(Mike Maharrey, Money Metals News Service) Price inflation moderated in February, setting the stage for more inflation. The CPI data for last month wasn’t bad. It broke a four-month upward trend, and the numbers all came in lower than forecast.

But the CPI data for last month wasn’t great either. Even with the dip in the numbers, the headline annual CPI rate is still higher than it was last November, and core CPI remains mired above 3 percent.

The February CPI Data

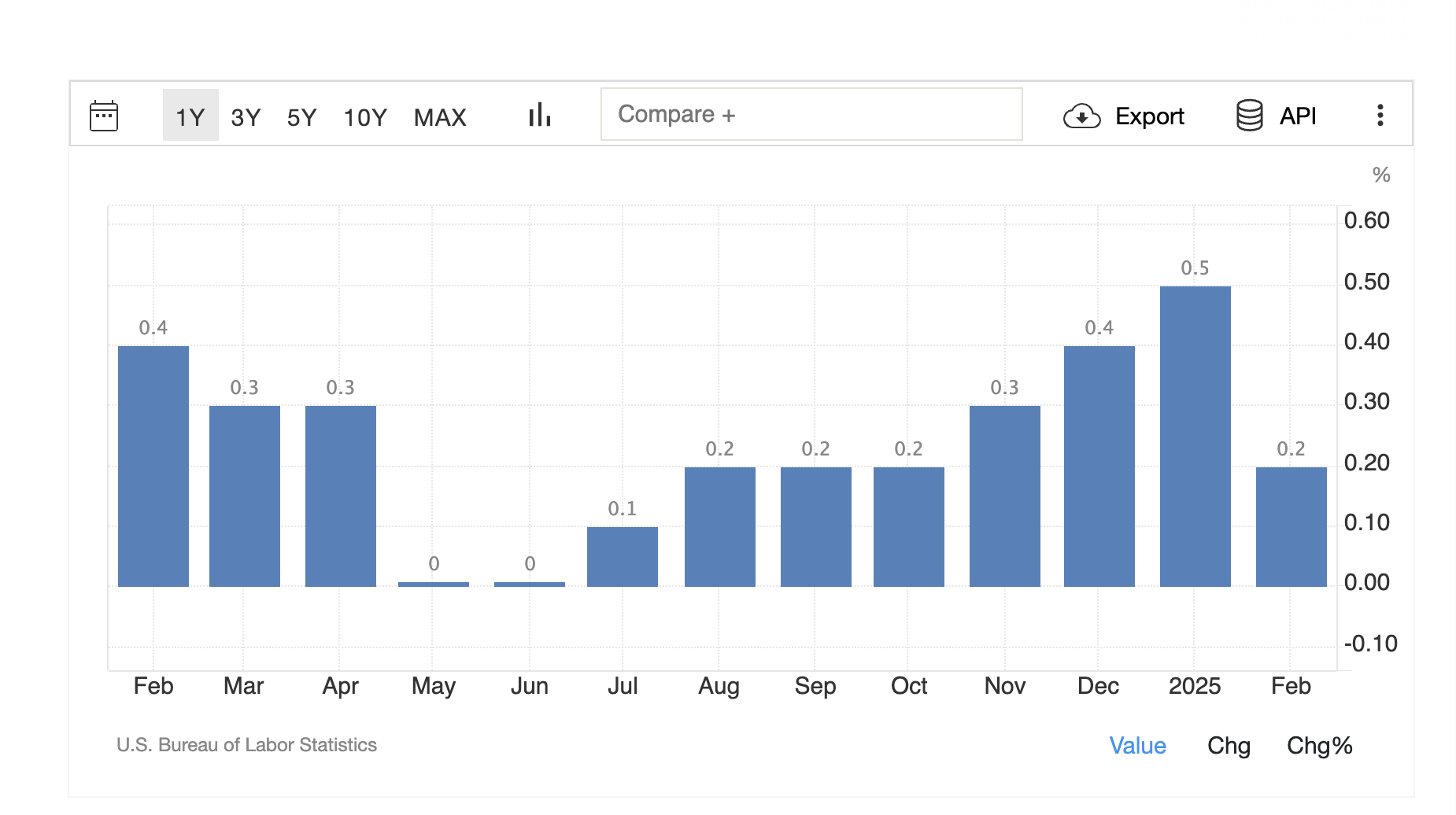

On an annual basis, prices rose by 2.8 percent in February, according to the latest release from the Bureau of Labor Statistics (BLS). This was down from 3.0 percent in January.

It’s important to put this number into context. This was the first drop in the annual CPI rate since September. Before that, prices crept up from 2.4 percent in September, 2.6 percent in October, 2.7 percent in November, and 2.9 percent in December.

We’ve also seen this song and dance before. Month-on-month CPI dropped to zero last spring, only to surge again later in the year.

Chart courtesy of Trading Economics

Chart courtesy of Trading Economics

One shouldn’t draw conclusions from a one-off report. It could be the beginning of a downward trend, but it could also be an anomaly.

Stripping out more volatile food and energy prices, the core CPI also moderated, coming in at 0.2 percent in February. That pushed the annual core CPI down to 3.1 percent. Core CPI has been mired in this range since last May and we still haven’t seen a core reading below 3 percent.

