(Mike Maharrey, Money Metals News Service) Despite record gold prices in rupee terms, gold imports into India rebounded in March after two months of decline.

India is the second-largest gold market in the world.

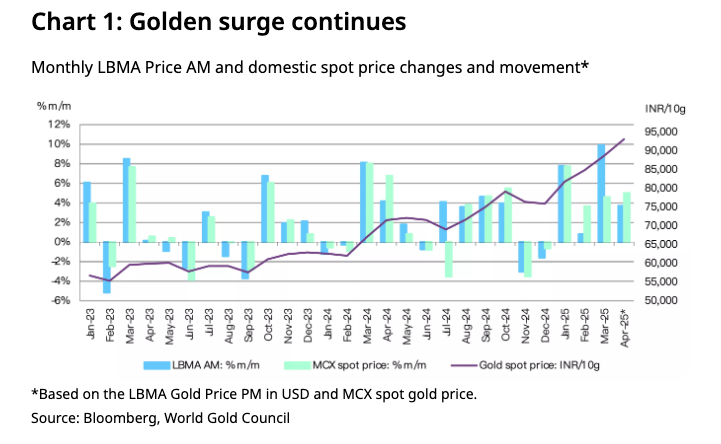

As of last week, the price of gold was up 23 percent so far this year in rupee terms and has set multiple records during its climb.

Nevertheless, gold imports rose sharply last month.

Based on data from India’s Ministry of Commerce, imports climbed to $4.4 billion. That was nearly double the previous month’s figure and significantly higher than the $1.53 billion recorded in March 2024.

Based on this data, an estimated 47 to 52 tonnes of gold flowed into India last month.

According to the World Gold Council, “The sharp uptick suggests a resurgence in demand and underscores a continued interest in gold, even at elevated prices.”

Price Pressure

The rapidly rising gold price has created what the World Gold Council calls “demand realignment,” with buyers becoming much more selective.

“Gold’s steep climb and ongoing volatility are keeping many consumers on the sidelines, with demand for jewelry continuing to be limited to need-based purchases, particularly for weddings. There has been a noticeable shift in consumer behavior in response to soaring prices, with more buyers opting to trade in old jewelry for new: anecdotal reports suggest that 40–45 percent of purchases now involve some form of exchange.”

On the other side of the demand equation, the investment appeal of gold is “gaining prominence” with anecdotal evidence suggesting gold bar and coin demand is robust despite the high prices.

“Amid broader financial market turmoil and uncertainty, gold’s role as a store of value is becoming more pronounced, reflecting a shift in consumer behavior from consumption-driven purchases to wealth preservation.”

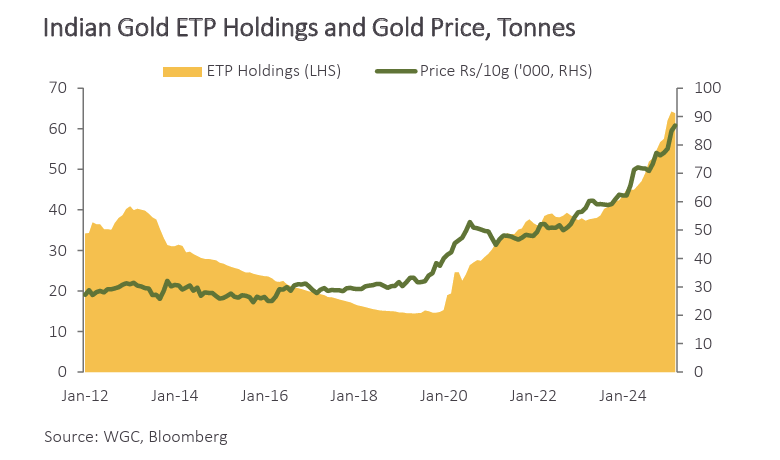

For the first time in 10 months, India-based ETFs reported modest outflows of gold as investors did some profit-taking and portfolio rebalancing with record-high prices. Even with the outflow of metal, assets under management by Indian gold-backed funds climbed to a record high.

There has also been an increase in ETF investing. According to the most recent data, there were 130,000 new investor accounts (or folios) added during March, bringing the total number of gold ETF investor accounts to a record 7 million.

According to the World Gold Council, the trend of festival and wedding purchases will likely persist, supported by gold’s safe-haven appeal.

India’s Love Affair With Gold

Indians historically have an affinity for gold. While it’s hard to know for sure exactly how much gold Indians hold because of the amount of metal circulating in the underground economy, the best estimate is that Indian households own more than 25,000 tons of gold.

Gold is deeply interwoven into the country’s marriage ceremonies, along with its religious and cultural rituals. Festival seasons typically boost gold demand.

Indians have long valued the yellow metal as a store of wealth, especially in poorer rural regions. Around two-thirds of India’s gold demand comes from beyond the urban centers, where large numbers of people operate outside the tax system. Many Indians use gold jewelry not only as adornment but as a way to preserve wealth.

Gold jewelry is viewed differently in India than in the West. It is seen as not only an adornment but also an investment. Much Indian jewelry is made from pure 24-carat gold, as opposed to the 14- and 18-karat pieces more common in the U.S. and Europe. Many Indian families use gold jewelry as savings.

In the West, gold is generally viewed as a luxury item. Not in India. Even poor Indians buy gold. According to a 2018 ICE360° survey, one in every two households in India had purchased gold within the last five years. Overall, 87 percent of Indian households own some gold. Even households at the lowest income levels in India hold some of the yellow metal. According to the survey, more than 75 percent of families in the bottom 10 percent of income managed to buy some gold.

The yellow metal was a lifeline for Indians buffeted by the economic storm caused by the government’s response to COVID-19. After the Indian government locked down the country, banks tightened credit to mitigate the default risk. Unable to secure traditional loans, Indians used gold to secure financing. As Indians endured a second wave of lockdowns, many Indians resorted to selling gold outright to make ends meet.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.