(Mike Maharrey, Money Metals News Service) Central bank gold buying picked up in September and gained momentum in October. That momentum carried into November with gold reserves continuing to climb.

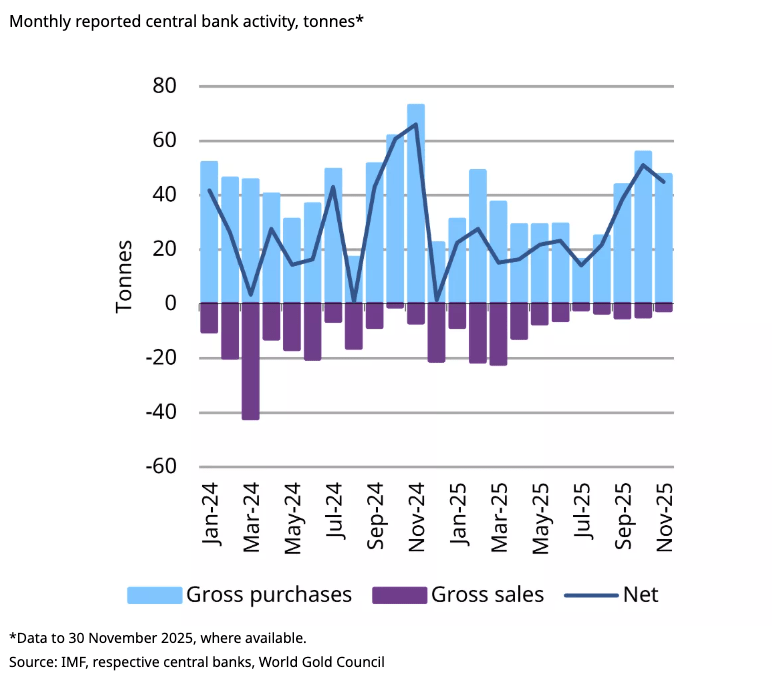

Officially, central banks globally added 45 tonnes of gold to their reserves in November. That was down slightly from 53 tonnes the previous month but elevated compared to earlier in 2025.

October and November central bank gold buying built on a strong third quarter, with official reported purchases coming in at a net 220 tonnes. That was up 28 percent from Q2 and 6 percent above the five-year third-quarter average.

The World Gold Council said the pickup in central bank gold demand in Q3 “is evidence that central banks continue to add gold strategically, despite facing higher prices.”

For the second straight month, Poland ranked as the biggest buyer, adding another 12 tonnes of gold to its reserves. That increased the country’s official gold holding to 543 tonnes, representing 28 percent of its total reserves based on gold prices at the end of November.

In September, the National Bank of Poland announced plans to boost its gold holdings to 30 percent of its total reserve assets.

When he announced plans to further expand Poland’s gold reserves, National Bank of Poland Governor Adam Glapiński called gold “the only safe investment for state reserves,” in these “difficult times of global turmoil and the search for a new financial order.”

In an interview earlier this year, Glapiński emphasized that gold is not directly linked to any national economic policies, is a safe haven during crises, and retains its real value over the long term.

“It is a symbol of stability that enhances our credibility in the eyes of investors and foreign partners.”

To date, Poland ranks as the top central bank gold purchaser with a 95-tonne increase to its reserves.

For the third straight month, Brazil expanded its gold holdings in November, adding 11 tonnes to its reserves. Over those three months, Brazil grew its gold holdings by 43 tonnes. The Brazilian central bank now officially owns 172 tonnes of gold, representing about 6 percent of its reserves.

Uzbekistan’s central bank continued to expand its gold reserves for the second straight month, reporting a 10-tonne increase in November after a 9-tonne purchase in October. The Uzbeks were sellers in September.

It is not uncommon for banks that buy from domestic production – such as Uzbekistan and Kazakhstan – to flip-flop between buying and selling.

The National Bank of Kazakhstan was also in a buying mood, expanding its reserves by 8 tonnes.

The Czech National Bank has been growing its gold reserves at a slow and steady pace. It added another 2 tonnes in November, its 33rd straight month of gold accumulation. The Czech Republic now holds 71 tonnes of gold. Czech officials say they plan to increase gold reserves to 100 tonnes by 2028.

China has reported an increase in its official reserves for 13 straight months, adding another tonne in November. The People’s Bank of China has increased its official holdings by 401 tonnes in that span.

Total official Chinese gold reserves are now over 2,300 tonnes, making up around 7 percent of its total reserves.

Notice the emphasis on “official.”

China is among the central banks that are likely to hold significantly more gold than they publicly disclose. As Jan Nieuwenhuijs has reported, the People’s Bank of China is secretly buying large amounts of gold off the books. According to data parsed by the renowned Money Metals researcher, the Chinese central bank is currently sitting on more than 5,000 tonnes of monetary gold located in Beijing – more than TWICE what has been publicly admitted.

Mainstream reporting has finally picked up on this.

The National Bank of the Kyrgyz Republic (2 tonnes) and the Bank of Indonesia (1 tonne) were the other significant buyers.

The Bank of Tanzania reported the purchase of 15 tonnes of refined monetary gold in the first year of its Domestic Gold Purchase Program. The stated goal is to strengthen the country’s foreign reserves.

Jordan and Qatar were the only notable sellers in November.

Overall, central bank gold buying slowed somewhat in 2025 (the big jump in the last three months notwithstanding). Final numbers for the year will come out next month.

Higher prices have undoubtedly incentivized some central banks to slow the pace of gold accumulation. However, the World Gold Council said the pickup in central bank gold demand in Q3 and the first two months of Q4 “is evidence that central banks continue to add gold strategically, despite facing higher prices.”

Despite the modest slowdown in gold accumulation, the World Gold Council remains bullish.

“We maintain our view that central banks will continue to add gold to their reserves. Our Central Bank Gold Reserves Survey 2025 shows that respondents overwhelmingly (95 percent) expect global central bank gold reserves to increase over the next 12 months, while 43 percent believe that their own gold reserves will also increase over the same period. Notably, none of the respondents anticipate a decline in their gold reserves.”

You can read more details about that central bank survey HERE.

On net, central banks officially increased their gold holdings by 1,044.6 tonnes in 2024. It was the 15th consecutive year of expanding gold reserves.

Last year was the third-largest expansion of central bank gold reserves on record, coming in just 6.2 tonnes lower than in 2023 and 91 tonnes lower than the all-time high set in 2022 (1,136 tonnes). 2022 was the highest level of net purchases on record, dating back to 1950, including since the suspension of dollar convertibility into gold in 1971.

To put that into context, central bank gold reserves increased by an average of just 473 tonnes annually between 2010 and 2021.

World Gold Council analysts said, “Central banks are likely to continue their buying spree,” calling central bank purchases “surprisingly resilient” given the rapid price increase.

The WGC has also noted that “diversification” with “a reduction of U.S. assets” is one of the factors driving central bank gold buying. In other words, de-dollarization.

“We don’t see an end to this narrative unless there is a material shift in geopolitical tensions. The IMF has downgraded growth prospects in the U.S. more than in other major economies, citing policy uncertainty. This suggests that other countries may have leverage in negotiations, although these typically last months and years, not weeks. Hence, we don’t expect any near-term resolutions.”

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.