(Clint Siegner, Money Metals News Service) Anyone with a naked short in the silver futures market risks getting squeezed by physical buying.

Demand for delivery of COMEX silver bars is rising, even as the paper price of the metal fell more than 4.5% last week.

Silver shorts sold contracts representing a whole lot more silver than they have available to deliver again last week.

The disconnect between paper prices and physical demand is getting more ridiculous by the day.

It is also getting more dangerous for COMEX market participants – long and short. The COMEX functions on confidence, which can vanish suddenly.

It will happen when long contract holders discover, en masse, the paper they bought cannot be redeemed for the actual metal as expected. Instead, they get cash settled or, in the event of an outright default, they get nothing at all from insolvent counterparties.

Garrett Goggin has been keeping an eye on COMEX silver deliveries. He notes a huge difference between this year and last.

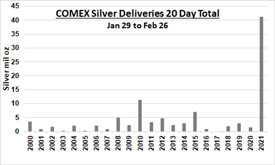

Delivery demand is roughly 20 times what it was for this period last year.

It is approximately 4 times the previous record for the period set in 2010.

The 41 million ounces delivered over the past three weeks is very significant relative to the total “Registered” stockpile of silver in the COMEX vaults. Bars in the “Registered” category are the ones actually available for delivery to a new owner.

COMEX vaults also contain a larger stockpile of “Eligible” silver. Bars in this category can be converted to Registered when owners decide they are willing to let them go. Until then, they are not available to be claimed by contract holders.

It looks like 80 to 100 million ounces of physical silver will be delivered in March – likely a new all-time record.

The latest report from the CME group shows just 135 million ounces of Registered silver sill available – down from 16 million from the 151 million ounces reported two weeks ago.

Watching the Registered inventory is a good way to judge whether the effort to squeeze silver prices is working.

How much of the silver currently being delivered will remain as Registered in the vaults? How much will be converted to Eligible and made unavailable? And how much will be moved to segregated storage or removed from COMEX vaults altogether?

It could get worse for the banks. Shorts may be nervous.

Demand for physical metal keeps accelerating and the COMEX bar inventory continues to fall.

Bullion dealer inventories are low and demand for retail bullion products has never been higher.

Even thousand-ounce bar premiums are elevated, which is an extremely rare occurrence. Rising lease rates in London imply an inventory shortage across the pond.

It is an extraordinarily dangerous time for bullion banks to continue selling silver they don’t have. Their play is to destroy sentiment and shake investors out of the market. Thus far, at least on the physical front, this effort appears to be backfiring…Original Source…

Clint Siegner is a Director at Money Metals Exchange, a precious metals dealer recently named “Best in the USA” by an independent global ratings group. A graduate of Linfield College in Oregon, Siegner puts his experience in business management along with his passion for personal liberty, limited government, and honest money into the development of Money Metals’ brand and reach. This includes writing extensively on the bullion markets and their intersection with policy and world affairs.