(Mike Maharrey, Money Metals News Service) Governments around the world have the same problem. They spend too much money. The national debt in the U.S. is knocking on the door of $36 trillion, but Uncle Sam isn’t the only one spending like the proverbial drunken sailor.

In its recent Financial Stability Review, the European Central Bank (ECB) warned of a “potential threat” facing the eurozone due to elevated debt levels.

What is that threat?

A sovereign debt crisis.

Eurozone debt totaled just over €13 trillion (USD$13.65 trillion), representing 81.5 percent of GDP at the end of the second quarter.

While an 81.5 percent debt-to-GDP ratio may sound perfectly manageable, especially compared to the U.S. (122.85 percent), many eurozone countries face significantly higher debt loads.

- Greece – 164.6 percent

- Italy – 137 percent

- France – 112 percent

- Belgium – 108 percent

According to the ECB report, the eurozone is at risk for a debt crisis if the bloc cannot lower public debt, boost economic growth, and stem the tide of “policy uncertainty.”

“Despite recent reductions in debt-to-GDP ratios, fiscal challenges persist in several euro area countries, exacerbated by structural issues such as weak potential growth and heightened policy uncertainty.”

As summarized by the Financial Times, the report pointed to “elevated debt levels and high budget deficits,” along with sluggish economic growth and political uncertainties caused by “election outcomes at the European and national levels, notably in France,” as significant economic problems facing the EU.

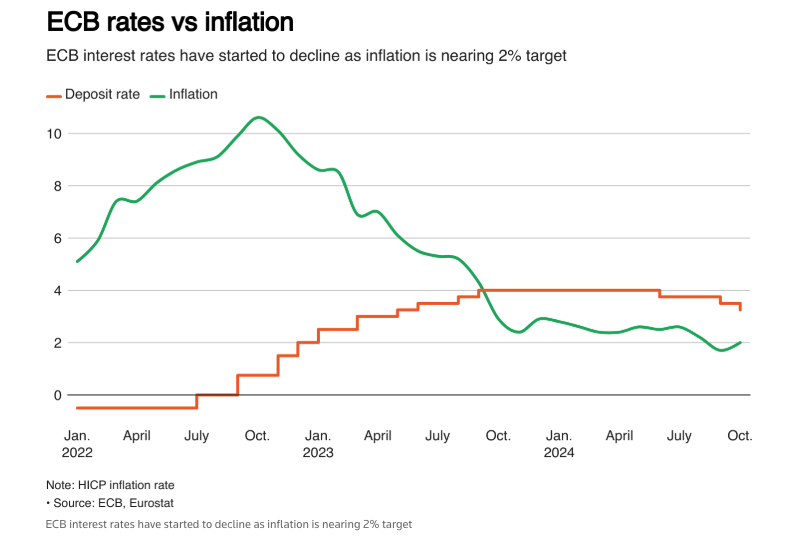

The ECB is walking the same tightrope as the Federal Reserve in trying to maintain a debt-riddled bubble economy as it battles price inflation.

Surging consumer prices after the pandemic forced the ECB to raise interest rates. After running negative interest rates for nearly a decade after the 2008 financial crisis, the ECB pushed rates to 4 percent during the recent spate of price inflation.

Like the Fed, the ECB has surrendered to inflation with three rate cuts so far this year. But it’s likely too late. The ECB broke things in the European economy years ago when it followed the Federal Reserve’s lead and opted for unprecedented rate cuts and quantitative easing during the Great Recession and the pandemic. After gorging on negative rates for eight years, Europeans are addicted to easy money. The economy simply can’t function in a higher interest rate environment.

The eurozone economy is already slowing. Policymakers there insist the ECB can guide the bloc to a “soft landing,” but the risk of a major economic crash is much more likely than the mainstream cares to acknowledge. The ECB followed the Federal Reserve down the road of monetary malfeasance. There is a cost to decades of easy money that the world has yet to reckon with.

