Inflation continued to rise sharply in May across many key components, with the Consumer Price Index increasing 0.6% in May according to the Bureau of Labor Statistics report released today.

BREAKING! US Headline #Inflation rose to 5.0% in May, beating expectations. Core #CPI up to a whopping 3.8%, highest since 1992! pic.twitter.com/CNBQQkupJq

— jeroen blokland (@jsblokland) June 10, 2021

“Over the last 12 months,” says the BLS, “the all items index increased 5.0 percent before seasonal adjustment; this was the largest 12-month increase since a 5.4-percent increase for the period ending August 2008.”

A survey of economists by Bloomberg predicted a 0.5% increase in CPI for May.

The surge was led by used cars and trucks, household furnishings and operations, new vehicles, airline fares and apparel.

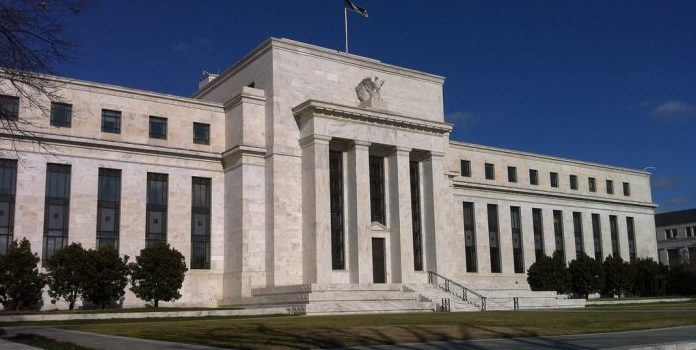

The rapid increase in inflation means that the Federal Reserve may stop stimulus measures like bond repurchase sooner rather than later. Hesitation to act risks much higher inflation, or worse, a recession.

Two days ago, Deutsche Bank warned against a crisis in inflation due to extraordinary stimulus measures worldwide and called on the Fed to tighten monetary supply.

“The consequence of delay will be greater disruption of economic and financial activity than would be otherwise be the case when the Fed does finally act,” wrote Deutsche’s chief economist, David Folkerts–Landau and others, according to CNBC.

“In turn, this could create a significant recession and set off a chain of financial distress around the world, particularly in emerging markets,” they wrote.

But Deutsche Bank’s view is in the minority right now.

Federal Reserve Chair Jerome Powell has indicated that he thinks the rapid rise in inflation is transitory because of supply disruptions due to COVID and will moderate over the coming months

“One-time increases in prices are likely to only have transitory effects on inflation,” Powell told CNBC in April.

Still, rapid inflation may be hard to ignore as it takes a bite out of consumer pocketbooks.

It will likely sharpen the debate as Democrats seek to expand federal spending to $6 trillion with new social programs and an infrastructure bill that is even pricier than the one former prresident Donald Trump proposed last year.