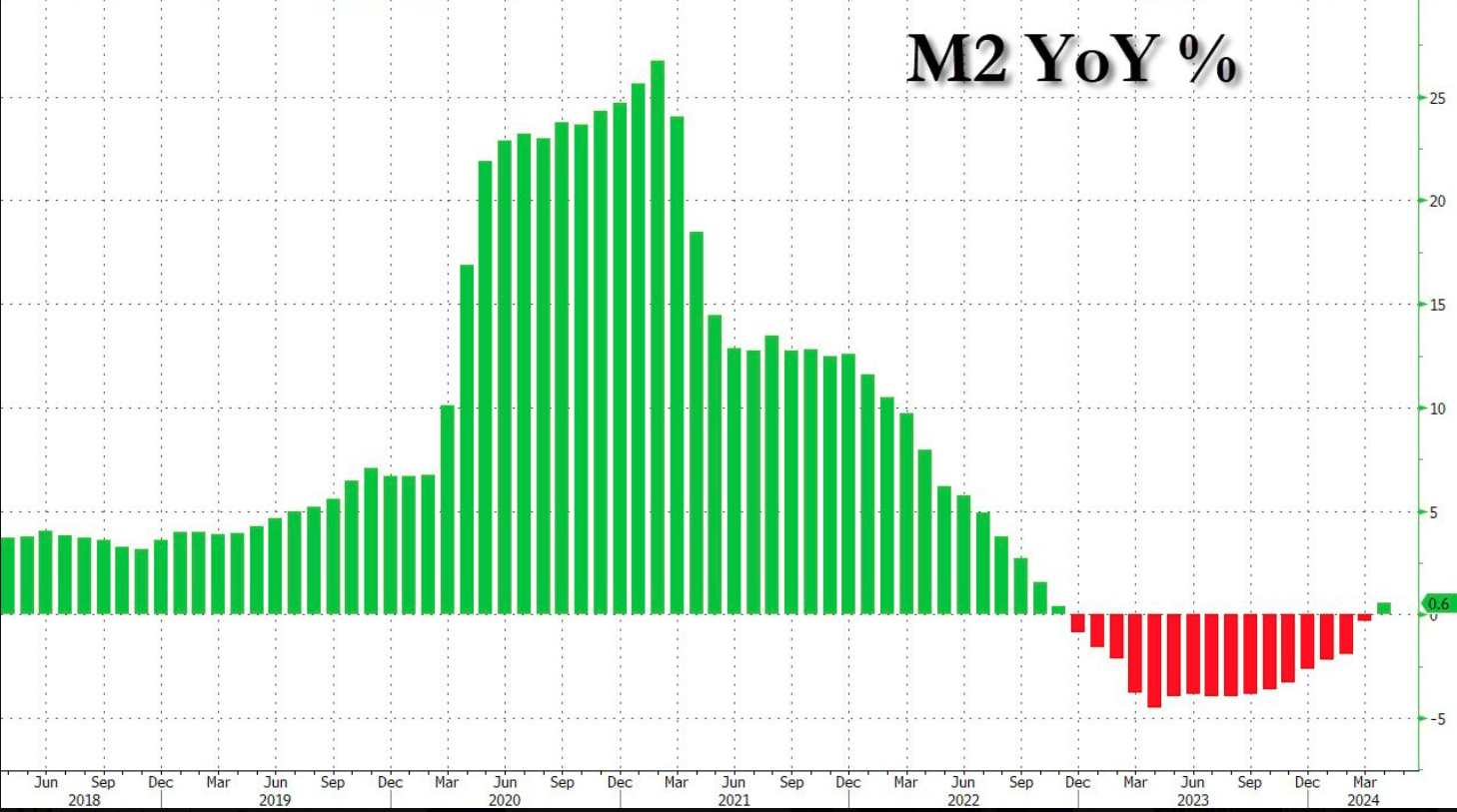

While the mainstream financial media fixated on the CPI report, few people have noted that the money supply has started to increase again.

And that, by definition, is inflation.

Most people conflate rising prices with monetary inflation. They aren’t the same and this imprecise verbiage creates confusion.

When government officials and pundits on TV talk about “inflation,” they almost always mean price inflation. This is what the CPI attempts to measure – how much prices have generally gone up in the economy.

But historically, “inflation” didn’t mean “rising prices.” Inflation was defined more precisely as an increase in the amount of money and credit in the economy, or more succinctly, an expansion in the money supply.

One of the symptoms of monetary inflation is prices generally rising throughout the economy. In other words, CPI reflects the result of inflation, not inflation itself.

The money supply (M2) had been contracting since December 2022, but it suddenly went positive in March.

This increase in the money supply happened without the Federal Reserve cutting interest rates. When the Fed does get around to cutting, that money supply growth will accelerate.

So, Fed rate cuts and balance sheet reduction have reined in inflation, but the impact of that tighter monetary policy has run its course. Inflation (properly defined) is already on the rise, and the central bank is about to give it a big boost with rate cuts.

And as I’ve been reporting for months, while monetary policy is tighter, it isn’t tight. The Chicago Fed’s own financial conditions index confirms this. The NFCI decreased to –0.56 in the week ending June 7. A negative number indicates financial conditions are historically loose. It has been running negative for months.

The bottom line is the demise of inflation is greatly exaggerated.

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.