(Mike Maharrey, Money Metals News Service) After slowing in August, central bank gold buying rebounded in September.

On net, central banks globally added 40 tons of gold to their reserves. This compares to an 8-ton increase in global central bank gold holdings in August, according to the latest data compiled by the World Gold Council.

Total central bank gold reserves increased by 48 tons. This was offset by 8 tons of selling.

The rebound in September helped drive central bank gold buying to a record third quarter.

Year to date, central banks have added a net 694 tons to their gold reserves. The pace is below the record set through the first three quarters of 2023 but is on pace with 2022 levels.

Over the last 12 months, central banks have increased gold holdings by an average of 26 tons per month.

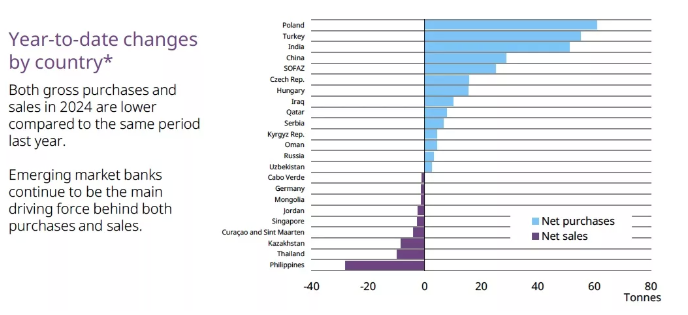

Two Eastern European countries led the way in September.

Poland was the biggest gold buyer, expanding its reserves by another 22 tons. The National Bank of Poland was also the biggest buyer in the third quarter.

Poland currently holds 420 tons of gold, making up about 16 percent of its total reserves.

NBP Governor Adam Glapiński recently indicated the Bank of Poland will continue adding to its reserves with a goal of holding at least 20 percent of the country’s reserves in gold.

“This makes Poland a more credible country, we have a better standing in all ratings, we are a very serious partner, and we will continue to buy gold.”

Hungary expanded its gold holdings by nearly 16 tons.

In a statement highlighting September’s purchase, the Hungarian central bank noted, “Amid increasing uncertainty in the global economy, the role of gold as a safe-haven asset and a store of value is of particular importance, as it enhances confidence in the country and supports financial stability. Gold continues to be one of the most important reserve assets globally, as shown by the significant purchases of gold by central banks in recent years.”

India continued to expand its gold reserves in September, adding another 6 tons to its holdings.

The RBI has been buying gold since 2017. Over that period, it has increased its gold reserves by over 260 tons.

An Indian economist told the Times of India that the push to accumulate gold was based on both political and economic reasons. He said that the “reliability” of the U.S. dollar has “diminished.” He noted the “noticeable decline” in the confidence in U.S. dollar assets.

Another economist told the Times, “It makes a lot of sense (to invest in gold), given the increased volatility in the FX market, elevated interest rates in the U.S., and, of course, also as the central banks in each economy would like to diversify the asset classes in which they are parking their reserves.”

India recently transported 100 tons of its gold from the UK back into India.

Other gold buyers in September were Turkey at 4 tons and the Czech Republic with a 2-ton purchase.

Kazakhstan was the biggest seller, decreasing its holdings by 4 tons. It is not uncommon for banks that buy from domestic production – such as Uzbekistan and Kazakhstan – to switch between buying and selling.

Jordan sold 3 tons of gold, and Singapore decreased its holdings by 1 ton.

These numbers represent official disclosures of central banks to the IMF. It’s important to note central banks may not always honestly report changes in their gold reserves. For instance, it is widely believed that China holds much more gold than it officially reports.

There is no indication central bank gold buying will slow down anytime soon.

According to the most recent World Gold Council survey released in June, 29 percent of central banks plan to add more gold to their reserves in the next 12 months. The WGC said it was the highest level since the survey began in 2018.

Only 3 percent said they had plans to decrease gold reserves.

Earlier this year, the World Gold Council said the continuation of gold buying supports its expectation that “2024 will be another solid year of central bank gold demand.”

“Last year, central banks placed great emphasis on gold’s value in crisis response, diversification attributes, and store-of-value credentials. A few months into 2024, the world seems no less uncertain, meaning those reasons for owning gold are as relevant as ever.”

Last year, central bank gold buying fell just 45 tons short of 2022’s multi-decade record.

According to the World Gold Council, central banks net gold purchases totaled 1,037 tons in 2023. It was the second straight year central banks added more than 1,000 tons to their total reserves.

Central bank gold buying in 2023 built on the prior record year. Total central bank gold buying in 2022 came in at 1,136 tons. It was the highest level of net purchases on record dating back to 1950, including since the suspension of dollar convertibility into gold in 1971.

China was the biggest buyer in 2023.

Analysts at ANZ Bank recently said they expect central bank gold buying to remain hot for at least the next six years.

According to these analysts, “Depleted trust in the U.S. fixed-income assets and the rise of non-reserve currencies are other themes that could support central bank gold buying.”

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.