(Mike Maharrey, Money Metals News Service) Record prices have dampened Indian gold jewelry demand but continue to drive investment buying.

India ranks as the world’s second-largest gold market.

The gold market dynamics in India are similar to those in China.

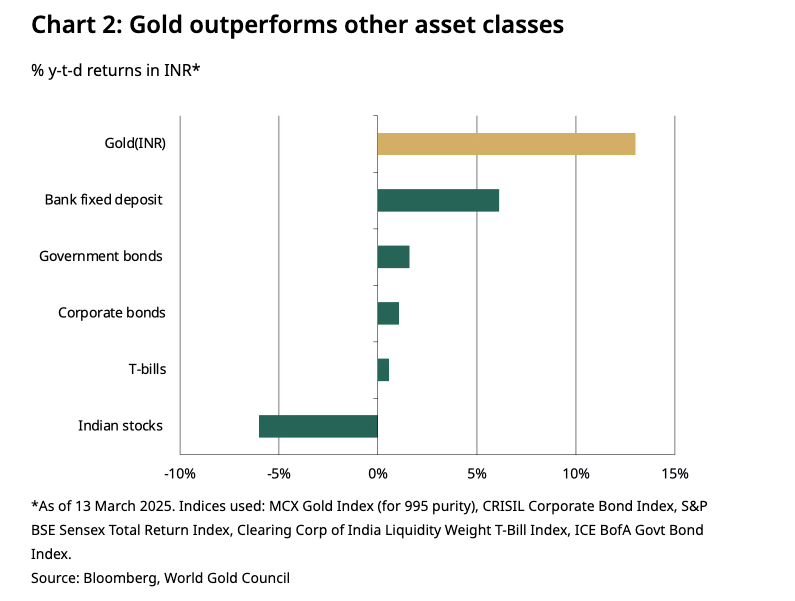

The price of gold is up 13 percent in rupee terms year-to-date, and the yellow metal ranks as the country’s best-performing asset in 2025.

Gold has hit record highs 13 times this year in dollar terms, with the price increasing even faster in rupee terms due to the weakening of the Indian currency against the dollar.

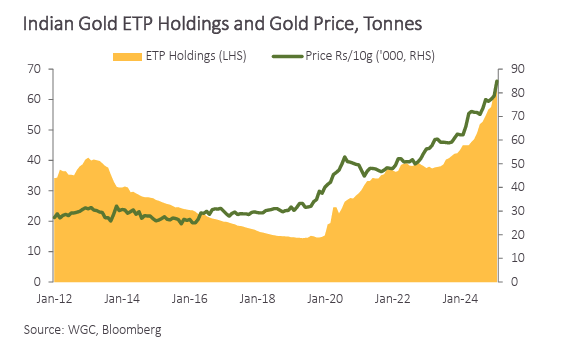

The rising price of gold has attracted significant investment interest as reflected by the growth in Indian gold ETFs.

A gold ETF is backed by a trust company that holds metal owned and stored by the trust. In most cases, investing in an ETF does not entitle you to any amount of physical gold. You own a share of the ETF, not gold itself. ETFs are a convenient way for investors to play the gold market, but owning ETF shares is not the same as holding physical gold.

About 2.2 tonnes of gold flowed into India-based ETFs last month, pushing collective holdings to 64.6 tonnes.

In rupee terms, ETF holding surged by ₹19 billion ($227 million). This was off the record pace in January but still far above average.

This occurred despite significant ETF redemptions, reflecting some profit-taking as gold prices surged.

According to the World Gold Council, broadening investor interest amid global economic and market uncertainty and the positive momentum in the gold price drove ETF inflows.

Demand for gold coins and bars has also remained strong with many investors anticipating further price increases.

While the rising price has sparked investor demand, it is putting a significant drag on the jewelry market. According to the World Gold Council, Indians are limiting themselves to “need-based” purchases, primarily for weddings.

“In addition, financial year-end dynamics, such as statutory payments and tax-saving investments, are curtailing discretionary spending and further weighing on demand. This slowdown is broad-based across both urban and rural areas.”

Along with slowing sales, many Indian jewelers also report increased consumer selling as people rush to lock in profits at higher prices. According to the World Gold Council, “Retailers have reported a significant uptick in scrap or old gold sales, with some attributing up to a third of their sales to the exchange of old jewelry for newer, lighter pieces.”

Many Indian consumers appear to be “waiting on the sidelines,” hoping for a price correction or at least some sign of price stability. However, it is likely demand will return at some point due to the cultural and economic significance of jewelry.

Gold jewelry is viewed differently in India than in the West. It is seen as not only an adornment but also an investment. Much Indian jewelry is made from pure 24-carat gold, as opposed to the 14- and 18-karat pieces more common in the U.S. and Europe. Many Indian families use gold jewelry as savings.

Indian demand is also heavily influenced by cultural and religious traditions that inform the best times for purchases and gift-giving. Some individuals may avoid making major purchases during certain phases of the lunar calendar, believing that these times bring bad luck.

According to the World Gold Council, market dynamics may shift toward higher gold jewelry demand in the next couple of months due to seasonal factors (auspicious days and festivals), along with an increase in wedding-related purchases.

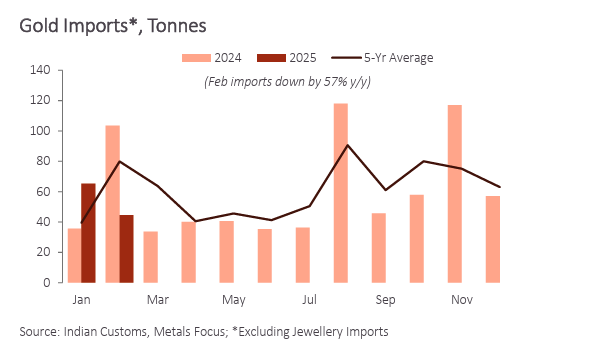

The dip in jewelry demand is reflected in falling gold imports.

Based on preliminary data, between 25 and 30 tonnes of gold flowed into India in February. It was the lowest import level since March 2024 and reflects a downward trend since record high imports in November.

Indians historically have an affinity for gold. While it’s hard to know for sure exactly how much gold Indians hold because of the amount of metal circulating in the underground economy, the best estimate is that Indian households own more than 25,000 tons of gold.

Gold is deeply interwoven into the country’s marriage ceremonies, along with its religious and cultural rituals. Festival seasons typically boost gold demand.

Indians have long valued the yellow metal as a store of wealth, especially in poorer rural regions. Around two-thirds of India’s gold demand comes from beyond the urban centers, where large numbers of people operate outside the tax system. Many Indians use gold jewelry not only as adornment but as a way to preserve wealth.

In the West, gold is generally viewed as a luxury item. Not in India. Even poor Indians buy gold. According to a 2018 ICE 360 survey, one in every two households in India had purchased gold within the last five years. Overall, 87 percent of Indian households own some gold. Even households at the lowest income levels in India hold some of the yellow metal. According to the survey, more than 75 percent of families in the bottom 10 percent of income managed to buy some gold.

The yellow metal was a lifeline for Indians buffeted by the economic storm caused by the government’s response to COVID-19. After the Indian government locked down the country, banks tightened credit to mitigate the default risk. Unable to secure traditional loans, Indians used gold to secure financing. As Indians endured a second wave of lockdowns, many Indians resorted to selling gold outright to make ends meet.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.