One might note that all these numbers remain well above the mythical 2 percent target.

Also keep in mind that the CPI doesn’t tell the entire story of inflation. The government revised the CPI formula in the 1990s so that it understated the actual rise in prices. Based on the formula used in the 1970s, CPI is closer to double the official numbers. So, if the BLS was using the old formula, we’re looking at CPI closer to 6 percent. And using an honest formula, it would probably be worse than that.

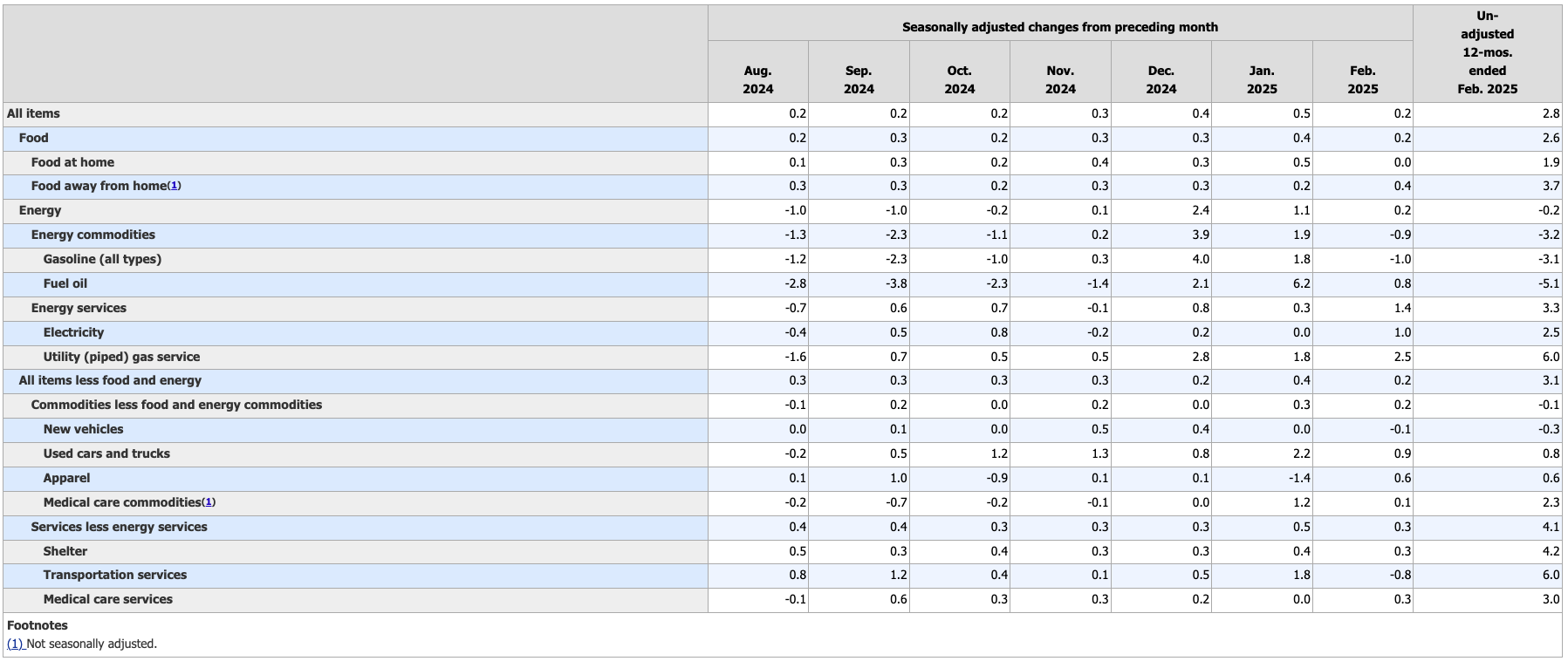

Looking more closely at the data, we find that a big drop in gasoline prices (-1.0 percent month-on-month) and energy commodities (-0.9 percent month-on-month) helped push overall CPI down.

Lower airline fares and dip in new car prices also helped pull the index lower.

Prices in virtually every other category rose last month, albeit at a slower rate.

This underscores a painful reality — you’re still paying more for everything even when there is “good news” on the price inflation front.

The producer price index data was also cooler than expected, adding more optimism on the inflation front.

On a monthly basis, PPI was unchanged. The forecast was for a 0.3 percent increase in producer prices. Core PPI fell -0.1 percent month-on-month. On an annual basis producer prices were up 3.2 percent, with the core PPI coming in at 3.4 percent. Both annual numbers were 0.1 percent below the forecast.

There was one hint of caution in the mainstream analysis of the February CPI data. Many analysts noted that the February report doesn’t reflect the impact of tariffs.

Setting the Stage for More Inflation

The better-than-expected CPI report boosted optimism that the Federal Reserve might resume cutting interest rates sooner than expected. A CNBC headline trumpeted, “Latest U.S. inflation data gives Fed cover to lower rates.”

FX Empire analyst James Hyerczyk said that the CPI numbers could prompt the Fed to cut rates earlier than forecast, triggering the next leg up for gold.