However, the ECB isn’t completely oblivious. The report warned, “Headwinds to economic growth from factors such as weak productivity make elevated debt levels and budget deficits more likely to reignite debt sustainability concerns.”

We’re seeing these concerns manifest in bond spreads between European nations.

When lenders perceive a country has a higher credit risk, they demand a premium to cover the higher likelihood of default. This is already happening in the eurozone, according to the ECB report. The spread between the German 10-year bond (the European benchmark) and the French 10-year bond hit 0.78 percentage points recently, close to the 12-year high hit during last summer’s French elections.

“Greater policy uncertainties and market concerns about their implications for debt sustainability have resulted in some sovereign spreads widening for some euro area sovereigns with high levels of debt, albeit with limited cross-border spillovers for now. Concurrently, the longer-term trend of rising political fragmentation observed over the past three decades has made it more challenging to form stable government coalitions.”

Higher interest rates also increase the cost of servicing debt, putting further pressure on the countries with the highest debt loads. As bonds with extremely low yields purchased in the 2010s mature, they must be replaced by bonds with much higher rates.

According to the EBC report, EU analysts estimate that interest payments on French debt would more than double to exceed 4 percent of GDP by 2034. Italy’s interest cost would rise a third to just under 6 percent of GDP.

The ECB report also warned of overvalued equity markets with high-risk concentrations. This elevates the likelihood of “sharp adjustments” in eurozone stock markets. The report noted that “recent market corrections have not dissipated concerns over the overvaluation of equity markets.”

Of course, the ECB caused this problem with its negative interest rates and money creation. Inflation doesn’t just manifest in rising consumer prices. It generally shows up first in inflated stock markets and other asset prices.

Problems caused by the massive levels of government debt could spill into the broader European and global economies.

According to the ECB, “liquidity fragilities in non-bank financial intermediaries, in some cases coupled with high financial and synthetic leverage, have the potential to intensify and render market stress more enduring. Meanwhile, sovereign vulnerabilities are deepening.”

We saw how government debt problems could spill into the broader financial system when Greece and several other countries plunged into a debt crisis in 2009. Banks across the EU that were heavily exposed to sovereign debt faced liquidity issues. Some were in danger of collapse. This ultimately required interventions and bailouts by the ECB.

It’s easy for people in the U.S. to look at European issues and think, “Well, that’s their problem.”

It’s not. It’s everybody’s problem.

In the first place, the U.S. faces an even worse fiscal situation than the EU. This report should serve as a warning for U.S. policymakers as well.

Furthermore, contagion from a European crisis would likely spill across the pond. This could manifest in the U.S. financial system in several ways.

- Stock Market Volatility: A European debt crisis would likely trigger a sell-off in global financial markets as investors flee risk assets. This could lead to sharp declines in U.S. stock indices.

- Bank Exposure: financial institutions with significant investments in European government bonds or businesses would face losses, potentially affecting their balance sheets and lending capabilities. We’ve already seen how tanking bond prices can cause a banking crisis with the collapse of Silicon Valley Bank, Signature Bank, and First Republic Bank when the Fed raised interest rates.

- Credit Crunch: If European banks face liquidity problems, it could reduce their ability to finance global trade, impacting credit availability for U.S. companies. From a psychological standpoint, a European debt crisis could elevate concerns about U.S. government debt and tank demand for U.S. Treasuries.

- Economic Slowdown: A debt crisis and the ensuing recession would weaken European demand for U.S. goods and services, hurting American exporters and slowing U.S. economic growth.

This reveals the fundamental problem with governments. Political incentives trump economic reality. Politicians have one overriding goal – to get reelected and expand their power. The fastest path to popularity is to spend money. That’s why talk about fiscal discipline never gets beyond the conversation phase. Politicians and bureaucrats are always finding new ways to spend money (and grow their power). Investors should be aware of this phenomenon and plan accordingly.

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.