In other words, one month of mildly optimistic CPI data has raised expectations for more inflation!

Rate cuts encourage borrowing. In turn, this boosts the money supply. This is, by definition, inflation. One of the symptoms of this monetary inflation is price inflation. In other words, any victory over price inflation opens the door for the Fed to resume the very policy that gave us higher price inflation to begin with.

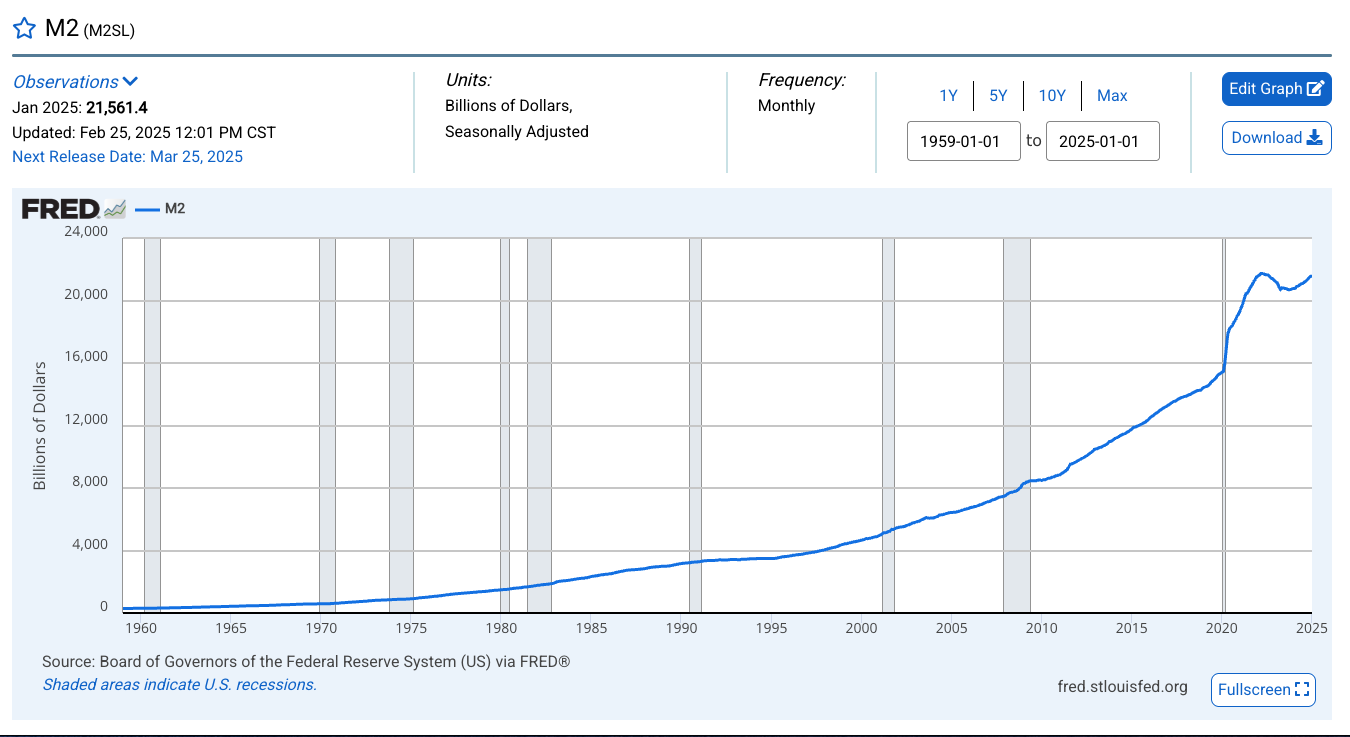

We’re already seeing this inflationary pressure manifest after the first round of rate cuts and the slowdown balance sheet reduction.

The M2 money supply bottomed a little over a year ago at $20.60 trillion. Since then, it has crept upward. As of January, it was at 21.56 trillion. That’s the highest level since September 2022 and approaching the all-time high of $21.72 trillion hit in the spring of 2022.

The money supply rose by 0.4 percent in December alone. This represents an annual monetary inflation rate of nearly 5 percent.

The Chicago Fed National Financial Conditions Index also reflects this increasingly inflationary environment. As of the week ending March 7, the NFCI stood at -0.57. A negative number reflects historically loose financial conditions.

And the markets want even more looseness!

This underscores the problem facing the central bankers over at the Fed.

The reality is the Federal Reserve is in a Catch-22. Given the escalating inflationary pressure, it needs to push rates even higher. After all, it never did do enough to slay the inflation monster. The bottom line is that the inflation dragon isn’t dead. Sure, the Fed might have knocked it to the mat. But it’s not down for the count.

On the other hand, the central bank needs to cut rates because the economy is addicted to easy money. Given the levels of debt and the amount of malinvestment, the economy can’t function in this higher interest rate environment. It needs its easy money drug.

How Powell & Company will navigate this remains to be seen, but they certainly can’t simultaneously raise and lower interest rates. They are walking a tightrope. The question is which way will they fall?

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.